Nvidia’s Future: Can it Really Grow Tenfold in a Decade?

Tom Lee, a noted equity research analyst at Fundstrat Global Advisors, recently shared his insights on one of the tech industry’s powerhouses, Nvidia (NASDAQ: NVDA). His predictions have sparked a discussion about the company’s potential in the face of both opportunity and challenge.

Start Your Mornings Smarter! Gain insights with Breakfast News delivered to your inbox every market day. Sign Up For Free »

This article will dive into the arguments for and against Lee’s ambitious forecast of tenfold growth for Nvidia over the next ten years. By examining various factors, we can help investors gain a deeper understanding of the challenges and catalysts facing Nvidia’s trajectory.

Reasons for Optimism about Nvidia

For those who have followed the surge in artificial intelligence (AI), the date November 30, 2022, marks a significant turning point. On this day, OpenAI unleashed ChatGPT to the world, igniting widespread interest similar to the early social media boom. This moment resonates with the remarkable growth Nvidia has experienced since then.

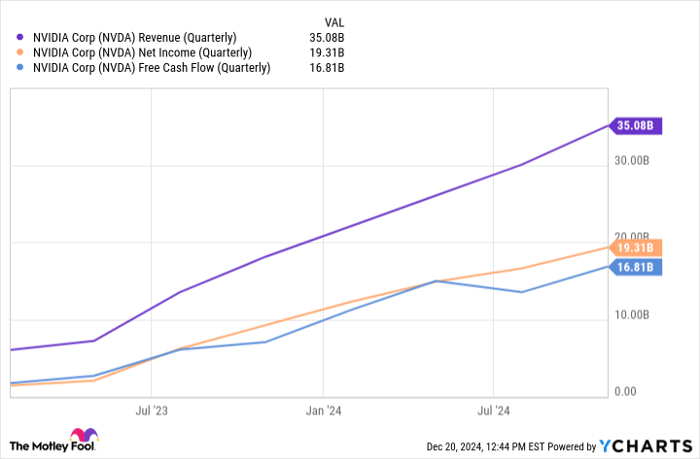

NVDA Revenue (Quarterly) data by YCharts

Examining Nvidia’s financial performance reveals a steep upward trend in revenue, net income, and free cash flow since the start of the AI revolution. Nvidia dominates approximately 90% of the GPU market, fueled by incredible demand for its chipsets. Experts predict that global investments in AI technology will surpass trillions of dollars in the coming years, and Nvidia is in an advantageous position with its new Blackwell GPU architecture and the upcoming Rubin model set for a 2026 release.

Given the company’s pace of innovation and strong profitability, it’s tough to embrace a negative outlook. However, prudent investors should consider all factors before making significant commitments to Nvidia.

Concerns Regarding Nvidia’s High Valuation

One notable factor behind Nvidia’s booming GPU sales is its unique technology integration. Nvidia’s GPUs work closely with its software, CUDA, which can make it challenging for businesses to switch to other chipmakers. This may cause concern over potential government scrutiny. The Department of Justice (DOJ) might investigate Nvidia for its market position, possibly forcing the company to make its system more compatible with competitors’ products. Such actions could hinder Nvidia’s growth and cause its market share to decline.

Moreover, competition presents a more tangible challenge. Major clients like Microsoft, Alphabet, and Amazon are increasingly developing their own chips or opting for more affordable alternatives from companies like Advanced Micro Devices. As these giants invest in AI infrastructure, it could have a dual effect, potentially benefiting Nvidia while also threatening its current market hold.

Image source: Getty Images.

Final Thoughts on Nvidia’s Future

Ultimately, projecting a tenfold increase in Nvidia’s valuation over the next ten years seems far-fetched. While I maintain a positive outlook on the company, I question the sustainability of such rapid growth given intensified competition and potential regulatory issues.

Nvidia remains a strong investment for those looking to gain exposure to the booming AI sector, but forecasting tenfold growth may be optimistic in light of the aforementioned challenges.

Seize Another Potential Investment Opportunity

Do you feel you missed out on investing in top companies? It might not be too late.

Our team of analysts occasionally issues a special “Double Down” stock recommendation for companies they believe are poised to see significant gains. If you think you’ve missed your chance, this might be the ideal moment to invest. Consider the returns:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $349,279!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $48,196!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $490,243!*

Currently, we are issuing “Double Down” alerts for three exceptional companies that may not present another opportunity like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.