Last week, strong first quarter results from Walmart WMT helped boost sentiment for discount retailers and investors may be eyeing Dollar Tree DLTR and Dollar General’s DG stock ahead of their Q1 reports on Thursday, May 23, and Thursday, May 30 respectively.

With that being said, let’s see if now is a good time to buy stock in either of these iconic discount retailers.

Q1 Overview & Expectations

Based on Zacks estimates, Dollar Tree’s Q1 sales are expected to rise 4% to $7.64 billion. However, Dollar Tree’s Q1 EPS is expected to dip -1% to $1.45 and Wall Street will be monitoring its inventory as the company is in the process of closing 600 of its Family Dollar locations this year. The move is aimed at improving profitability with excessive inventory from the higher-priced Family Dollar consumer products being sold at its flagship Dollar Tree stores for the time being.

As for Dollar General, Q1 earnings are expected to fall to $1.57 a share versus EPS of $2.34 in a very profitable and tough-to-compete against prior-year quarter. Still, quarterly sales are thought to have risen 5% to $9.85 billion.

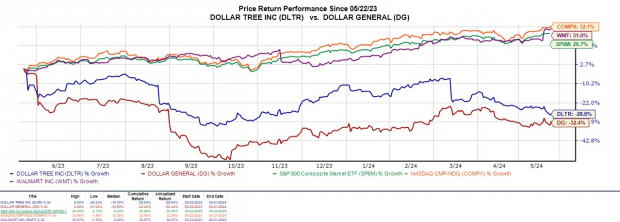

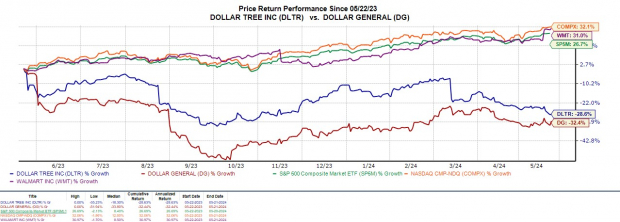

Recent Price Performance

Dollar Tree’s stock has fallen -19% year to date mostly attributed to the company’s annoucement that it accrued $2 billion in impairment charges due to its plan to close hundreds of Family Dollar stores. Meanwhile, Dollar General shares have risen a respectable +5% YTD although this has also trailed the broader indexes and Walmart’s +22%.

Furthermore, investors may be contemplating on buying the dip in DLTR and DG with both down nearly -30% in the last year. The decline comes as Dollar Tree and Dollar General have lost their inflationary mojo associated with consumers seeking cost savings although their growth and valuations remain attractive.

Image Source: Zacks Investment Research

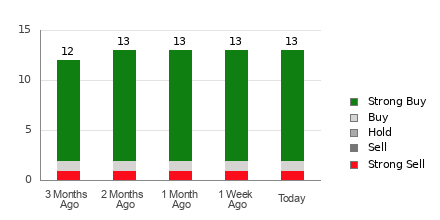

EPS Outlook

It’s noteworthy that Dollar Tree currently has an “A” Zacks Style Scores grade for Growth with Dollar General having a “B” grade for the trading indicator.

In this regard, Dollar Tree’s annual earnings are projected to climb 17% in its current fiscal 2025 and are expected to climb another 17% in FY26 to $8.14 per share. More impressive, FY26 EPS projections would represent 40% growth over the last five years.

Image Source: Zacks Investment Research

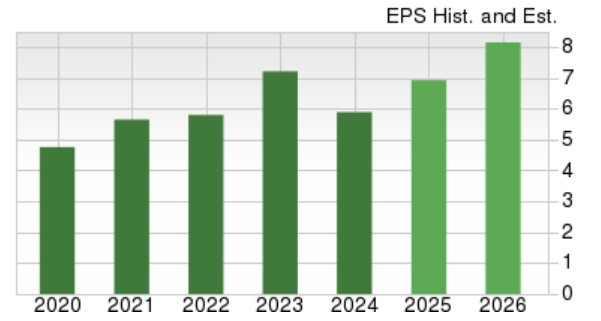

Pivoting to Dollar General, annual earnings are expected to dip -3% in its current FY25 but are forecasted to rebound and jump 13% in FY26 to $8.23 per share. With that being said, FY26 projections would be a -19% dip over the last five years with Dollar General’s EPS at a very strong $10.17 in 2022.

Image Source: Zacks Investment Research

Valuation Comparison (P/E)

Dollar Tree and Dollar General both check an “A” Zacks Style Scores grade for Value. Dollar Tree’s stock trades at a 16.2X forward earnings multiple with Dollar General trading at 18.9X. Notably, both trade at a slight discount to their Zacks Retail-Discount Stores Industry average of 20.6X and Walmart’s 26.7X.

Image Source: Zacks Investment Research

Takeaway

Buying the dip in Dollar Tree and Dollar General’s stock is very tempting but for now, they both land a Zacks Rank #3 (Hold). To that point, Q1 results will be critical to see if these large discount retailers can reconfirm a favorable outlook and make an argument for a sharp rebound in their price performances.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Dollar General Corporation (DG) : Free Stock Analysis Report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.