Investing in Block and Roku: Opportunities Amid Market Volatility

One strategy to manage the current market volatility is to buy shares of resilient companies during price dips. Historically, investing in stocks when they are down can yield substantial long-term returns. Every bear market eventually transitions back to a bull market, often lasting longer. This prompts the question: which stocks should investors consider in the current environment?

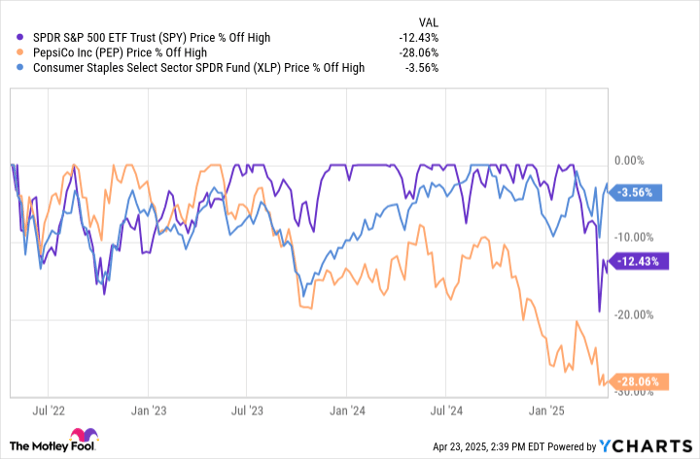

Let’s examine two stocks favored by Cathie Wood, founder and CEO of Ark Invest: Block (NYSE: XYZ) and Roku (NASDAQ: ROKU). As of now, Roku ranks as the fifth-largest holding in Ark Invest’s portfolio, while Block is number 12. Both stocks have dropped by over 20% this year, presenting potential opportunities for investors.

1. Block

Block aims to innovate traditional banking with its fintech solutions. Through its Square ecosystem, the company offers a suite of services for businesses, such as payroll, inventory management, loans, credit cards, and payment processing. Additionally, Block serves individual consumers via Cash App, which features a debit card, direct deposit, stock and crypto trading, and buy-now-pay-later services. Despite a challenging year, Block’s core businesses have shown resilience.

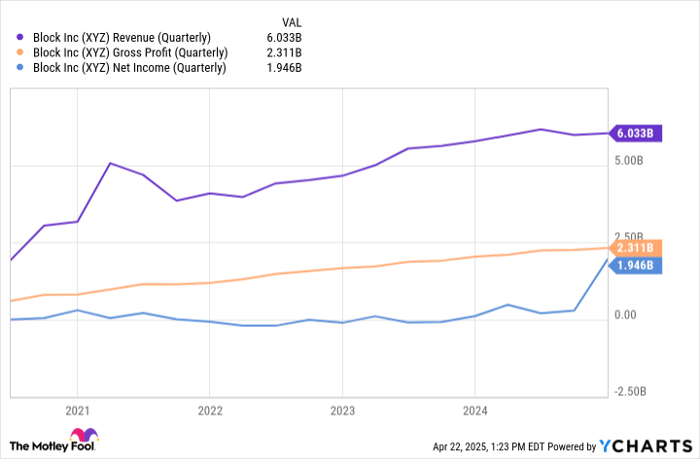

Revenue and gross profit figures have generally been positive, and the company has achieved profitability for several quarters. However, it faces some hurdles, such as slowing revenue growth and instability in its crypto-trading segment.

XYZ Revenue (Quarterly) data by YCharts

Looking ahead, Block’s outlook remains optimistic. The Cash App concluded 2024 with 57 million monthly active users, reflecting a 2% year-over-year increase. Block can enhance revenue by cross-selling services and introducing new offerings. For instance, only about 25 million Cash App users currently utilize its debit card.

This popularity among younger consumers indicates that Block’s ecosystem will likely strengthen over time. As more transaction dollars shift away from traditional banks, Block stands to benefit significantly. Overall, Block’s promising growth opportunities make its shares attractive for long-term investors.

2. Roku

Roku is also making waves in its industry by redefining television entertainment. As consumers increasingly shift away from cable to streaming, Roku provides a platform that connects users with leading streaming services without competing directly against them.

The company has significantly expanded its ecosystem, now reaching nearly 90 million streaming households and facilitating over 100 billion viewing hours annually. Naturally, this growth has attracted advertisers looking to follow viewers’ habits. However, Roku faces challenges, including ongoing profitability issues and stagnant average revenue per user.

Roku’s strategy involves selling hardware at a loss to attract users to its ecosystem, where it can then monetize them through advertising. This tactic has established Roku as a leading connected TV provider in North America and Mexico, with plans to replicate this success in other regions.

As monetization efforts ramp up internationally, Roku’s potential appears strong, particularly considering the untapped opportunities in the streaming market. Investors may want to consider buying Roku shares while they are still down.

Should You Invest $1,000 in Roku Right Now?

Before making any investment, potential buyers should be aware that the Motley Fool Stock Advisor analyst team recently highlighted what they consider the 10 best stocks to buy right now, and Roku did not make the list. The selected stocks could generate significant returns in the upcoming years.

For context, if you invested $1,000 in Netflix when it made their recommendations on December 17, 2004, you would have $594,046 today!* Alternatively, an investment of $1,000 in Nvidia on April 15, 2005, would now be worth $680,390!*

It’s also noteworthy that Stock Advisor’s total average return is 872%, significantly outperforming the S&P 500’s 160%. Stay informed on the latest top recommendations when you join Stock Advisor.

*Stock Advisor returns as of April 21, 2025

Prosper Junior Bakiny holds no position in the aforementioned stocks. The Motley Fool has positions in and recommends Block and Roku. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.