Top Stocks to Watch as 2025 Takes Off

The stock market has shown a fair start to 2025, characterized by gains in major indices. Currently, the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average have increased by 3.2%, 2%, and 5.6%, respectively.

Yet, beneath these numbers, some companies are shining brighter than others. Investors should pay attention to two stocks making headlines this year.

Considering where to invest $1,000?

Our analysts recently identified the 10 best stocks to buy now.

Learn More »

Image source: Getty Images.

1. Robinhood Markets

First on the list is Robinhood Markets (NASDAQ: HOOD).

As of now, Robinhood’s shares have surged over 42% since the start of the year, and they are up more than 387% over the last 12 months.

This company operates a brokerage platform allowing users to trade a variety of investments, such as stocks, ETFs, and cryptocurrencies.

In the latest quarter, Robinhood reported impressive earnings:

- Revenue of $637 million, a 37% increase from the previous year.

- Net income of $150 million, compared to a net loss of $85 million a year earlier.

- Customer count reached 24.3 million, up 1 million compared to the prior year.

- Average revenue per user increased to $105, a 31% rise year over year.

Clearly, Robinhood is effectively attracting new investors while boosting revenue and profits. Management is also branching into new ventures that could draw in more customers and enhance revenue from current users.

The company is reportedly expanding into futures trading for cryptocurrencies, oil, and major equity indexes. Additionally, Robinhood has ventured into prediction markets, allowing users to bet on outcomes of live events such as sports and high-profile elections.

Analysts forecast that Robinhood will generate over $2.8 billion in revenue by 2025, a 17% increase from the previous year. Some believe these estimates may be too conservative, suggesting the potential for even greater growth.

Ultimately, growth investors should keep an eye on Robinhood; it has the potential to be a standout stock in 2025.

2. Meta Platforms

Next, we turn our attention to Meta Platforms (NASDAQ: META).

So far this year, shares of Meta have climbed nearly 20%. Over the past 12 months, the stock has risen more than 50%, a notable achievement for a company valued at nearly $1.8 trillion.

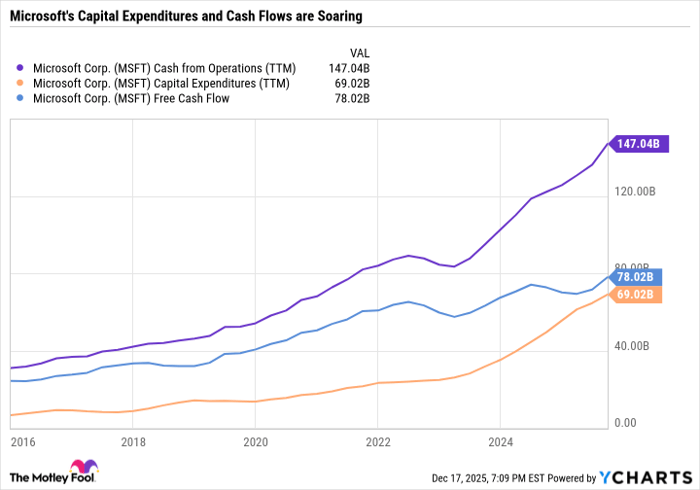

Meta’s stock performance is fueled by strong financial results, with revenue, net income, and free cash flow all reaching record highs.

META Revenue (TTM) data by YCharts

Meta benefits from its extensive global reach, with more than 3.4 billion daily average users among its apps, including Facebook and Instagram. This vast user base allows Meta to generate substantial advertising revenue, accounting for nearly 97% of its total revenue. The company makes about $14.25 from each user every quarter, a figure that has been steadily climbing and is up approximately 16% year-over-year.

Moreover, successful companies prioritize shareholder value, and Meta adheres to this principle. A year ago, Meta unveiled a $50 billion share repurchase program and established a regular quarterly dividend of $0.50 per share. These initiatives provide real value to shareholders.

In summary, Meta’s large user base translates to incredible revenue and profits, leading to significant shareholder value through buybacks and dividends. This strong formula has paid off over the past year and could position Meta as a top choice for investors in 2025.

Explore this Unique Investment Opportunity

Do you sometimes feel like you missed your chance to invest in successful stocks? If so, pay attention.

On rare occasions, our team of analysts issues a “Double Down” stock recommendation for companies they believe could experience substantial growth. If you’re worried about missing the boat again, now might be the right time to invest before opportunities slip away. Just look at the numbers:

- Nvidia: A $1,000 investment in 2009 would have grown to $336,677!*

- Apple: If you invested $1,000 in 2008, it would be worth $43,109!*

- Netflix: A $1,000 investment in 2004 would have reached $546,804!*

Currently, we are providing “Double Down” alerts for three remarkable companies, and this may be a chance that won’t come around again soon.

Learn more »

*Stock Advisor returns as of February 3, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jake Lerch has no position in any of the mentioned stocks. The Motley Fool holds positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed herein belong to the author and do not necessarily reflect the views of Nasdaq, Inc.