“`html

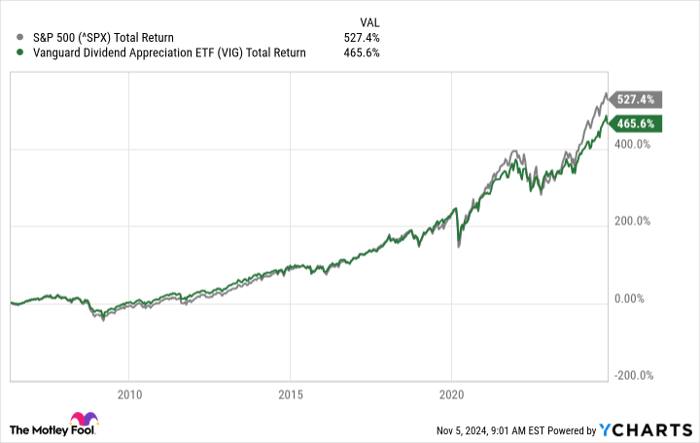

Vanguard Dividend Appreciation Index Fund ETF (NYSEMKT: VIG) offers a yield of 1.7%, exceeding the S&P 500’s average yield of 1.3%. The ETF includes 338 stocks, featuring major companies such as UnitedHealth Group and ExxonMobil. It has maintained performance similar to the S&P 500 over the past 20 years, with a low expense ratio of 0.06%.

Vanguard Consumer Staples Index Fund ETF (NYSEMKT: VDC) yields 2.5% and focuses on consumer staples, including top holdings like Costco Wholesale and Coca-Cola. While it contains 105 stocks, its performance has outpaced the S&P 500 for much of the last two decades. It carries a slightly higher expense ratio of 0.10%.

“`