Strong Q3 Performance: Why Progressive and PNC are Sound Investment Choices

Insurance leader Progressive Corporation PGR and banking powerhouse PNC Financial Services Group PNC reported impressive Q3 results that surpassed expectations, marking them as top financial stocks to watch.

Here’s a closer look at their Q3 numbers and why investing in Progressive, which has surged nearly +60% year to date, and PNC, which has seen over +20% growth in 2024, remains a solid decision.

Image Source: Zacks Investment Research

Highlights from Progressive’s Q3 Report

Zacks Rank #1 (Strong Buy)

Progressive showed a remarkable increase in net premiums written, with Q3 sales reaching $19.43 billion. This figure topped estimates by 2% and marked a significant 24% increase from $15.7 billion a year earlier. Additionally, the company reported a Q3 EPS of $3.58, soaring 71% from $2.09 per share during the same period last year.

This beat the anticipated Q3 EPS of $3.40 by 5%. Impressively, Progressive has surpassed the Zacks EPS Consensus for five consecutive quarters, with an average earnings surprise of 19.85% over its last four reports.

Image Source: Zacks Investment Research

Key Takeaways from PNC’s Q3 Report

Zacks Rank #2 (Buy)

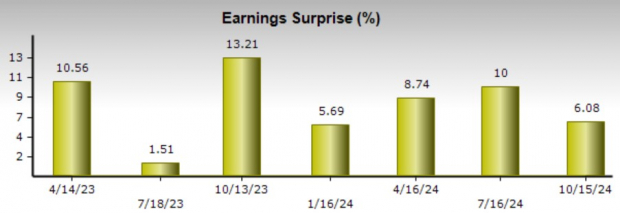

PNC reported Q3 sales of $5.43 billion, a 3% increase year over year, exceeding expectations of $5.36 billion by 1%. The company’s Q3 EPS of $3.49 also surpassed estimates of $3.29 per share by 6%, despite a drop from $3.60 per share reported in the same quarter last year. The decrease was attributed to reduced customer interest payments and a larger reserve set aside for unpaid loans.

CEO Bill Demchak remains optimistic about PNC’s future, mentioning the company’s potential for record net interest income (NII) by 2025. Notably, PNC has exceeded earnings forecasts for seven consecutive quarters, with an average EPS surprise of 7.63% in its latest four reports.

Image Source: Zacks Investment Research

Valuation Appeal of PGR & PNC

In recent weeks, analysts have raised EPS estimates for both Progressive and PNC for fiscal years 2024 and 2025. This upward trend has reinforced their attractive forward price-to-earnings (P/E) ratios of 19.6X for Progressive and 14.4X for PNC.

Image Source: Zacks Investment Research

Conclusion

With both companies surpassing Q3 expectations, it’s likely that earnings estimates will continue to rise. This increase could fuel the ongoing rally of Progressive and PNC, making them strong candidates for long-term investment, especially given their favorable current valuations.

Only $1 to Access Zacks’ Investment Picks

No gimmicks here.

We previously surprised our members by allowing them 30-day access to all our investment picks for just $1, and there’s no obligation to spend any more.

Many have taken advantage of this offer, while others hesitated, thinking it was too good to be true. Our intent is straightforward: we want you to familiarize yourself with our services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which yielded 228 positions with significant gains in 2023 alone.

The PNC Financial Services Group, Inc. (PNC): Free Stock Analysis Report

The Progressive Corporation (PGR): Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.