“`html

KB Home (KBH), one of the largest homebuilders in the U.S., reported a decline in fiscal Q2 2025 earnings and revenues on June 23, 2025. The company reported earnings of $1.50 per share, surpassing the Zacks Consensus Estimate of $1.45. However, revenue fell to $1.53 billion, down from $1.71 billion a year ago, as homes delivered dropped 11% to 3,120.

KB Home’s adjusted gross profit margin decreased to 19.7% from 21.2% year-over-year due to market pressures, including higher land costs and necessary price reductions. In response to tough market conditions, KB Home scaled back land acquisitions, investing $513.9 million in land and development, a 23% drop from the previous year. The company also bought back $200 million in stock at an average of $54 per share.

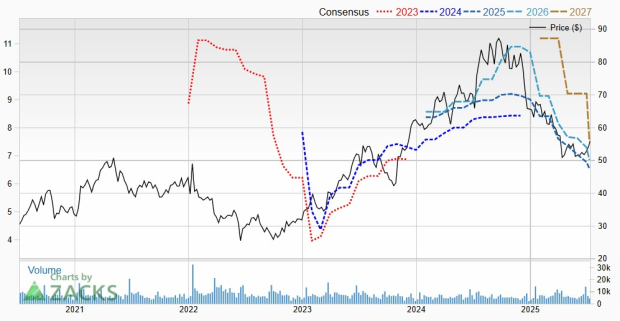

Analysts have cut KB Home’s fiscal 2025 earnings estimate to $6.55 from $7.05, indicating a decline of 22.5% compared to last year’s $8.45. The outlook for fiscal 2026 earnings has also been downgraded, with the consensus now at $6.86, down from $7.64.

“`