Market Recovery: S&P 500, Nasdaq, and Dow Jones Reach Breakeven

As of May 29, the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average reflect nearly breakeven returns for the year. After each major index fell by double digits a month earlier, this stability is viewed as a positive outcome.

Notably, significant market fluctuations in 2025 correlate closely with key announcements from Washington, D.C. Recent data indicates that traders responded strongly to President Donald Trump’s tariff decisions; unfavorable announcements led to market downturns, while indications of eased restrictions spurred rapid stock recoveries. This pattern is dubbed the TACO trade—short for “Trump always chickens out.”

Continuing Market Uncertainty

The ongoing tariff situation suggests that markets may face sustained uncertainty. Amidst this volatility, two artificial intelligence (AI) stocks are highlighted as strong investment opportunities. This focus represents a strategic shift away from short-term speculation based on political developments to stable long-term options.

1. Nvidia (NASDAQ: NVDA)

Nvidia, a leading semiconductor company, dominates the graphics processing unit (GPU) market. Its performance is a critical indicator of the AI sector’s health; growth at Nvidia often leads to increased investor optimism for AI.

Investment in AI infrastructure positions Nvidia well. Major cloud users, including Amazon, Microsoft, and Alphabet, continue to drive demand for its products. Nvidia faces challenges in China due to new export controls and competition from Huawei, but recent contracts in the UAE and Saudi Arabia could mitigate these issues. Additionally, rumors suggest Elon Musk’s AI firm, xAI, may invest around $40 billion in Nvidia chips for future projects.

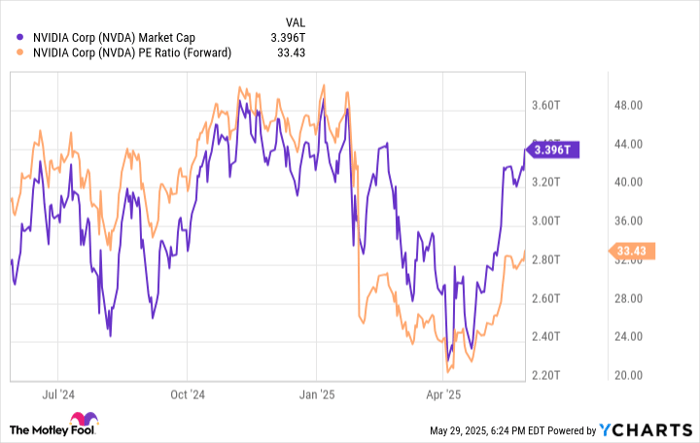

Looking ahead, Nvidia’s stock is expected to recover significantly in the latter half of 2025 as tariff-induced anxieties diminish. Despite recent valuation increases following a strong earnings report, Nvidia remains attractively priced based on historical price-to-earnings ratios.

NVDA Market Cap data by YCharts

2. Amazon (NASDAQ: AMZN)

Amazon presents an intriguing investment option despite potential vulnerabilities in its core e-commerce operations due to tariffs. Instead, strong performance from Amazon Web Services (AWS) is key. AWS not only bolsters sales but also maintains healthy operating margins, indicating the success of Amazon’s AI investments.

This division primarily drives Amazon’s operating profits, ensuring substantial cash flow even in uncertain economic climates. This financial security allows Amazon to expand AI initiatives across its diverse ecosystem, which includes e-commerce, logistics, advertising, and healthcare.

Notably, investor sentiment is positive; billionaire hedge fund manager Bill Ackman has added Amazon to his holdings, alongside other notable investors. While tariffs may cause short-term challenges, Amazon historically adapts to regulatory pressures and manages to enhance its profitability across myriad sectors.

Investment Recommendations

Considering these insights, both Nvidia and Amazon stand out as prudent investments amidst ongoing market fluctuations driven by external factors.

Investors should note that the Motley Fool’s Stock Advisor team has identified additional strong stock options distinct from Nvidia. Historical performance suggests that early investments in companies like Netflix or Nvidia have yielded substantial returns, affirming the potential value in selecting emerging growth stocks wisely.

Amazon, Nvidia, and various other investments carry inherent risks and rewards. Careful analysis is imperative for navigating today’s volatile markets.

The views and opinions expressed herein belong solely to the author and may not reflect those of Nasdaq, Inc.