Exploring the Future of Energy: Insights on Nuclear Stocks

Zacks Thematic Screens opens the door to 30 exciting investment themes that are shaping our future. From advanced technology to renewable energy and healthcare advancements, these themes help you focus on investments that resonate with you.

For those interested in exploring our thematic lists, click here >>> Thematic Screens – Zacks Investment Research.

Understanding the Nuclear Energy Theme

Nuclear energy is becoming increasingly relevant in the global effort for a low-carbon and more sustainable energy future. This theme includes companies involved in uranium mining, nuclear reactor construction and maintenance, and the generation of electricity from nuclear sources, as well as firms providing vital technologies and services to the nuclear sector.

In the face of growing energy demands and geopolitical challenges, nuclear power stands out for its ability to operate at near-full capacity while emitting zero greenhouse gases. For more direct insights, click here to access the Zacks Nuclear Thematic Screen.

Constellation Energy and Microsoft’s Strategic Alliance

Constellation Energy’s shares surged after announcing a partnership with tech leader Microsoft to restart a nuclear plant. This initiative aligns with Microsoft’s need for power to support its data centers, a key consideration in light of the AI boom.

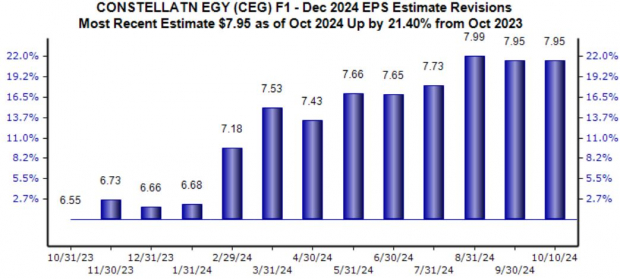

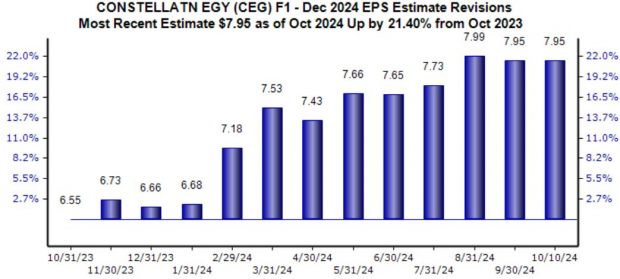

Year to date, CEG shares have skyrocketed nearly 130%, significantly outperforming the S&P 500, which has gained only 23%. Looking ahead, the company’s earnings outlook is promising, with the Zacks Consensus EPS estimate for this fiscal year projected at $7.95—up 21% year-over-year and suggesting even more robust growth of 59% compared to last year.

Image Source: Zacks Investment Research

Vistra Corporation’s Strong Performance

Vistra operates a diverse and efficient energy generation fleet that includes natural gas, nuclear, coal, solar, and battery storage. In 2024, the company has seen its shares soar nearly 200%, boosted by the same news about Constellation Energy.

Earlier this year, Vistra completed the acquisition of Energy Harbor, adding over 4,000 MW of nuclear energy capacity and gaining around one million retail customers. Additionally, the company established power purchase agreements with both Amazon and Microsoft, enhancing its growth trajectory.

Vistra’s potential also appeals to income-focused investors, as reflected in its current 14% five-year annualized dividend growth rate—showing a commitment to enhancing shareholder value. Below is a chart detailing the company’s quarterly dividends.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion: Navigating Thematic Investing

Thematic investing allows individuals to align their portfolios with trends that are shaping the economy. A combination of long-term and short-term themes plays a crucial role in determining which companies thrive as the market evolves.

While the stocks mentioned here are not direct recommendations, they serve as a valuable starting point. Utilize the Zacks Rank alongside other metrics to identify optimal stocks for your investment strategy. Each highlighted stock comes with a Zacks report for deeper analysis of their performance and future potential.

Unlock Access to Zacks’ Insights for Just $1

We’re not joking.

A few years ago, we surprised our members by offering a 30-day access to all our stock picks for only $1. There are no further obligations.

Many have taken advantage of this offer, while others may have hesitated, thinking there was a catch. Our goal is to familiarize you with our portfolio services such as Surprise Trader, Stocks Under $10, and Technology Innovators, which delivered 228 double- and triple-digit gains in 2023 alone.

Constellation Energy Corporation (CEG): Free Stock Analysis Report

Vistra Corp. (VST): Free Stock Analysis Report

Read this article on Zacks.com here.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.