With consumer lending stocks bouncing back within the financial sector, names like LendingTree, Ally Financial, Synchrony Financial, and OneMain Holdings are catching investors’ attention. After soaring near the $50-a-share range, OneMain’s stock is standing out among its industry peers. But is now a good time to consider buying OneMain’s stock for the potential of higher highs?

Why OneMain’s Stock Stands Out

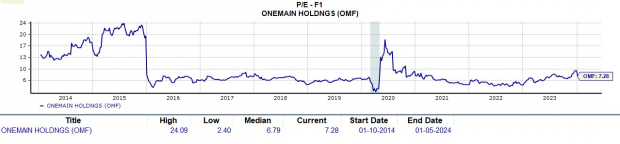

OneMain has become a popular financial service holding company, offering personal loans, credit cards, optional credit insurance, and a financial wellness program. Despite the recent surge in OMF shares, they still trade at just 7.2X forward earnings, making their valuation quite reasonable.

Image Source: Zacks Investment Research

This is despite OneMain expected to round out its fiscal 2023 with EPS at $5.37 per share compared to $7.32 a share in 2022. However, FY24 EPS is projected to rebound and soar 25% to $6.72 per share. Total sales are projected to be up 2% in FY23 and rise another 5% in FY24 to $3.73 billion. The steady top line growth serves as a positive affirmation that OneMain’s earning potential will remain compelling as easing inflation leads to more attractive interest rates for consumers and hopefully lower operating cost.

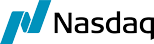

More impressive and perhaps most compelling to investors is that OneMain has been able to sustain its lofty dividend with a current yield of 8.17% which towers over the Zacks Financial-Consumer Loans Markets’ 2.2% and the S&P 500’s 1.4% average. Furthermore, OneMain has now increased its dividend seven times in the last five years with a 44.47% annualized dividend growth rate during this period.

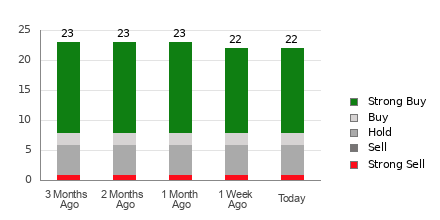

Image Source: Zacks Investment Research

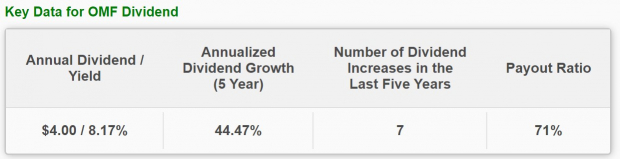

Recent Performance

Like Synchrony and Ally Financial, OneMain’s stock has hovered near its 52-week highs hitting this mark at $49.89 a share in late December. Still at just over $49, OneMain’s stock has soared +36% over the last year to top the S&P 500’s +22%, Synchrony’s +21%, and even beat Ally’s +33% while roughly matching LendingTree’s strong price performance. Even better, when including dividends, OneMain’s total return over the last year is +50% to easily outperform the benchmark and many of its consumer lending peers.

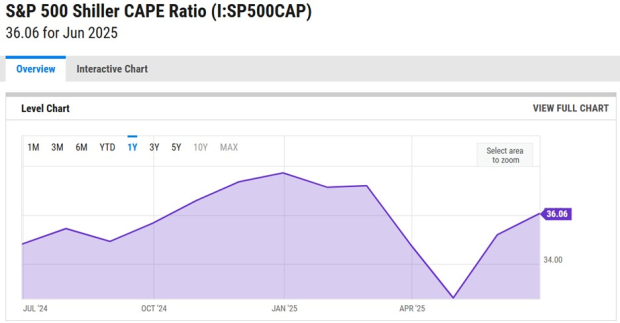

Image Source: Zacks Investment Research

Bottom Line

For now, OneMain Holdings’ stock lands a Zacks Rank #3 (Hold). OneMain’s valuation and lucrative dividend yield remain enticing to income investors but more upside in OMF shares may largely depend on the company’s fourth-quarter results in early February.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

OneMain Holdings, Inc. (OMF) : Free Stock Analysis Report

LendingTree, Inc. (TREE) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.