Affirm Holdings: A Strong Contender for Your Portfolio

Affirm Holdings, a Zacks Rank #1 (Strong Buy), specializes in payment solutions that allow consumers to use flexible, transparent installment loans. The company partners with many merchants, giving customers the option to pay for purchases over time.

Stock Performance Signals Growth

The stock has demonstrated significant strength, repeatedly reaching 52-week highs. This upward momentum suggests a positive outlook as we move into the new year. Increased trading volume indicates growing investor interest, highlighting Affirm as a top-ranked option in the market.

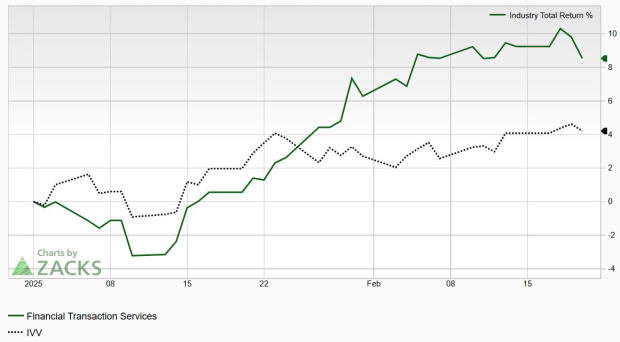

Part of the Zacks Financial Transaction Services industry group, Affirm is within the top 33% of over 250 industries. This favorable ranking suggests outperformance over the next three to six months, mirroring its progress this year:

Image Source: Zacks Investment Research

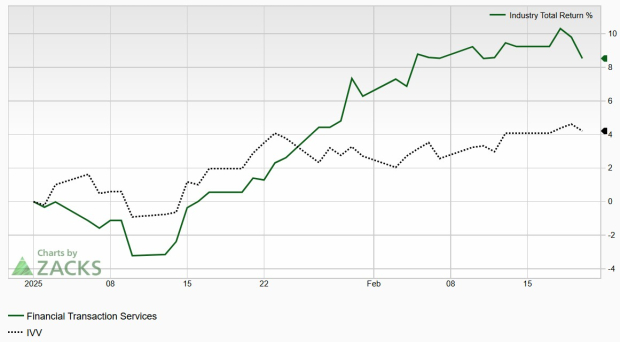

Below are the strong metrics for this industry group:

Image Source: Zacks Investment Research

Historical data shows that around half of a stock’s price increase can be attributed to its industry. Notably, the top 50% of Zacks Ranked Industries outperform the bottom half by more than two to one. Investing in stocks within leading industry groups may enhance market performance, making stock selection more successful.

About Affirm Holdings

Affirm operates a payment network not only in the United States but also in Canada and internationally. Its platform offers point-of-sale payment solutions for both consumers and merchants along with a dedicated consumer app.

With over 337,000 active merchants, ranging from small businesses to large enterprises, Affirm’s tools assist merchants in boosting sales and engaging customers effectively. The company recently renewed a multi-year agreement with Shopify, solidifying its role as the exclusive buy now, pay later provider for Shop Pay Installments in the U.S. and Canada, with future expansion plans into the UK and beyond.

Positive Earnings Trends and Projections

Affirm (AFRM) has shown a strong reporting history, beating earnings estimates in seven of the last eight quarters, with an impressive average surprise of 84.1% over four quarters.

In February, Affirm posted fiscal second-quarter earnings of $0.23 per share, exceeding the consensus estimate of -$0.20 by 215%. Revenue reached $866.38 million, surpassing projections by 7.7%. The company’s performance benefited from higher transaction volumes, strong customer retention, and a successful holiday season.

Analysts remain optimistic, raising current-quarter earnings estimates by 30.77% in the past 60 days. The Zacks Consensus Estimate for fiscal Q3 currently stands at -$0.09 per share, indicating a growth of 79.1% compared to the same period last year.

Image Source: Zacks Investment Research

Technical Analysis Indicates Continued Strength

This market leader has seen its stock price surge by over 80% in the past year. Such remarkable performance typically indicates strong uptrends. Stocks that exhibit this kind of momentum deserve consideration in investment portfolios.

Image Source: StockCharts

The 200-day moving average shows a positive slope, and the stock has consistently reached higher peaks over the last year. Coupled with solid fundamental and technical indicators, AFRM appears well-positioned for ongoing success.

Research indicates a strong link between stock trends and earnings estimate revisions. Affirm has recently benefited from positive revisions, suggesting the stock can maintain its upward trajectory if it continues to meet or exceed earnings expectations.

Conclusion

With a strong backing from its industry and a history of exceeding earnings, it’s easy to see why AFRM stock stands out as a wise investment choice. Its robust fundamentals alongside encouraging technical trends make it a solid addition to any portfolio.

Affirm’s diverse income streams, which include merchant fees and loan interest, contribute significantly to its revenue growth. The company employs advanced machine learning and predictive modeling to power its cloud-based platform.

Recent positive earnings revisions may also provide stability against unexpected downturns. If you haven’t reviewed it already, consider placing AFRM on your investment watchlist.

Unlock Zacks’ Insights for Only $1

We’re not joking.

In a surprising move, we previously offered members 30-day access to all investment picks for just $1. No further obligations required.

Thousands have seized this opportunity, while others were skeptical. This offering allows you to engage with our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, which celebrated 256 positions with double- and triple-digit gains in just one year.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Download the free report: 7 Best Stocks for the Next 30 Days.

Affirm Holdings, Inc. (AFRM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.