Municipal bond closed-end funds (CEFs) are currently being analyzed for investment opportunities, offering an average yield of 7.4%, with one fund, the Invesco California Value Municipal Income Trust (VCV), trading at a nearly 5% premium to its net asset value, despite a 6% drop in its NAV this year.

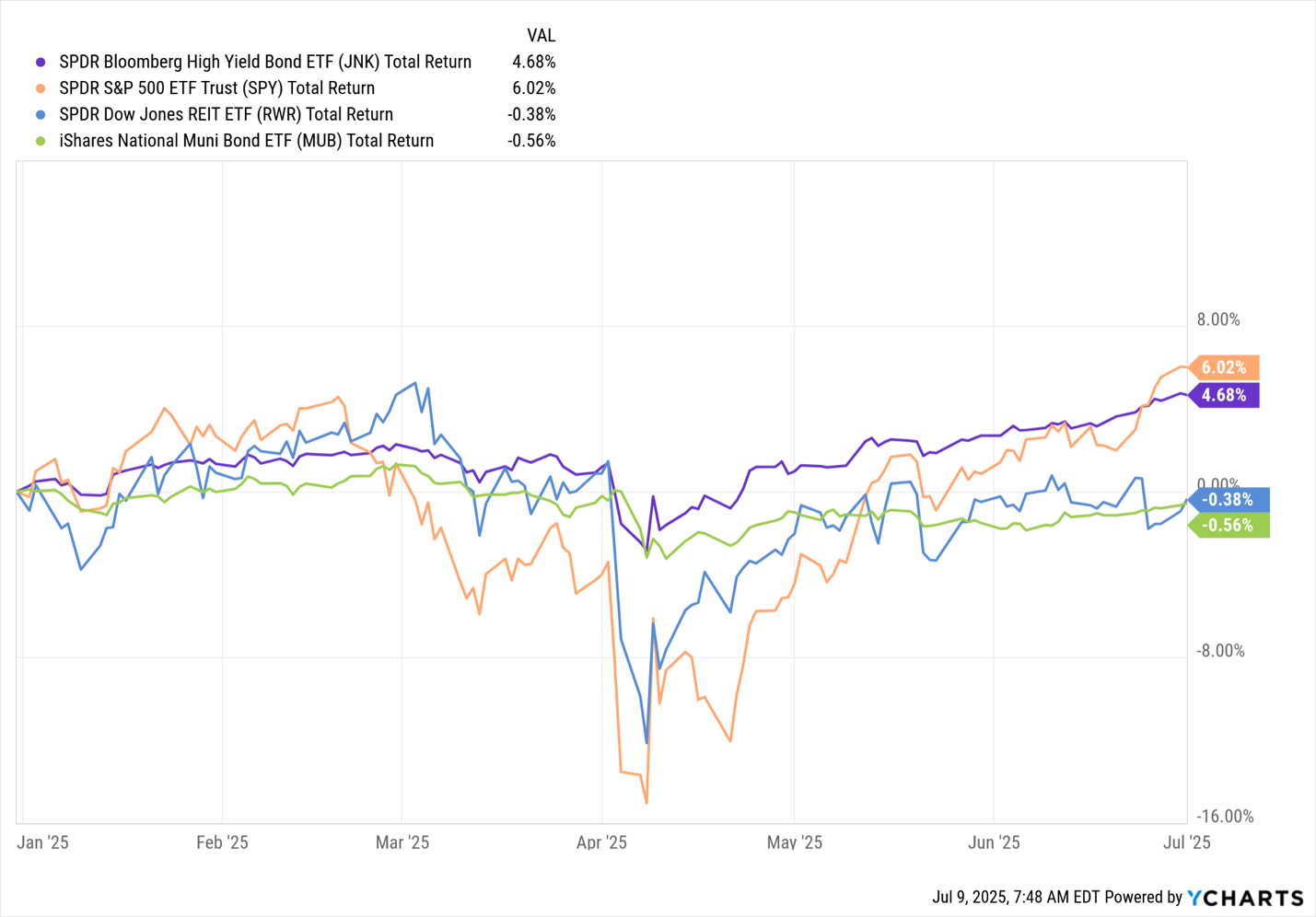

While municipal bonds have underperformed in the first half of 2025, their potential tax advantages and high yields make them an attractive option for income diversification. Another fund, the abrdn National Municipal Income Fund (VFL), offers a 6.2% yield and is trading at a 10.3% discount to NAV, representing a more favorable entry point, especially as investors seek stability amid market fluctuations.

In recent years, municipal bonds have seen declining interest. However, in times of stock market corrections, they typically experience a recovery, suggesting this could be a strategic moment for investors to consider entering the muni-bond market.