“`html

Investors Eye Mitsubishi UFJ Amid Global Market Shifts

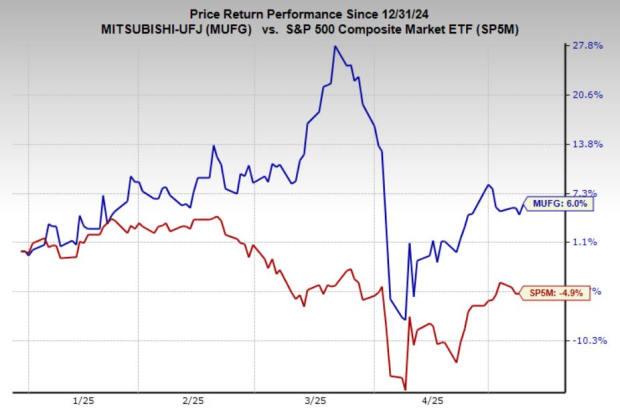

While equity markets have made a recovery from recent tariff-driven fluctuations, global investors are increasingly shifting their focus to non-dollar assets. Leading markets like Japan are witnessing renewed interest in financial stocks, especially major global institutions.

Mitsubishi UFJ Financial Group

(MUFG) is Japan’s largest financial institution and among the largest banking groups globally. With over $3 trillion in assets and operations in over 50 countries, MUFG offers a range of financial services, from commercial banking to asset management.

The institution benefits from capital inflows directed at international equities and global financials. With a strong Zacks Rank, attractive valuation, and notable relative resilience, MUFG signifies growing investor interest. While it may not be the fastest-growing stock, it offers dependable, low-volatility returns, which are increasingly sought after in today’s market.

Image Source: Zacks Investment Research

Warren Buffett’s Favor for Japanese Stocks

At Berkshire Hathaway’s 2025 annual meeting, Warren Buffett reaffirmed his positive stance on Japanese equities, including long-term plans to maintain shares in Japan’s five major trading houses, such as Mitsubishi Financial, for “50 years or more.” He noted the strong returns these investments have generated and expressed no plans to sell.

Buffett praised the cultural and governance differences between Japanese and US firms, which he feels enhance long-term value.

For investors interested in this approach, Mitsubishi UFJ Financial Group provides a solid entry into the Japanese financial sector. As the country’s leading bank, MUFG has qualities Buffett finds appealing: stability, a global footprint, and long-term earnings potential, all offered at a reasonable valuation.

Mitsubishi Financial Group: Earnings Momentum and Valuation

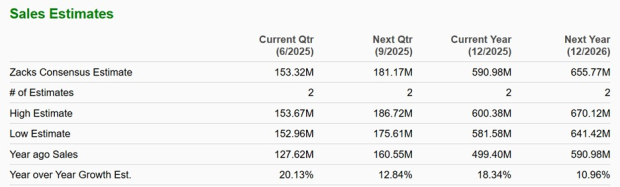

Mitsubishi UFJ Financial Group is demonstrating robust earnings momentum, reflected in rising estimate revisions and encouraging long-term growth projections. Analysts have increased their earnings forecasts by 10.1% for the current year and 7.3% for the next, which has helped MUFG achieve a Zacks Rank #1 (Strong Buy) rating.

In the future, the company is projected to grow earnings at a 13.2% annual rate over the next three to five years. Despite this optimistic outlook, the stock trades at a modest 10.5x forward earnings, which is just above its 10-year median and aligns with industry averages.

Given the current global pivot away from US-centric assets and renewed interest in Japanese equities, MUFG stands to potentially gain a more favorable valuation over time.

With its strong earnings performance and attractive valuation, MUFG’s PEG ratio of 0.8 suggests the stock remains undervalued relative to its growth potential—an appealing situation for investors seeking value in international markets.

Image Source: Zacks Investment Research

Is Now the Time to Invest in MUFG?

For investors focused on stability, global diversification, and value, Mitsubishi Financial Group meets all these criteria. With vigorous earnings momentum, a strong Zacks Rank, and exposure to a revitalizing Japanese equity market, MUFG offers a blend of reliability and growth potential.

It may not be a flashy investment, but in a climate marked by uncertainty, MUFG presents a reliable, steady addition to any globally-minded, long-term investment portfolio.

Mitsubishi UFJ Stock Analysis

Mitsubishi UFJ Financial Group, Inc. (MUFG): Free stock analysis report.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`