Two Trending Stocks in the Internet-Services Sector: Trivago and Upwork

The Zacks Internet-Services Industry is currently ranked in the top 37% of over 240 Zacks industries. Recently, two notable stocks have been added to the Zacks Rank #1 (Strong Buy) list: Trivago TRVG and Upwork Software UPWK.

This industry features established companies like Alphabet GOOGL, Uber Technologies UBER, and Zillow Z. Trivago and Upwork stand out due to a favorable trend in earnings estimate revisions, making their comparatively lower stock prices appealing.

Trivago: A Compelling Penny Stock

Trivago, known for its hotel and accommodation search platform, trades under $5 per share, classifying it as a penny stock. Its impressive revenue growth and strategic decisions could make it a target for acquisition by larger travel firms like Expedia EXPD and Booking.com BKNG.

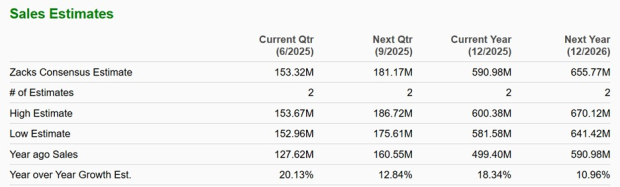

In line with growth strategies, last year Trivago secured a 30% stake in Holisto, an AI-focused hotel rate aggregator. Projections indicate that Trivago’s sales will rise 18% in fiscal year 2025, followed by an additional 11% increase in FY26, reaching $655.77 million.

Image Source: Zacks Investment Research

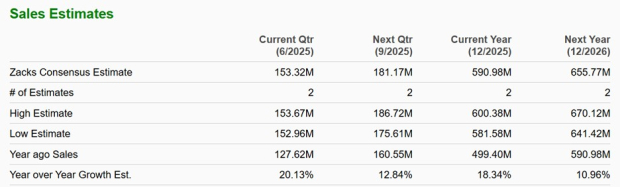

Critical to Trivago’s performance, earnings per share (EPS) estimates for FY25 and FY26 have risen significantly in the past month. The company outperformed expectations in their Q1 report released in late April, anticipating an EPS of $0.10 this year and $0.20 in FY26.

Image Source: Zacks Investment Research

Upwork’s Remarkable Growth

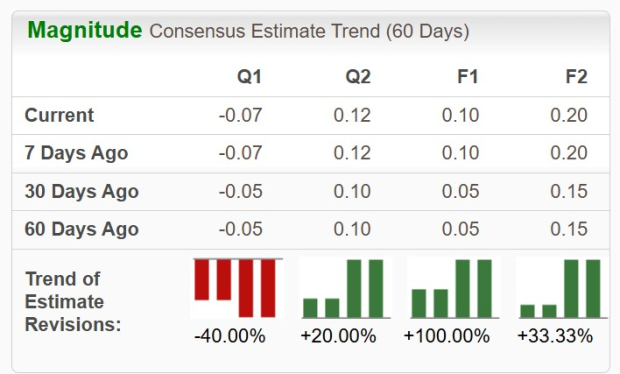

Upwork is trading around $16 per share, reflecting a 30% increase over the past month, while maintaining a forward earnings multiple of 14.4X. This positions Upwork below the Zacks Internet-Services Industry average of 17.9X and the S&P 500’s 21.4X.

The company’s recent surge can be attributed to its effective use of AI-powered solutions, which have significantly enhanced client engagement. Furthermore, Upwork announced record quarterly revenue and net income in its recent Q1 earnings report.

Image Source: Zacks Investment Research

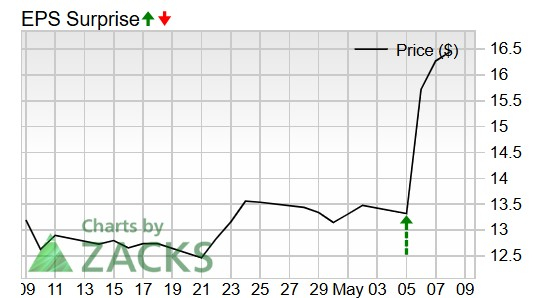

After exceeding Q1 expectations, Upwork provided optimistic guidance that may continue to uplift EPS revisions for FY25 and FY26, which have increased by 9% and 10% within the last week. The company’s annual earnings are projected to grow by 9% in FY25 and another 16% in FY26, reaching $1.33 per share.

Image Source: Zacks Investment Research

Conclusion

Currently, Trivago and Upwork present compelling investment opportunities in the rapidly evolving internet services sector. The trend of positive earnings estimate revisions has made the risk-to-reward ratio for purchasing TRVG and UPWK shares increasingly favorable.