Lennar Faces Challenges Amid Declining Homebuilding Market

Lennar Corporation LEN is recognized as one of the largest homebuilders in the United States.

The stock of LEN has seen a significant decline, plummeting nearly 45% from its peaks in September, as earnings estimates fall due to a slowing housing market and ongoing inflation affecting many areas of the business.

Key Insights for Investors Regarding Lennar

Lennar Corporation leads the U.S. homebuilding sector, with a focus on affordable, move-up, and active adult homes. Its financial services division provides mortgage financing, title, and closing services to Lennar homebuyers. Furthermore, Lennar engages in the development of high-quality multifamily rental properties nationwide.

The company faces challenges common in the homebuilding industry and the wider housing market.

Inflation has negatively impacted Lennar’s margins throughout fiscal year 2024 and into Q1 FY25, which the company reported on March 20.

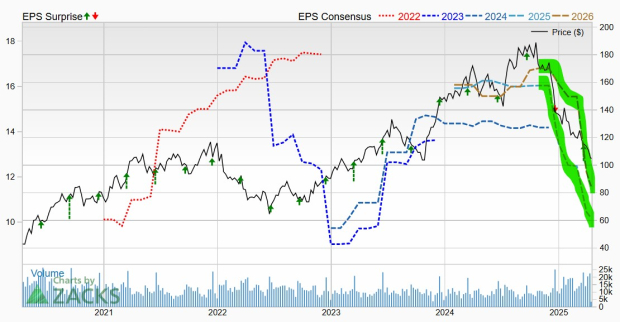

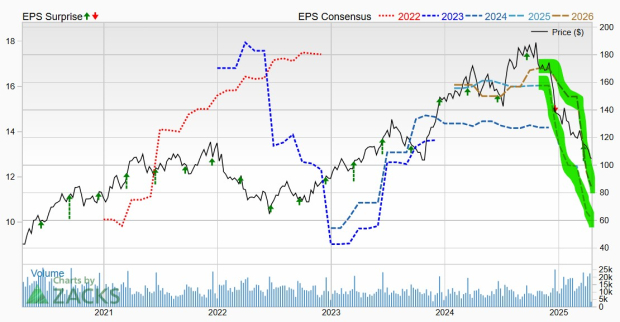

Image Source: Zacks Investment Research

Lennar concluded Q1 fiscal 2025 with a gross margin of 18.7% on home sales, representing a decline of 310 basis points (bps) year-over-year. This drop was primarily due to lower revenue per square foot and rising land costs. Furthermore, increased sales incentives and mortgage rate buydowns, implemented to address affordability issues, have also affected margins.

The consensus earnings estimate for fiscal 2025 plummeted 18% since the first quarter report, with the estimate for FY26 being lowered by 26%.

Negative EPS revisions for Lennar signal a difficult phase, a trend that accelerated after the release of its Q4 FY24 results. Co-CEO Stuart Miller commented, “Our first quarter faced a challenging macroeconomic environment for homebuilding.”

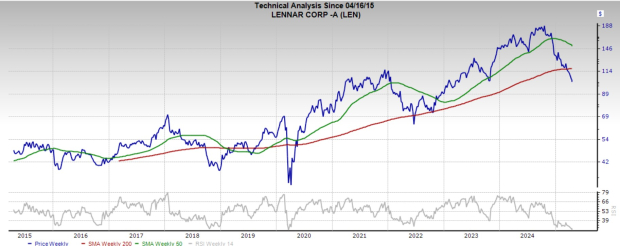

Image Source: Zacks Investment Research

Miller elaborated, “Despite strong demand, the combination of persistently high interest rates and inflation, weakened consumer confidence, and a limited supply of affordable homes, makes it increasingly difficult for consumers to access homeownership.”

Is It Time to Avoid Lennar Stock?

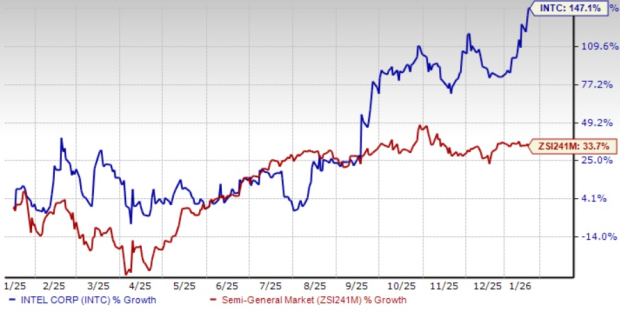

The decline in Lennar’s earnings estimates has led to a Zacks Rank #5 (Strong Sell). The stock has decreased about 45% from its highs, including a year-to-date (YTD) drop of 25%.

LEN’s performance has fallen beneath its 200-week moving average, indicating it is at its most oversold levels in a decade.

While some investors may consider purchasing shares of Lennar at these depressed levels, it is important to recognize the risks. Attempting to find a bottom in the hard-hit Lennar stock could be challenging until there are clearer signs of recovery in the broader homebuilder market.

Only $1 to see All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we surprised our members by offering them 30-day access to all our picks for just $1, with no obligation to spend more.

Thousands took advantage of this opportunity. Some did not, thinking there might be a catch. Our goal is to introduce you to our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more, that realized 256 positions with double- and triple-digit gains in 2024 alone.

see Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get your free report

Lennar Corporation (LEN): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.