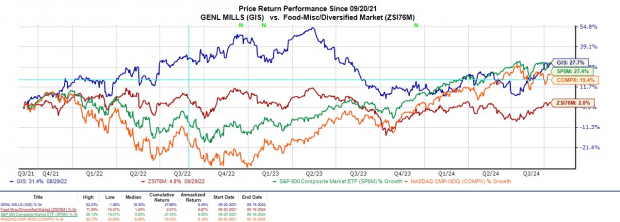

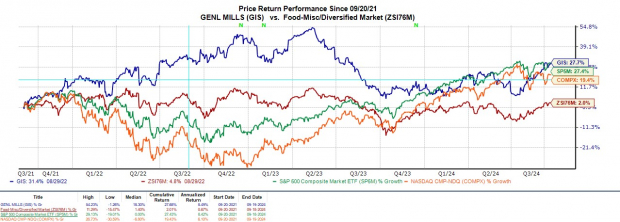

General Mills’ GIS stock has triumphed with a robust 15% surge this year, leaving investors with a tantalizing question – could this consumer food behemoth continue to satiate shareholder appetites?

Having orchestrated a triumphant overture to its fiscal first quarter, mastering both top and bottom-line forecasts, General Mills seems poised to tantalize shareholders further. Let’s delve into the prospect of seizing General Mills stock for a potentially mouth-watering upside.

Image Source: Zacks Investment Research

General Mills Q1 Results Unveiled

General Mills disclosed Q1 sales of $4.84 billion, surpassing estimates by 1% despite a slight dip from the prior year. On the earnings front, Q1 EPS of $1.07 outshone expectations by 2%, albeit taking a slight downturn from the previous year.

In a plot twist, General Mills, previously apprehensive about underperforming its annual objectives due to challenging net sales and margin comparisons, announced a game-changing move: the proposed sale of its North American Yogurt sector to French entities like Lactalis and Sodiaal for a hefty $2.1 billion.

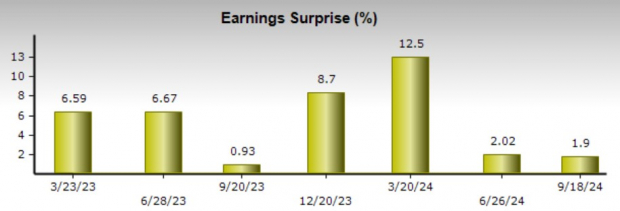

Of significance, General Mills has remarkably eclipsed the Zacks EPS Consensus for 11 consecutive quarters, yielding an average earnings surprise of 6.28% in its past four quarterly publications.

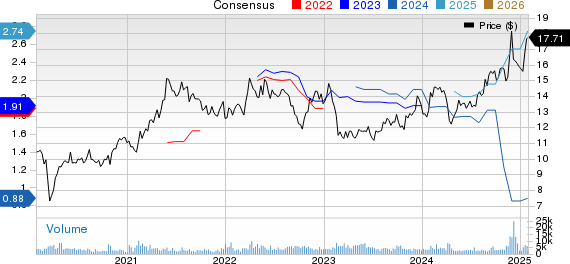

Image Source: Zacks Investment Research

Insight into General Mills Earnings Projection

Despite the murky economic terrain for consumers in General Mills’ primary markets, the company stands steadfast, reaffirming its fiscal 2025 EPS forecast.

General Mills maintains its projected FY25 EPS range, either slightly decreasing or increasing by 1% in constant currency, aligning harmoniously with the Zacks Consensus. As per Zacks estimates, General Mills anticipates a 5% rebound in EPS by FY26, reaching $4.72.

Image Source: Zacks Investment Research

Decoding GIS Stock Valuation

With shares trading at $75 apiece, General Mills stock boasts a forward earnings multiple of 16.7X, a delightful markdown compared to the S&P 500’s 23.7X.

Interestingly, GIS prices itself lower than the industry average of 17.7X forward earnings, sharing the spotlight with prominent peers like Kraft Heinz KHC and Mondelez International MDLZ.

Image Source: Zacks Investment Research

Final Thoughts

Following a dazzling Q1 performance, General Mills holds a Zacks Rank #3 (Hold). While GIS stock’s ascent this year has been remarkable, its future trajectory hinges on potential earnings adjustments in the near term.

General Mills’ caution regarding broader economic uncertainties impacting consumers, despite its appealing valuation, suggests that GIS remains an enticing long-haul investment.