Over the weekend, investors were digesting the quarterly results from industry titans Amazon, Apple, and Meta Platforms last Friday. Meta Platforms’ stood out by announcing its first-ever dividend during its earnings release, but both Amazon and Apple managed to exceed their top and bottom line expectations. While Meta may have stolen the show, let’s delve into Amazon and Apple’s quarterly results to assess if now is a propitious moment to invest in these iconic tech giants.

Amazon Q4 Review

Rounding out its fiscal 2023, Amazon reported Q4 earnings of $1.01 per share, surpassing the Zacks Consensus of $0.81 a share by 24%. Even better, Q4 earnings soared 380% from $0.21 a share in the comparative quarter. Fourth quarter sales of $169.96 billion beat estimates by 2% and leaped 14% YoY. Amazon produced Q4 net income of $10.6 billion, surging from the $300 million the e-commerce behemoth brought in a year ago.

Image Source: Zacks Investment Research

Amazon attributed its very strong Q4 results to a record-breaking holiday shopping season and saw 13% and 17% growth in its North America and International segment sales respectively. In terms of its cloud services, Amazon’s AWS segment sales were up 13% to $24.2 billion during Q4 but slightly missed estimates of $24.37 billion.

Still, Amazon’s total sales were up 12% in FY23 to $574.8 billion with net income of $30.4 billion, swinging from a net loss of -$2.7 billion a year ago. This translated into annual earnings of $2.90 per share, skyrocketing 308% from $0.71 a share in 2022.

Image Source: Zacks Investment Research

Apple Q1 Review

Reporting its fiscal first quarter results on Friday, Apple’s Q1 earnings of $2.18 per share were up 16% YoY to a new record high and topped the Zacks Consensus of $2.09 a share by 4%. Quarterly sales of $119.57 billion topped estimates by over 1% and rose 2% YoY. Apple reported net income of $33.92 billion, a 13% jump from the prior year quarter.

Image Source: Zacks Investment Research

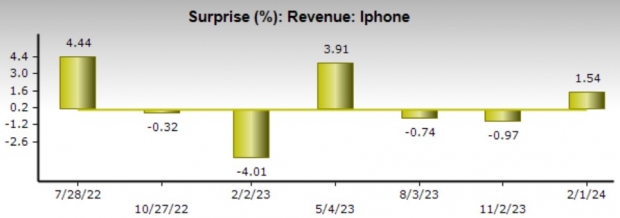

Apple’s Q1 growth was fueled by iPhone sales and an all-time revenue record in its Services segment sales which includes Apple news, music, and TV along with its App Store, iCloud, AppleCare, and Apple Pay. iPhone sales came in at $69.7 billion and beat estimates by 1%, although Services sales of $23.11 billion were still -1% short of the consensus of $23.39 billion.

Image Source: Zacks Investment Research

Bottom Line

Following their favorable quarterly results, Amazon’s stock currently sports a Zacks Rank #2 (Buy), while Apple lands a Zacks Rank #3 (Hold). The trend of positive earnings estimate revisions looks likely to continue for Amazon, while investors may want to monitor Apple’s warning of softer iPhone sales during the current quarter despite the company’s immense probability.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook names 5 hand-picked stocks with sky-high growth potential in a brilliant sector of Artificial Intelligence. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

Today you can invest in the wave of the future, an automation that answers follow-up questions … admits mistakes … challenges incorrect premises … rejects inappropriate requests. As one of the selected companies puts it, “Automation frees people from the mundane so they can accomplish the miraculous.”

Download Free ChatGPT Stock Report Right Now >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.