Stock Market Soars: Discover Exciting Investment Opportunities

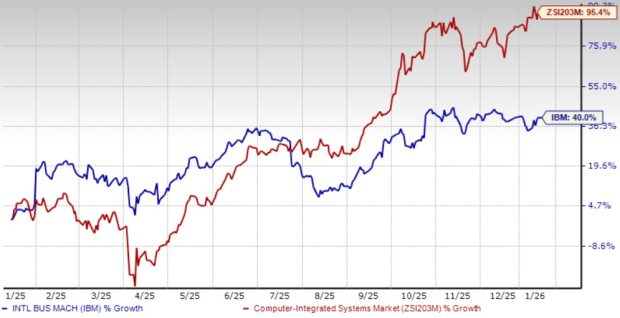

In 2024, stock market indexes have shown strong performance, offering investors impressive returns.

*Stock prices referenced are from the afternoon of October 31, 2024. The video was published on November 2, 2024.

Your Chance to Invest in High-Growth Stocks

Do you sometimes feel like you missed out on buying successful stocks? If so, you’ll want to listen closely.

Occasionally, our team of analysts identifies certain stocks they believe are on the verge of significant growth. If you’re concerned that you have already lost your opportunity to invest, now may be the best time to act before it becomes too late. The figures definitely highlight the potential:

- Amazon: A $1,000 investment when we recommended doubling down in 2010 would now be worth $22,292!*

- Apple: A $1,000 investment from our 2008 recommendation would grow to $42,169!*

- Netflix: If you had invested $1,000 based on our 2004 recommendation, it would now amount to $407,758!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, and this opportunity may not come around again soon.

Discover the 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, the former CEO of Whole Foods Market (an Amazon subsidiary), and Suzanne Frey, an executive at Alphabet, serve on The Motley Fool’s board of directors. Randi Zuckerberg, a previous director at Facebook, also sits on this board. Parkev Tatevosian, CFA, holds positions in Alphabet, PayPal, and Visa. The Motley Fool is invested in and recommends Advanced Micro Devices, Alphabet, Amazon, Chewy, Fiverr International, Home Depot, Meta Platforms, Netflix, Nike, Nvidia, PayPal, Salesforce, Target, Uber Technologies, UiPath, Visa, and Zoom Video Communications. Additionally, The Motley Fool recommends Alibaba Group and eBay and currently has options for long January 2027 $42.50 calls on PayPal and short December 2024 $70 calls on PayPal. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein belong to the author and do not necessarily represent those of Nasdaq, Inc.