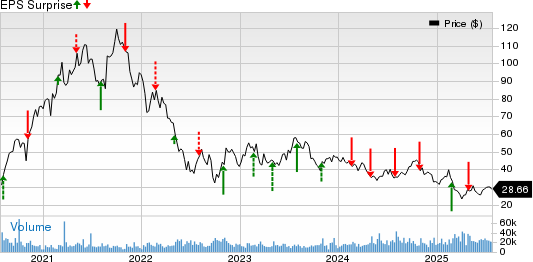

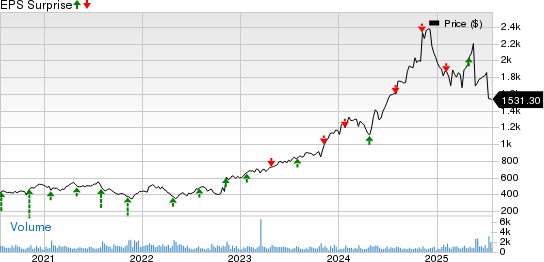

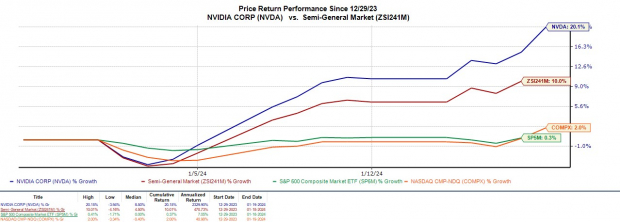

Undoubtedly, one of the standout performers in early 2024 has been Nvidia (NVDA). The chipmaker has significantly outperformed the broader market, experiencing a staggering +200% surge over the past year.

Nvidia’s unprecedented streak of success has propelled its stock to new and unprecedented heights, with the current price per share hovering near $600. The burning question for investors is whether it’s still the opportune moment to invest in this artificial intelligence leader, given its remarkable year-to-date increase of +20%.

Image Source: Zacks Investment Research

Recent Momentum

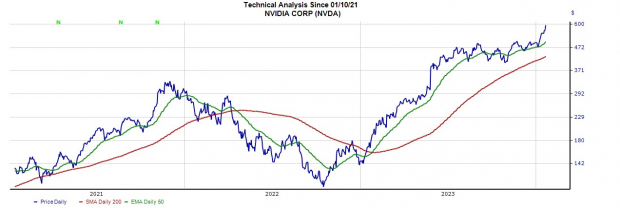

Remarkably, Nvidia’s stock surged past the $500 per share mark last week, extending an exceedingly bullish trend after surpassing its 50-day and 200-day moving averages.

As of the most recent trading session, Nvidia’s stock is on the verge of crossing the $600 line, concluding the day with a remarkable +4% increase and hitting new 52-week highs of $595. The rush to invest comes on the back of the impending release of Nvidia’s cutting-edge AI chip, the HGX H200, expected during the second quarter of this year. This release is anticipated to maintain the company’s lead over competitors such as AMD (AMD) and Intel (INTC).

Image Source: Zacks Investment Research

When Does Nvidia Report Earnings?

Nvidia is scheduled to report its Q4 results on February 28 and is anticipated to deliver another quarter of exponential growth.

Projections for the fourth quarter are staggering, with earnings expected to skyrocket by 410% to $4.49 per share compared to $0.88 per share a year ago. Quarterly sales are forecasted to surge by 232% to $20.1 billion. This would mark Nvidia’s fifth consecutive quarter of exceptional sequential growth on both its top and bottom lines, with Q4 EPS and sales expected to rise by 11% from the third quarter, respectively.

In addition, Nvidia has surpassed earnings expectations for four consecutive quarters, with an average earnings surprise of 18.99%.

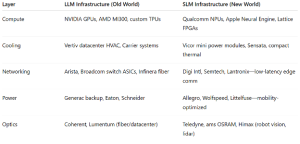

Image Source: Zacks Investment Research

Bottom Line

Currently boasting a Zacks Rank #1 (Strong Buy), Nvidia’s stock still offers an upside potential of 13% with an Average Zacks Price Target of $649.11 per share. The exceptional growth, and more crucially, its position as a leader in powering artificial intelligence, could pave the way for further gains in Nvidia’s stock leading up to its Q4 report in February.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we stunned our members by offering them 30-days access to all our picks for just $1. There was no obligation to spend another cent.

Thousands seized this opportunity, but thousands hesitated, suspecting a catch. Well, there is a reason. We wanted them to familiarize themselves with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more. In 2023 alone, these services closed 162 positions with double- and triple-digit gains.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.