Two industry giants, Marriott International (MAR) and Hilton Worldwide (HLT) have recently reported their Q4 results, showcasing their prowess in the hotel operations arena. As investors look for opportunities in the year 2024, it’s time to analyze whether investing in these hospitality giants is a prudent move post their Q4 results.

Marriott Q4 Performance

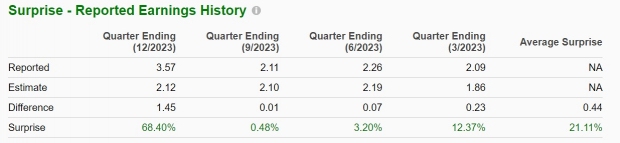

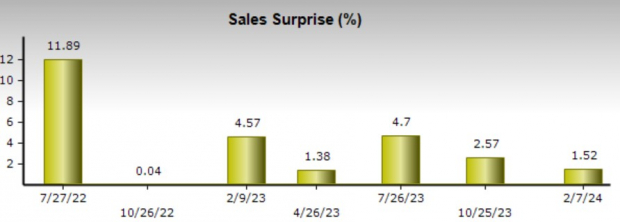

Marriott delivered a solid performance during its Q4 earnings release. Although it fell short of the revenue estimates, the company managed to crush the earnings expectations, with an impressive EPS of $3.57 per share, outperforming the estimates by a staggering 68%. Its quarterly EPS surged by an impressive 82% from the previous year. The company has recorded consecutive quarters of surpassing earnings expectations, with an average earnings surprise of 21.11% in its last four quarterly reports. Marriott attributed its stellar results to the sustained demand for its industry-leading portfolio and offerings across the globe. Notably, the company observed a 14% hike in total sales in FY23, reaching $23.71 billion, with an annual EPS growth of 49%.

Image Source: Zacks Investment Research

Hilton Q4 Performance

Hilton also posted a strong Q4 performance, surpassing both the revenue and bottom line expectations. The company reported an earnings of $1.68 per share, beating the estimates by 7% and witnessing a 5% year-on-year growth. Its quarterly sales stood at $2.6 billion, outpacing estimates by 1% and marking a 6% increase from the comparative quarter. Hilton has consistently outperformed earnings and sales estimates, with total sales registering a hefty 17% growth in FY23, amounting to $10.24 billion, while its annual EPS leaped 27%.

Image Source: Zacks Investment Research

Growth Projections

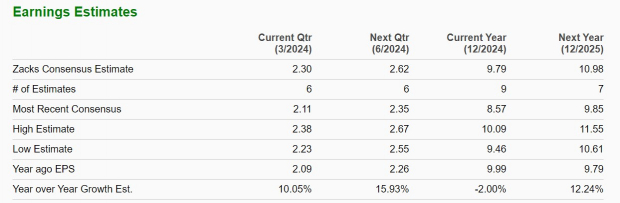

Looking at the future growth projections, Marriott’s annual earnings are expected to observe a slight dip of -2% in FY24 but rebound and rise 12% in FY25 to $10.98 per share. The total sales are projected to climb 8% this year and another 7% in FY25 to $27.44 billion. On the other hand, Hilton foresees a 13% rise in annual earnings for FY24 and an impressive 17% surge in FY25 to $8.17 per share. The company also anticipates a 9% jump in total sales for FY24 and an additional 8% growth in the subsequent year, amounting to $12.15 billion.

Image Source: Zacks Investment Research

Final Thoughts

Both Marriott and Hilton remain strong long-term investment prospects, with an assigned Zacks Rank #3 (Hold). However, given the considerable rally of MAR and HLT shares by over +25% in the past year, potential investors might be prudent to wait for better buying opportunities. The substantial growth and expansion of these market giants nevertheless position them as ideal candidates for buying opportunities in the future.

Zacks Reveals ChatGPT “Sleeper” Stock: One little-known company is at the heart of an AI sector with a predicted economic impact of $15.7 trillion by 2030. As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.