As the earnings week approaches, the spotlight will be on the robust growth stocks, with leading attention on Airbnb (ABNB) and DaVita (DVA).

It is a propitious time to consider investing in these giants as their Q4 results loom on Tuesday, February 13.

Airbnb Q4 Preview

The expansion of Airbnb has begun to live up to its buzz as a premier platform for booking unique, non-traditional accommodations, competing with the established hotel offerings. In the past year alone, it has added nearly 1 million global listings, indicating pronounced momentum, which is expected to persist following a record travel season during the third quarter.

Projections indicate a 14% surge in fourth-quarter sales to $2.16 billion. Additionally, estimated earnings per share (EPS) of $0.67 would represent a meteoric 39% surge. The forecast paints a picture of Airbnb wrapping up fiscal 2023 with total sales climbing 17% to $9.86 billion and annual earnings skyrocketing 201% to $8.40 per share. Notably, Airbnb has remarkably surpassed earnings expectations for 10 consecutive quarters, averaging an impressive 49.99% beating in its last four quarterly reports.

Image Source: Zacks Investment Research

DaVita Q4 Preview

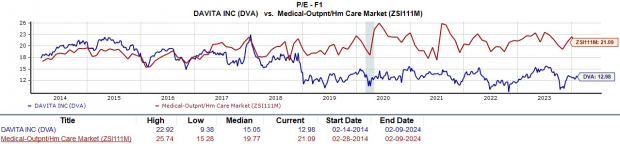

DaVita has maintained its allure as one of the most captivating healthcare companies due to its expansion as a dialysis services provider across America. With a focus on growth, DaVita’s stock stands out with a very reasonable 12.9X forward earnings multiple. In the upcoming quarter, it is anticipated to report an EPS of $1.53, marking a 38% increase from $1.11 per share a year ago. Likewise, Q4 sales are expected to ascend by 3% to $3 billion.

Image Source: Zacks Investment Research

Looking ahead, DaVita is forecasted to conclude FY23 with total sales up 3% to $12 billion and annual EPS expanding 22% to $8.07 per share. Impressively, DaVita has surpassed earnings expectations in each of its last four quarterly reports, posting an average earnings surprise of 36.55%.

Image Source: Zacks Investment Research

Investment Insight

Presently, both Airbnb and DaVita stock possess a Zacks Rank #2 (Buy), reflecting their captivating growth narratives and sustained annual earnings estimate revisions over the last 90 days. It is plausible that both stocks could witness an upswing in the coming weeks if they meet or exceed their ambitious growth projections for Q4, especially if accompanied by positive or better-than-expected guidance.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

DaVita Inc. (DVA) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.