In a week marked by market turmoil where the mixed jobs report fueled a selloff, September’s volatile reputation holds true once more. However, amidst this turbulence, discerning investors might find solace in the stability of insurance equities gracing the esteemed Zacks Rank #1 (Strong Buy) list.

Industry Strength Amid Volatility

Offering a haven in the storm, three top-ranked insurance stocks reside in the Zacks Insurance-Property and Casualty Industry, now positioned in the upper echelon of over 250 Zacks industries. With insurance often portraying stability as a necessary business, these standout equities boast beta ratios below 1.0, indicating a potential shield from the tempestuous market.

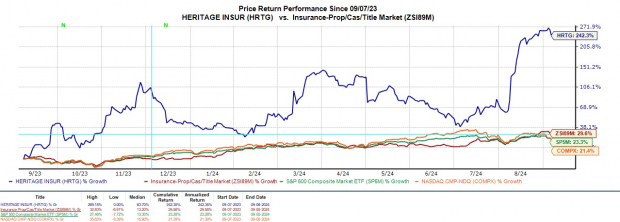

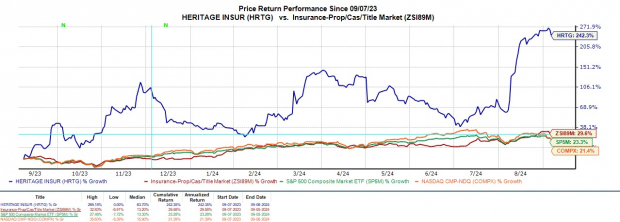

Heritage Insurance HRTG

In the realm of personal residential insurance for single-family dwellings and condo proprietors, Heritage Insurance shines with a stellar “A” VGM Zacks Style Scores grade, embodying a fusion of Value, Growth, and Momentum.

Image Source: Zacks Investment Research

Notably, HRTG flirts only 8% below its pinnacle of nearly $17 in the past year, soaring over 200% from its $4 nadir. Despite this meteoric rise, HRTG trades at a modest 8.4X forward earnings, with EPS projections looking up by 10% in fiscal 2024 and a further 18% surge anticipated in FY25 to $2.28 per share.

Moreover, earnings estimate revisions for FY24 and FY25 have skyrocketed by 33% and 26% respectively in the last 30 days.

Value in Volatility

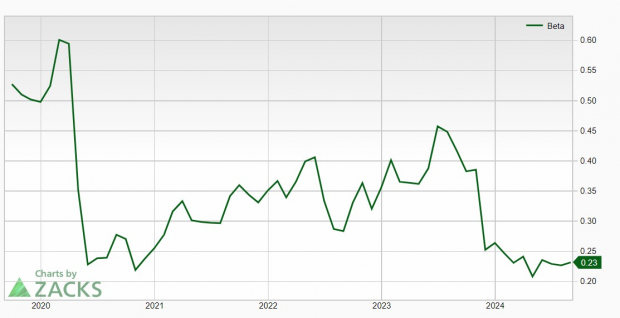

ProAssurance PRA

Sporting a mere 0.23 beta, ProAssurance, a conglomerate offering professional liability insurance to medical practitioners, hints at minimal downside vulnerability from current levels.

Image Source: Zacks Investment Research

Setting aside a historically high forward earnings multiplier of 322X earlier this year, with a median of 41.2X, PRA now trades below $15 at a more reasonable 23.1X. Forecasts predict robust double-digit EPS growth for FY24 and FY25, with earnings estimates soaring 52% and 16% for the respective years.

A Soaring Star

Skyward Specialty Insurance (SKWD)

Completing the triad is Skyward Specialty Insurance Group, a recent entrant to the public market specializing in commercial property and casualty insurance underwriting.

Holding near its annual peak around $40, Skyward boasts a beta ratio of 0.60, ascending 77% from its one-year low of $22.97 last September. Projections foresee double-digit growth in both top and bottom lines for FY24 and FY25, with EPS estimates on a positive trajectory over the past 60 days.

Image Source: Zacks Investment Research

Remarkably, Skyward trades at 14X forward earnings, aligning closely with the industry average and comfortably below the S&P 500’s 23.1X. The company has consistently outperformed earnings expectations since its IPO, with SKWD surging over 100% from its initial public offering.

Seizing the Opportunity

Revisions pointing skyward for earnings estimates indicate a promising outlook for these standout insurance stocks. With low beta ratios and attractive valuations, now might be the opportune moment to delve into stocks often viewed as stalwart defenses in tumultuous times in the market.

Invest Wisely

Unveiling Zacks’ Portfolio Services: A Window to Investing Prowess

Unlocking Access to Zacks’ Buys and Sells

The curtain rises on a compelling offer.

A few years back, Zacks set the financial stage abuzz by extending a rare opportunity to its members: a 30-day voyage through all its selections for a mere $1. A one-time fee with no strings attached.

Throngs seized this golden ticket, enticed by the promise of untapped potential. Yet, others hesitated, skeptical of such generosity. Is it too good to be true? Zacks’ motives were crystal clear. It sought to introduce investors to its treasure trove of portfolio services, such as Surprise Trader, Stocks Under $10, Technology Innovators, and more – platforms that notched up a phenomenal 228 positions with stellar double- and triple-digit returns in the year 2023 alone.

Embracing Zacks Investment Research Recommendations

Analyzing Key Players in the Field

ProAssurance Corporation (PRA) : Detailed Stock Analysis Report

Heritage Insurance Holdings, Inc. (HRTG) : Comprehensive Stock Analysis Report

Skyward Specialty Insurance Group, Inc. (SKWD) : Elaborate Stock Analysis Report

Seizing Opportunities Amid Market Flux

For more insights, visit Zacks.com.

Explore Zacks Investment Research

Please note that the views expressed here are solely those of the author and do not necessarily represent the views of Nasdaq, Inc.