Investing Insights: Nvidia’s Rivals AMD and Micron Show Promise

Nvidia (NASDAQ: NVDA) emerged as one of the standout stocks in 2024, soaring 171%. This surge was fueled by the soaring demand for its data center graphics processing units (GPUs), which are regarded as the leading technology for artificial intelligence (AI) development.

However, the competition in AI hardware is intensifying. Peer companies like Advanced Micro Devices (NASDAQ: AMD) and Micron Technology (NASDAQ: MU) are also becoming attractive investment options. Both firms have recently reported record financial results propelled by AI chip sales, although their stock prices have dropped significantly from their recent peaks.

Considering where to invest your $1,000? Our analysts have identified the 10 best stocks to buy now. Learn More »

As AMD and Micron present increasingly appealing investment values, here’s why they might be worthwhile additions to your portfolio in 2025.

Image source: Getty Images.

The Case for Advanced Micro Devices

AMD plays a significant role in consumer electronics, with its chips powering devices from Tesla electric vehicles to Microsoft‘s Xbox game console. In late 2023, the company entered the data center market by launching its own AI GPUs, starting with the MI300X.

Despite arriving on the market later than Nvidia’s H100 chip, the MI300X attracted major clients such as Microsoft, Oracle, and Meta Platforms, with many reaping benefits like reduced costs and improved performance. Moreover, AMD has accelerated its innovation, introducing a new GPU architecture called Compute DNA (CDNA) 4 last year to rival Nvidia’s Blackwell architecture.

Upcoming CDNA 4-based GPUs like the MI350 are set to provide an impressive 35 times more performance than earlier models such as the MI300. AMD initially planned to ship the MI350 in late 2025, but it is ahead of schedule and will begin sending samples to customers shortly, with production ramping up mid-year.

AI models are evolving to be more efficient, with personal computers (PCs), smartphones, and other devices soon powerful enough to execute these models locally. This shift reduces dependency on external data centers. AMD’s Ryzen AI 300 Series is considered the best AI chipset for PCs, with over 100 commercial platforms expected to utilize them in 2025, including major manufacturers like HP, Microsoft, and Lenovo.

In its recent financial results for 2024, AMD reported a record $12.6 billion in data center revenue, a 94% increase from 2023, which included $5 billion from GPU sales alone. Revenue from its client segment, which includes Ryzen AI PC chips, rose 52% to $7 billion.

As a result, AMD’s stock appears to be a valuable opportunity. With an adjusted earnings per share (EPS) of $3.31 last year, AMD’s stock has a price-to-earnings (P/E) ratio of 32.6, compared to Nvidia’s 49.7, representing a 34% discount.

Wall Street anticipates AMD’s earnings could grow by 43% in 2025 (according to Yahoo!), making its stock even more appealing on a forward basis. This anticipated growth is a compelling reason to consider AMD as a solid investment this year.

The Case for Micron Technology

Micron stands out as a crucial supplier of memory chips for various applications, particularly in the data center where they enhance GPU performance in AI tasks. These memory chips quickly store information, allowing GPUs to retrieve data instantly, which accelerates processing time. Micron’s HBM3E (high-bandwidth memory) solutions set industry standards, offering 50% more capacity while using 30% less energy than competitors.

Micron’s HBM3E hardware is employed in Nvidia’s latest Blackwell GB200 GPU, currently the industry’s leading AI chip. Demand for Micron’s data center memory has surged, resulting in a backlog until 2026, and the company expects the addressable market in this segment to expand from its current $16 billion to $100 billion annually by 2030.

To support this growth, Micron is developing a new HBM4E solution that promises a 50% performance increase over its current offerings.

Micron reported $8.7 billion in revenue for its fiscal 2025 first quarter (ending November 28), an 84% increase compared to the previous year. Notably, its data center revenue soared by 400% to $4.4 billion, making up 50% of the company’s total revenue for the first time.

Moreover, Micron’s potential extends beyond the data center. New PCs equipped with AI processors now require between 16 to 24 gigabytes of DRAM capacity, an increase from the 12 gigabytes average in non-AI PCs last year. A similar trend is emerging in the smartphone market, where manufacturers are introducing devices that support up to 16 gigabytes of memory to accommodate AI workloads. These trends suggest significant growth opportunities for Micron in the near future.

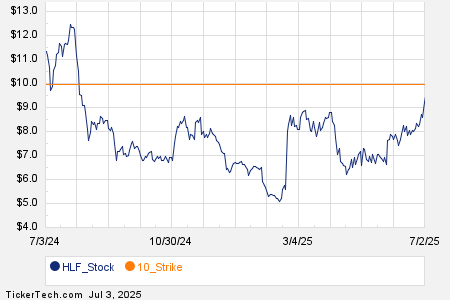

According to Wall Street’s consensus (from Yahoo!), Micron is projected to generate $6.89 in EPS during fiscal 2025, leading to a forward P/E ratio of just 13.8. This is significantly lower than the forward P/Es of both Nvidia and AMD:

NVDA PE Ratio (Forward) data by YCharts

Thus, with its remarkable growth potential, Micron’s stock may currently represent one of the best bargains in the AI chip sector.

Seize This Potentially Profitable Opportunity

Often, investors feel they missed their chance at acquiring top-performing stocks. It’s essential to stay alert.

On rare occasions, our analytical team issues a “Double Down” Stock recommendation for companies expected to see substantial growth. If you’re worried you’ve already missed your investment window, now is the opportune moment to act. The numbers speak for themselves:

- Nvidia: An investment of $1,000 when we doubled down in 2009 would have grown to $328,354!*

- Apple: A $1,000 investment from our 2008 recommendation would be worth $46,837!*

- Netflix: Investing $1,000 in 2004 could now yield $527,017!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not come again soon.

Learn more »

*Stock Advisor returns as of February 24, 2025

Randi Zuckerberg, former market development director and spokesperson for Facebook, is on The Motley Fool’s board of directors. Anthony Di Pizio has no stake in any discussed stocks. The Motley Fool recommends Advanced Micro Devices, HP, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla and holds positions in them. The Motley Fool also recommends options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool’s disclosure policy is available for review.

The views contained herein reflect those of the author and not necessarily those of Nasdaq, Inc.