Tesla’s TSLA is set to unveil its fourth-quarter financial results on January 24, one among the big-league companies announcing earnings this week. Despite a notable +46% surge in its stock over the past year, Tesla’s shares have plummeted by -15% at the inception of 2024. It begs the question – is this the right moment to capitalize on the recent pullback before the earnings report?

Image Source: Zacks Investment Research

Recent Performance and Market Share

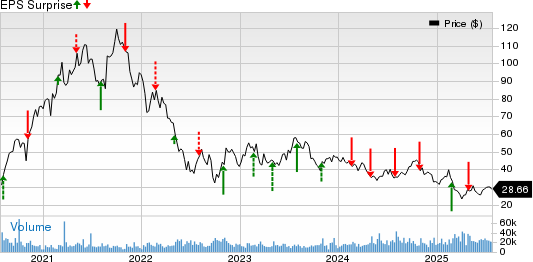

During Q4, Tesla notched up 484,507 deliveries, reinforcing its position as the global EV leader. The company continues to dominate the domestic market, outpacing competitors like General Motors GM and Ford F. Notably, Q4 deliveries witnessed a 19% surge year over year, with Tesla’s Model Y and Model 3 emerging as the top-selling EVs in the United States, surpassing the likes of General Motors’ Chevrolet Bolt, Rivian’s RIVN R1T/R1S, and Ford’s Mustang Mach-E. Notably, the company is believed to control just over 50% of the domestic EV market and disclosed annual deliveries of slightly over 1.8 million EVs, signifying a 38% year-over-year growth.

Image Source: Tesla Investor Relations

Preview of Q4 Financials and Future Outlook

Despite attaining a record annual delivery figure, Tesla’s Q4 earnings are anticipated to decline to $0.74 per share from $1.19 per share in the previous year. This decline might be tied to Tesla’s price reductions and its ambition to offer a more affordable EV array, with projected quarterly sales of $25.94 billion, marking a 6% increase.

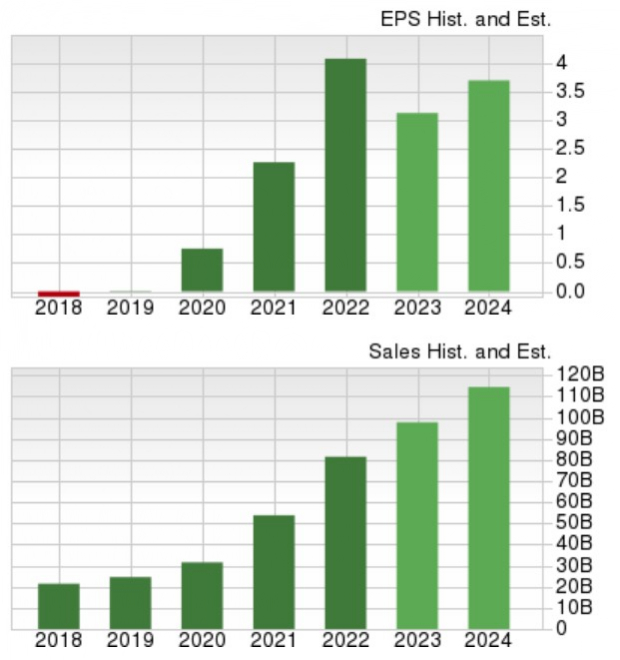

Overall, Tesla is expected to wrap up its fiscal 2023 with an annual earnings decrease of -22% to $3.16 a share compared to $4.07 per share in 2022. However, there’s optimism surrounding FY24 EPS, forecasted to rebound and surge 21% to $3.82 per share. Furthermore, total sales are predicted to spike 20% in FY23 and are anticipated to expand an additional 20% this year, reaching $117.47 billion.

Image Source: Zacks Investment Research

Evolving Valuation of Tesla

Following the recent stumble in Tesla’s stock, its forward earnings multiple stands at 55.5X, notably lower than its decade-long highs and 44% below its one-year peak of 100.5X – a 30% markdown from the median of 79.9X.

Image Source: Zacks Investment Research

Furthermore, Tesla’s price-to-sales ratio is currently contracting to a more reasonable 5.7X in comparison to a high of 9.2X over the past year and a median of 7.3X.

Image Source: Zacks Investment Research

Conclusion: Is it Time to Buy?

The upcoming fourth-quarter financial results hold the key to potential upward momentum for Tesla’s shares. The EV frontrunner remains one of the most captivating growth stocks, and the recent downturn may present a favorable opportunity, especially for long-term investors, given Tesla’s stock currently boasts a Zacks Rank #2 (Buy).

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.