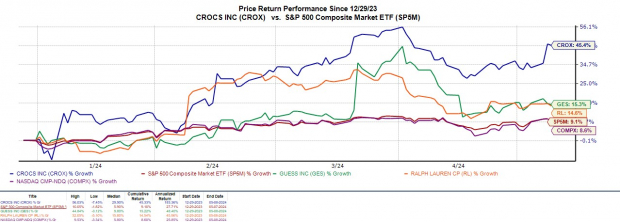

Crocs CROX stock has highlighted this week’s earnings lineup after crushing Q1 earnings expectations on Tuesday. The footwear and apparel leader has seen its stock soar over +40% this year to impressively outpace the broader indexes and many noteworthy peers such as Guess GES and Ralph Lauren RL.

That said, let’s see if it’s still worth holding or buying Crocs stock after the company’s impressive Q1 results.

Image Source: Zacks Investment Research

Strong Q1 Results

Crocs brand growth remains compelling as Q1 sales rose 6% year over year to $938.63 million which beat estimates of $883.85 million by 6% as well. Even better was Crocs increased profitability with earnings of $3.02 per share rising 16% from the prior year quarter and crushing EPS estimates of $2.25 by 34%.

More impressive, Crocs has now surpassed top and bottom line expectations for 16 consecutive quarters and has posted an average earnings surprise of 17% in its last four quarterly reports.

Image Source: Zacks Investment Research

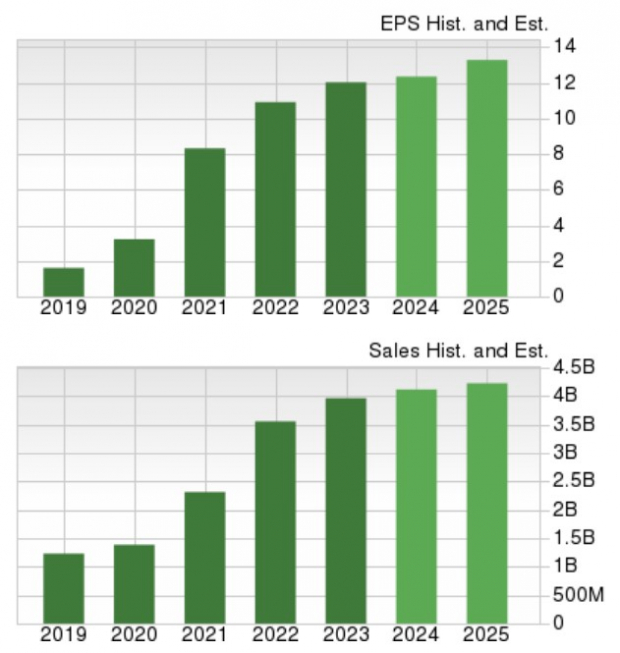

Growth & Outlook

According to Zacks estimates, Crocs’ annual earnings are now expected to rise 3% in fiscal 2024 and are projected to expand another 9% in FY25 to $13.56 per share. Total sales are forecasted to expand 4% this year and are expected to rise another 6% in FY25 to $4.37 billion.

Image Source: Zacks Investment Research

Attractive P/E Valuation

Despite the incredible year-to-date rally in Crocs stock, CROX still trades at just 10.9X forward earnings. This is a slight discount to the Zacks Textile-Apparel Industry average of 12.5X and Ralph Lauren’s 14.8X while being just above the P/E valuation of Guess at 9.1X.

Image Source: Zacks Investment Research

Bottom Line

At the moment Crocs stock lands a Zacks Rank #3 (Hold). Given the company’s growth trajectory and valuation remains attractive, holding CROX may continue to pay off although there could be better buying opportunities after such a blazing start to the year.

Top 5 Dividend Stocks for Your Retirement

Zacks targets 5 well-established companies with solid fundamentals and a history of raising dividends. More importantly, they have the resources and will to likely pay them in the future.

Click now for a Special Report packed with unconventional wisdom and insights you simply won’t get from your neighborhood financial planner.

See our Top 5 now – the report is FREE >>

Crocs, Inc. (CROX) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.