Walmart’s WMT stock split has investors buzzing as the retail giant gears up for a three-to-one split come Monday, February 26. The split aims to enhance trading liquidity and widen the investor base, with shares set to open at approximately $59 after the split from the current $177 per share.

Excitement is running high, especially with over 400,000 associates actively participating in Walmart’s stock purchase program, eager to see the company shares become more accessible to a wider investor pool. However, while this is promising news, a closer look at Walmart’s recent performance post-split announcement and its Q4 results unveiling this week might provide a more robust picture.

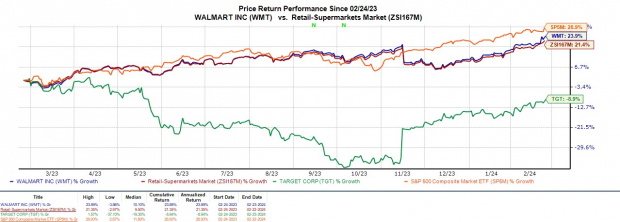

Recent Stock Performance

Walmart stock has already surged +12% year-to-date, outpacing the S&P 500’s +6% as well as rival Target’s TGT +7%. Over the past year, WMT shares have soared +24%, surpassing Target’s -9% performance and beating the Zacks Retail-Supermarkets’ +10%, though it slightly trails the broader market benchmark.

Image Source: Zacks Investment Research

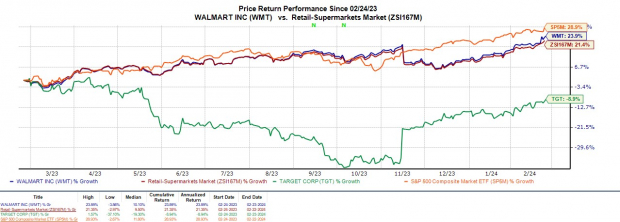

Strong Q4 Results Fueled by E-commerce Sales

In its recent Q4 report, Walmart impressed the market, setting a positive tone for the retail sector ahead of Target’s earnings release in early March. Beats in earnings with $1.80 per share against the Zacks Consensus estimate of $1.65 per share by 9%, and a 5% year-over-year rise in Q4 earnings, signaled the company’s robust performance. The quarter’s sales of $173.38 billion, up 5% year-over-year, also exceeded the estimated $170.63 billion by over 1%.

Image Source: Zacks Investment Research

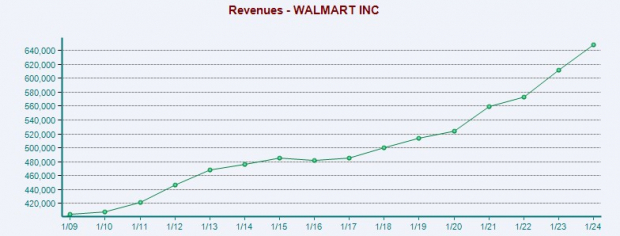

Walmart’s stellar quarter can be primarily attributed to its expanding e-commerce division, which witnessed a 23% sales surge during Q4, culminating in over $100 billion in online sales for the fiscal year. Overall, the company’s total sales for fiscal 2024 grew by 6% to reach $648.1 billion, while annual earnings also saw a 6% uptick to $6.65 per share.

Image Source: Zacks Investment Research

EPS & Outlook Overview

Following the stock split, Walmart’s EPS stands to adjust due to a higher number of outstanding shares. However, it’s crucial to note that the total earnings or net income of a company remains unaffected by such splits, akin to how revenue or sales figures remain constant. Zacks estimates a 3% sales growth for Walmart in the current fiscal year, with a further 4% rise to $698.5 billion projected for the following fiscal year. Annual earnings are forecasted to climb 5% to $7.02 per share in FY25, translating to $2.34 per share post-split. Furthermore, Walmart is anticipated to achieve a 9% EPS growth in FY26.

Image Source: Zacks Investment Research

Key Takeaways

Walmart currently holds a Zacks Rank #3 (Hold) as it gains momentum in the early weeks of the year. While the stock has seen a significant uptick from investors anticipating a pre-split rally, it’s essential to remember that even with Walmart’s promising e-commerce growth and long-term prospects, post-split buying opportunities might still present themselves. Stock splits do not guarantee an immediate increase in share prices, and patience might yield better buying moments. With the upcoming split, Walmart investors should weigh their options judiciously and consider the historical trends post-splits before making investment decisions.

Exclusive Insight: Zacks Top 10 Stocks for 2024

Stock market enthusiasts still have the chance to access the top 10 stock picks for 2024 identified by Zacks Director of Research, Sheraz Mian. These handpicked options have exhibited remarkable and enduring success, tripling the S&P 500’s performance between 2012 and November 2023. With over 4,400 companies reviewed under the Zacks Rank, Sheraz has captured the crème de la crème in this year’s potential stocks. Don’t miss this opportunity to explore these newly released stocks with exceptional growth prospects.

Walmart Inc. (WMT) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policies or positions of Nasdaq, Inc.