Supermicro Looks to Rebound in 2025: What Investors Should Know

Reviewing Supermicro’s 2024 Rollercoaster

Super Micro Computer, Inc. (SMCI) had a wild ride last year, starting strong but facing significant hurdles later on. The company’s ability to customize equipment for data centers fueled rising revenues in early 2024. By partnering with chip designers, Supermicro integrated the latest technology into its products, leading to increased stock prices and even a stock split to make shares more accessible for retail investors.

However, the latter half of 2024 was tough for Supermicro. The stock saw downturns amidst serious concerns, including accusations from a short-seller about accounting issues, delays in filing its annual 10-K report, a resignation from its auditor, and the threat of being removed from the Nasdaq Stock Exchange.

Positive Early Signs for Supermicro in 2025

Despite last year’s challenges, Supermicro appears to be on the upswing in 2025. A special committee found no evidence of wrongdoing by management, allowing the company to stay on track with its reporting process thanks to the appointment of a new independent auditor.

Additionally, Supermicro announced a shift toward full production for its artificial intelligence (AI) data center solutions, powered by NVIDIA Corporation’s (NVDA) Blackwell platform. With this development, Supermicro aims to deliver custom server designs tailored to specific customer needs.

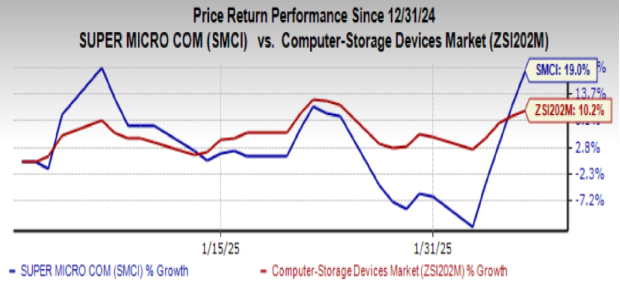

The reassurance that Supermicro’s designs utilize Blackwell chips has helped elevate investor confidence. So far this year, Supermicro’s shares have outpaced the Computer Storage Devices industry, gaining 19.0% compared to the industry’s 10.2% increase.

Image Source: Zacks Investment Research

Should You Consider Buying SMCI Stock Ahead of Q2 Earnings?

As 2025 unfolds positively for Supermicro, investors should keep an eye on the upcoming fiscal second-quarter update scheduled for February 11, after market close. Should the company emphasize the strong demand for Blackwell chips and announce more direct liquid cooling (DLC) orders, it may lead to further upward movement in stock prices. DLCs are crucial for addressing heat issues in AI data centers.

On the flip side, failing to deliver good news could introduce heightened volatility. New investors might want to approach this stock cautiously and wait until February 25 when Supermicro launches its 10-K report, offering deeper financial insights.

Encouragingly, Supermicro’s CEO, Charles Liang, has expressed confidence in submitting a compliance plan by February 25 to prevent Nasdaq delisting and rebuild investor trust. Therefore, consider potential investments in Supermicro stock after this date.

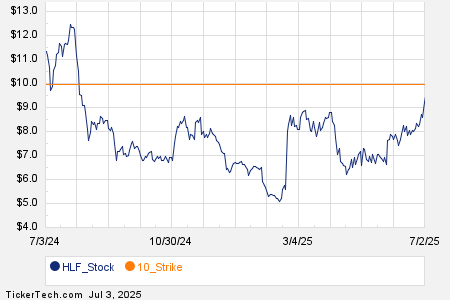

Currently, Supermicro shows solid profitability, with a return on equity (ROE) of 34%, surpassing the industry average of 20.4%. For investors already onboard, holding onto Supermicro stock might yield long-term benefits. The stock currently holds a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

New Insights: Zacks Top 10 Stocks for 2025

Don’t miss out! Discover our selection of the top 10 stocks for 2025. This shortlist, curated by Zacks Director of Research Sheraz Mian, has consistently outperformed expectations. Since its inception in 2012, the Zacks Top 10 Stocks portfolio has achieved a remarkable gain of +2,112.6%, significantly exceeding the S&P 500’s +475.6% growth. Sheraz has meticulously sifted through 4,400 covered companies to find the top 10 investments to buy and hold into 2025. Be among the first to access this newly released list of stocks full of potential.

See New Top 10 Stocks >>

Looking for the latest stock recommendations from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days for free.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.