Two Stocks to Consider for a Potential Economic Downturn

Concerns about a looming recession are on the rise, partly fueled by President Trump’s trade policies. While a recession may not be imminent, preparing for potential economic challenges is a prudent strategy.

In the event of a recession, the Stock market will react variably, impacting different companies and sectors. Here, we highlight two stocks that are likely to remain resilient in tough economic times: Vertex Pharmaceuticals (NASDAQ: VRTX) and HCA Healthcare (NYSE: HCA).

Start Your Mornings Smarter! Receive insightful Breakfast news directly in your inbox every market day. Sign Up For Free »

1. Vertex Pharmaceuticals: A Strong Player in Healthcare

Vertex Pharmaceuticals is a leading developer of treatments for cystic fibrosis (CF), a condition that causes thick, sticky mucus to accumulate in the lungs and other organs, leading to severe health issues. For CF patients, Vertex offers the only drugs that target the disease’s root causes, ensuring ongoing demand for its products, regardless of the economic climate.

This lack of competition solidifies Vertex’s position. Boasting the only targeted therapies, the company is expected to navigate a recession with relative ease. Recently, Vertex reported a 12% increase in revenue year-over-year, reaching $11.02 billion in 2024.

Vertex still has significant growth potential within its core CF franchise as many patients remain untreated. Additionally, the company has expanded its portfolio with drugs like Casgevy for rare blood diseases and Journavx, a non-opioid pain medication, both of which will drive future growth.

Furthermore, Vertex’s pipeline includes a promising phase 3 study for inaxaplin, aiming to treat APOL-1 mediated kidney disease, which currently lacks approved therapies targeting the underlying mechanisms.

Given these factors, Vertex Pharmaceuticals is positioned to thrive through any forthcoming recession and continue to yield robust returns afterward.

2. HCA Healthcare: Resilience in the Healthcare Sector

HCA Healthcare stands as one of the largest hospital chains in the United States, a segment of the healthcare industry that typically exhibits resilience during economic downturns. Although facilities that offer elective procedures may see reduced demand, the nature of hospital visits—often due to emergencies—means HCA should fare well overall.

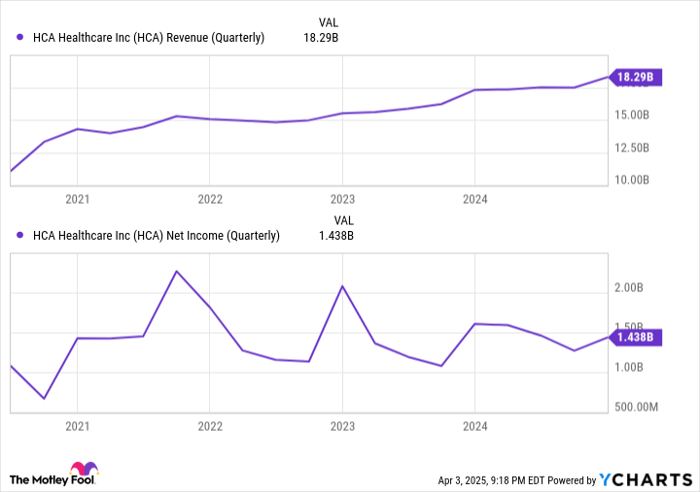

Past performance has illustrated HCA’s durability. Despite facing pandemic-induced disruptions, rising costs, and reliance on more expensive temporary labor, the company has maintained a strong trajectory over the past five years.

HCA Revenue (Quarterly) data by YCharts.

HCA Healthcare has adeptly increased its market share, climbing from 24% in 2012 to 27% a decade later. The firm plans further growth to secure a 29% market share by the end of 2030, showcasing its market strength and competitive edge.

The company’s strategy to expand its portfolio of essential services, along with its established relationships with patients and payers, position HCA Healthcare for continued success, regardless of economic fluctuations. Thus, for those anticipating a recession or those who simply seek robust investment opportunities, HCA Healthcare is a strong buy-and-hold candidate.

Should You Invest $1,000 in Vertex Pharmaceuticals Right Now?

Before deciding to purchase Stock in Vertex Pharmaceuticals, consider this:

The Motley Fool Stock Advisor team has identified the 10 best stocks to invest in right now, with Vertex Pharmaceuticals not making this cut. The selected stocks have significant potential for impressive returns in the coming years.

For instance, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, you would now have a remarkable $578,035!*

Stock Advisor provides investors with a straightforward roadmap for success, featuring portfolio guidance, analyst updates, and two new Stock picks each month. The Stock Advisor service has yielded returns that more than quadruple the performance of the S&P 500 since its inception in 2002.*

See the 10 stocks »

*Stock Advisor returns as of April 5, 2025.

Prosper Junior Bakiny has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends Vertex Pharmaceuticals. The Motley Fool recommends HCA Healthcare. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.