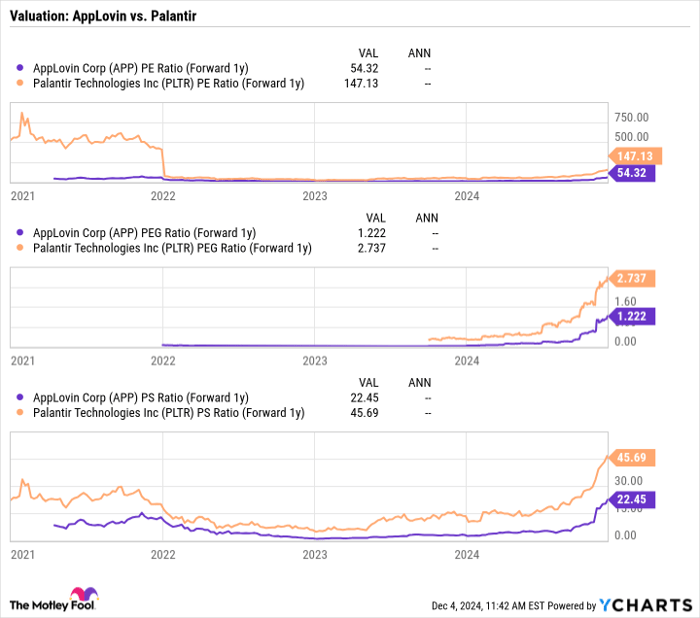

Palantir Technologies (NASDAQ: PLTR) has seen its stock price nearly quadruple this year and is now part of the S&P 500 index. However, its valuation is concerning, with a forward price-to-sales (P/S) ratio of 45.7 and a price-to-earnings (P/E) ratio of 147, significantly higher than historical SaaS company highs. Notably, some insiders, including CEO Alex Karp and Chairman Peter Thiel, have been actively selling shares.

In contrast, AppLovin (NASDAQ: APP) is experiencing rapid growth, with a 39% increase in revenue last quarter, compared to Palantir’s 30%. AppLovin’s stock has risen approximately 750% this year, with a more modest forward P/E ratio of 54 and a price-to-earnings-to-growth (PEG) ratio of 1.2. Furthermore, it aims to expand into e-commerce, enhancing its revenue potential.

SentinelOne (NYSE: S), a cybersecurity firm, is currently trading flat for the year but showcases strong growth potential with a 36% revenue increase in the first half of its fiscal year. The company has secured a significant partnership with Lenovo, providing endpoint security for new PCs. Its current price-to-sales (P/S) ratio is under 8.5, making it an attractive option in the AI sector.