“`html

TJX Companies Reports Strong Q1 2026 Earnings and Future Outlook

TJX Companies (TJX), the parent company of TJ Maxx, Marshalls, and HomeGoods, announced its fiscal Q1 2026 earnings today. The company exceeded expectations with earnings per share of $0.92 and revenue of $13.1 billion. Comparable store sales rose by 3%, aligning with the higher end of projections, while pretax margins reached 10.3%, surpassing estimates. In this quarter, TJX returned $1 billion to shareholders through share repurchases and dividends.

Despite a slight decline in shares following the earnings report, TJX benefits from positive short-term catalysts, including a Zacks Rank #2 (Buy) rating, reflecting favorable earnings estimate revisions and robust analyst confidence.

Image Source: Zacks Investment Research

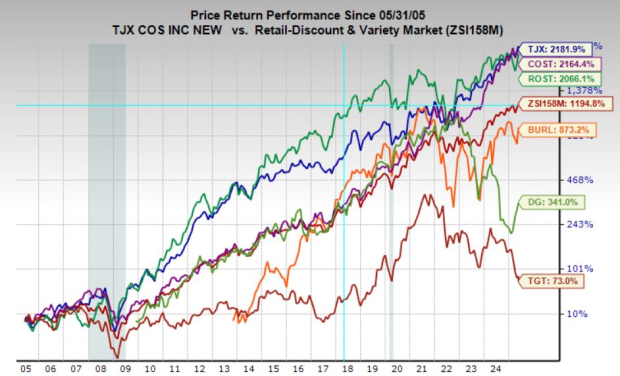

Factors Contributing to TJX’s Steady Returns

TJX Companies’ enduring success stems from steady earnings growth, share buybacks, and reasonable multiple expansion. Annual earnings per share (EPS) have increased from just $0.06 in 1996 to $4.26 today.

Their management has successfully reduced shares outstanding by 60% since 1998, reflecting a commitment to returning capital to shareholders. Furthermore, TJX’s median earnings multiple has climbed from approximately 19x to 24.4x, depending on the timeframe analyzed.

Currently, TJX is trading at a premium valuation of 30.4x, showcasing investors’ willingness to invest in a high-quality company.

Image Source: Zacks Investment Research

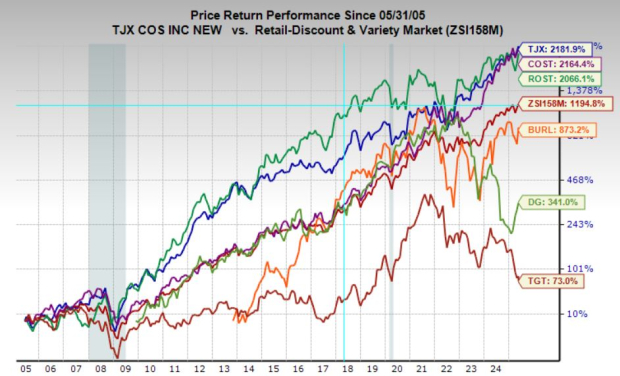

Earnings Forecast Comparison: TJX, COST, ROST, and BURL

The discount retail sector includes several robust competitors, showcasing the profitability of this business model. Although TJX holds a premium valuation, its earnings growth forecast stands at a modest 9.1% annually over the next three to five years.

Costco, known for its strong customer loyalty and subscription model, has a similar growth forecast of 9.4%. Investors currently pay a premium for that consistency, as Costco trades at an elevated 57.7x forward earnings.

Ross Stores reports an earnings growth estimate of 8% and trades at 24x forward earnings, highlighting a balanced approach to value and stability.

On the other hand, Burlington Stores presents an appealing growth/value trade-off with the highest projected earnings growth at 14.5% annually, priced at 29.2x forward earnings.

Investment Considerations: TJX, COST, BURL, and ROST

For long-term investors, TJX Companies stands as a reliable figure in retail. Its consistent performance, disciplined capital return strategy, and effective off-price business model make it a sound core holding, even with its premium valuation.

Those pursuing stronger near-term earnings growth or a favorable growth-to-valuation balance might find Burlington Stores more appealing, while Ross Stores also presents interesting potential. Costco is a strong company but has less room for downside risks due to its high valuations.

In summary, TJX is a quintessential compounder, and its stock remains worth considering for any serious and diversified investment portfolio.

“`