Tesla’s Q1 Earnings: Key Insights for Investors Awaiting Financial Review

Tesla Inc (TSLA) is poised to release its first-quarter earnings report, which will shed light on the company’s vehicle performance, innovations, and CEO Elon Musk’s political engagements. This earnings release is particularly significant as investors are split on Tesla’s growth prospects following mixed sales and stock performance. Many are reconsidering their trading strategies in the wake of these developments. The question remains: Is it a good time to invest in Tesla stock or should investors wait? Let’s explore further.

Challenges Facing Tesla Ahead of Q1 Earnings

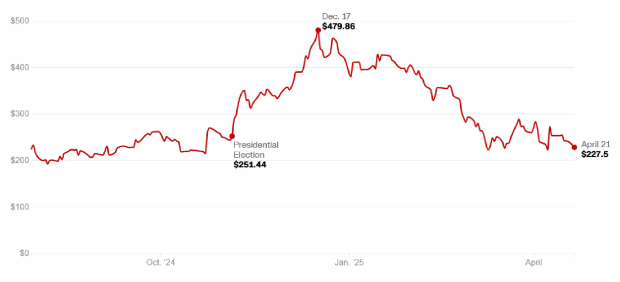

Musk’s ties with former President Donald Trump had initially buoyed Tesla shares after the election, leading to speculation that he could influence self-driving vehicle regulations. Nonetheless, Musk’s camaraderie with Trump turned contentious when tariffs imposed by the administration alienated some Tesla enthusiasts. This volatility resulted in price fluctuations from $251.44 to $479.86 in December, followed by a decline to $227.5 in April.

Tesla Closing Price by Day

Image Source: Yahoo! Finance

The imposition of tariffs particularly affected Chinese electric vehicle (EV) buyers, a significant concern since China ranks as Tesla’s second-largest market after the U.S. In 2022, Tesla registered $20.9 billion in sales, accounting for nearly 21% of total revenues. However, the company now faces fierce competition from China’s burgeoning EV leader, BYD.

Musk’s political activities and critiques of federal spending have led to protests and vandalism at Tesla showrooms, damaging the brand’s reputation and negatively impacting global sales. During the first quarter, Tesla produced 362,000 vehicles but shipped only 336,681 units, falling short of Wall Street’s expectations.

Image Source: Tesla’s Investor Relations Website

Additionally, delays in launching the more affordable Model Y may further dampen first-quarter sales as economic conditions tighten and auto loan delinquencies rise. Analyst Dan Ives of Wedbush Securities issued a “code red” alert in light of Tesla’s challenging outlook before the earnings report.

What Analysts Are Watching for in Tesla’s Earnings

Despite the potentially disappointing first-quarter results, optimistic responses from management could revitalize investor confidence and reverse Tesla’s declining stock value experienced since mid-December. Key indicators to look for include the potential disclosure of the financial impact of Trump’s tariffs. If this impact is less severe than anticipated, it could elevate Tesla’s stock.

It’s important to note that Tesla is less vulnerable to tariffs than many other automakers. The company imports fewer cars from overseas markets and utilizes a smaller proportion of foreign parts in its U.S.-assembled vehicles. Moreover, Tesla had to suspend new orders for California-made Model S and Model X cars in China due to retaliatory tariffs, which could positively influence earnings.

Second, analysts anticipate management will indicate progress in launching self-driving robotaxis and humanoid robots, which could significantly enhance the company’s market value. Although earnings reports may not reflect positive news, any announcement regarding the rollout of a driverless ride-hailing service might drive up Tesla’s stock, particularly given the competitive pressures from companies like Uber Technologies, Inc. (UBER) and Alphabet Inc. (GOOGL), which are also pursuing this market.

Strategies for Trading Tesla Stock Moving Forward

Recent delays in its lower-priced model, sluggish vehicle deliveries, and Musk’s controversial political engagements have contributed to a notable decline in Tesla’s stock price since the election cycle, potentially impacting first-quarter performance. Currently, Tesla’s earnings ESP sits at -4.93%, signaling that the company may struggle to meet projections in the upcoming earnings report. (Find the latest EPS estimates and surprises on Zacks earnings Calendar.)

Tesla, Inc. Stock Price and EPS Surprise

Tesla, Inc. price-eps-surprise | Tesla, Inc. Quote

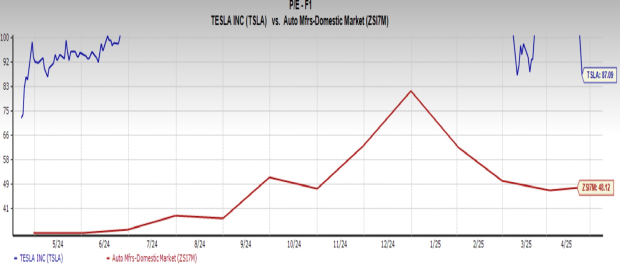

Furthermore, Tesla’s high valuation—exemplified by a forward price-to-earnings (P/E) ratio of 87.09, far exceeding the Automotive – Domestic industry average of 48.1—poses a risk of significant stock depreciation should growth forecasts not materialize. Investors are advised to proceed cautiously and avoid purchasing Tesla stock until the first-quarter results are released.

Image Source: Zacks Investment Research

Should Musk convey a favorable outlook on tariffs and self-driving technology during the earnings call, alongside a commitment to reduce involvement in government initiatives, it may pave the way for positive investor sentiment toward Tesla shares. Currently, Tesla carries a Zacks Rank #4 (Sell).

For additional insights, you can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

5 Stocks Set to Double

Each of these was selected by a Zacks expert as their #1 choice to potentially gain +100% or more in 2024. While not every pick may succeed, previous recommendations have achieved impressive returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Most of these stocks are currently under the radar of Wall Street, presenting an excellent chance for early investment.

Today, see These 5 Potential Home Runs >>

For the latest recommendations from Zacks Investment Research, you can download 7 Best Stocks for the Next 30 Days. Click to access this free report

Tesla, Inc. (TSLA): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

Uber Technologies, Inc. (UBER): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.