Toast’s Trading Performance

Toast (TOST) closed at $28.98, up 0.63% from the previous day, slightly lower than the S&P 500’s daily gain. Over the last month, the stock surged by 21.62%, surpassing the sector and broader market gains during the same period.

Upcoming Financial Outlook

Analysts predict Toast will report earnings of $0.01 per share, a 111.11% increase from the previous year. Revenue is estimated to reach $1.29 billion, up by 24.78% compared to the same quarter a year ago. For the full year, earnings are expected to be -$0.10 per share with revenue totaling $4.9 billion.

Investor Considerations

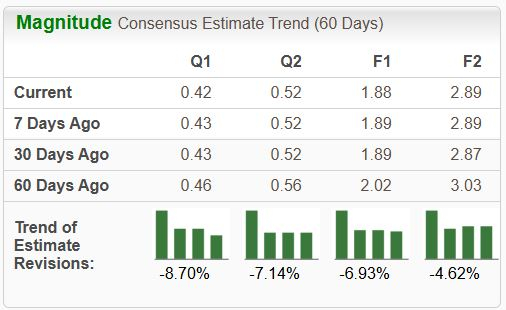

Analyst estimates for Toast reflect short-term business trends. Positive estimate revisions can indicate a favorable business outlook. Utilizing the Zacks Rank system, which rates Toast as #3 (Hold), can aid investors in decision-making, historically showing an average annual return of +25% for #1 (Strong Buy) stocks.

Industry Standing

The Internet – Software industry, part of the Computer and Technology sector, holds a Zacks Industry Rank of 73, positioning it in the top 29% of industries. Industries in the top 50% by Zacks Industry Rank tend to outperform the bottom half significantly.

Stock Recommendations

Zacks experts have identified 5 stocks set to potentially double in 2024. Previous recommendations have yielded impressive returns, with some soaring by up to +673.0%. These stocks provide an opportunity for investors to enter the market early.

Key Takeaways

Follow Zacks.com for insights on market-moving metrics during upcoming trading sessions and consider the free stock analysis report on Toast, Inc. (TOST) available on Zacks.com.

The views and opinions expressed herein are of the author and do not necessarily reflect those of Nasdaq, Inc.