Reporting its first quarterly results since aiming to make its stock more affordable to retail investors and implementing a 3-1 stock split in February, many eyes will be on Walmart’s WMT Q1 report on Thursday, May 16.

Of course, Walmart’s report will give a glimpse into the current trend in consumer shopping behavior with earnings from fellow omnichannel retail giant Target TGT due next week. That said, let’s see if now is a good time to buy Walmart’s stock as Q1 earnings approach.

Q1 Expectations

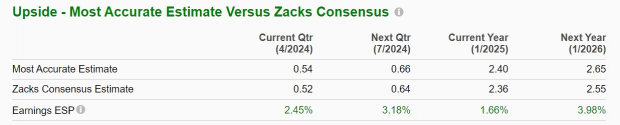

Based on Zacks estimates, Walmart’s Q1 earnings are expected to rise 6% to $0.52 per share with quarterly sales thought to have risen 4% to $159.33 billion. Furthermore, the Zacks ESP (Expected Surprise Prediction) indicates Walmart could surpass earnings expectations with the Most Accurate Estimate having Q1 EPS pegged at $0.54 and 2% above the Zacks Consensus.

Image Source: Zacks Investment Research

Notably, Walmart has exceeded bottom line expectations in three of its last four quarterly reports most recently beating Q2 EPS estimates by 9% in February with earnings at $0.60 per share compared to the Zacks Consensus of $0.55 a share.

Image Source: Zacks Investment Research

Growth & Outlook

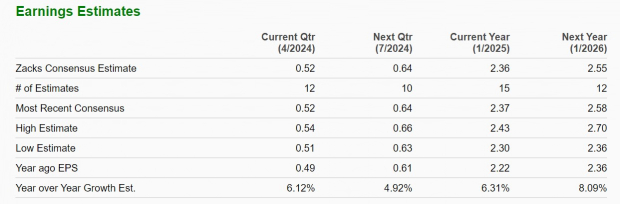

Walmart’s annual earnings are forecasted to be up 6% in its current fiscal 2025 and are projected to rise another 8% in FY26 to $2.55 per share. Total sales are expected to increase 4% in FY25 with Walmart’s top line projected to expand another 4% in FY26 to $699.86 billion.

Image Source: Zacks Investment Research

Recent Performance & Valuation

Walmart’s low-cost offerings and the ability to act as a defensive hedge against inflation in regard to its stock has helped WMT rise +18% over the last year which has trailed the S&P 500’s +26% but topped Target’s -1%. Year to date, WMT is up +14% to impressively edge the benchmark’s +10% and TGT at +11%.

Image Source: Zacks Investment Research

Checking Walmart’s valuation, WMT trades at 25.6X forward earnings and not a stretched premium to the S&P 500’s 21.9X although this is noticeably above Target’s 17.1X. In terms of price to sales, WMT has a forward P/S ratio of 0.7X which is nicely beneath the optimum level of less than 1X and roughly on par with Target while being well below the S&P 500’s 3.8X.

Image Source: Zacks Investment Research

Takeaway

Going into its Q1 report Walmart’s stock lands a Zacks Rank #3 (Hold). With Walmart’s stock off to a strong start this year the company’s valuation does allude to the notion that there could be better buying opportunities ahead although long-term investors may still be rewarded from current levels.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Walmart Inc. (WMT) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.