Stock Market Insights: Analyzing Amazon and The Trade Desk’s Potential

The stock market saw a sharp recovery on Wednesday following President Trump’s announcement to pause tariffs and implement a flat 10% rate, with the exception of China. Despite this rebound, the Nasdaq remains in a bear market. A bear market officially begins when an index declines by 20% from its peak and continues until a new all-time high is achieved, marking the transition to a bull market.

Nevertheless, opportunities exist, and investors should consider making purchases. Among the top stocks to buy are Amazon(NASDAQ: AMZN) and The Trade Desk(NASDAQ: TTD). The recent market reaction indicates that these stocks are poised for growth in the next three to five years.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Understanding Amazon’s Value Proposition

Many perceive Amazon as vulnerable due to the ongoing trade war with China, given the extensive sourcing of goods from China through its platform. However, viewing the Stock solely through that lens is limiting.

While e-commerce is a significant part of Amazon’s business, it is not the primary reason to invest. The company operates across various segments, including online retail, advertising services, and its cloud computing division, Amazon Web Services (AWS). It is widely recognized that retail margins are slim; however, segments like advertising and AWS demonstrate much stronger profit potential. These areas are less likely to experience significant impacts from rising tariffs on goods sourced from China.

In 2024, AWS contributed 58% of Amazon’s operating profit while representing only 17% of total sales. Although we cannot specifically quantify the operating margin from its advertising services, it is reasonable to estimate a 20% margin based on comparable advertising firms, such as Meta Platforms(NASDAQ: META). This suggests advertising could generate about $11.2 billion, well within the context of Amazon’s overall revenue of $68.6 billion.

This figure serves as a conservative estimate, meaning actual revenues may surpass this projection. Therefore, Amazon’s advertising and AWS segments position the company favorably, even amid tariff uncertainties. For these reasons, now is an opportune time to consider investing in Amazon.

Analyzing The Trade Desk’s Market Position

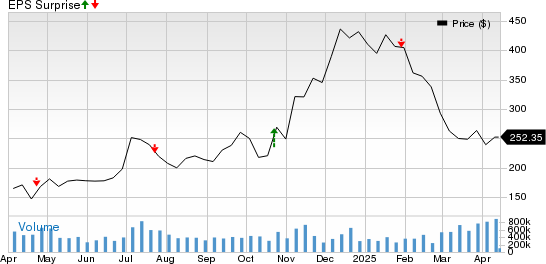

This year has been challenging for The Trade Desk, with shares falling over 50%. The decline stems from both self-inflicted issues and broader market sell-offs. As a company in the advertising sector, it assists clients in locating optimal placements for their ads on the internet, particularly in the burgeoning field of connected television.

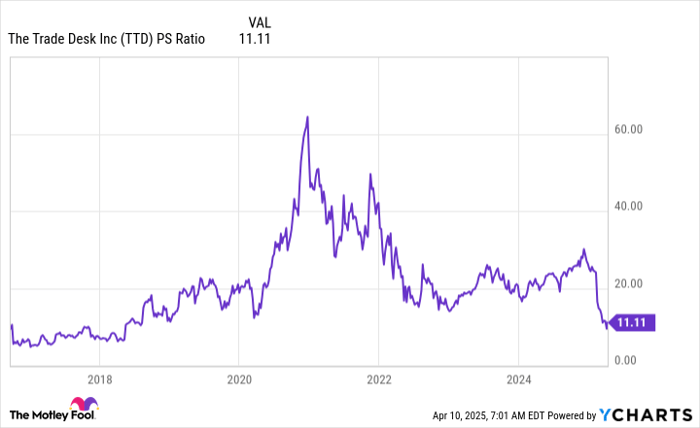

Although The Trade Desk has exhibited impressive growth historically, it faced its first notable setback as a public entity, missing fourth-quarter revenue forecasts for the first time and presenting a lukewarm outlook for the first quarter. This resulted in a one-day stock sell-off exceeding 30%. Further compounded by the overall market downturn, shares have reached valuations not seen since before 2020.

TTD PS Ratio data by YCharts

Despite recent challenges, The Trade Desk is projected to achieve revenue growth of 18% in 2025 and 20% in 2026. Thus, this stock remains an appealing opportunity, making it one of the best bargains currently available in the market.

Should You Invest $1,000 in Amazon Now?

Before committing to Amazon shares, consider this:

The Motley Fool Stock Advisor team recently pinpointed ten stocks they believe represent the best investment opportunities at present—and Amazon is noticeably absent from this list. The selected stocks have the potential to yield substantial returns in the near future.

Take for example Netflix which was listed on December 17, 2004—if you had invested $1,000 at that time, your investment would be worth $495,226 today!*Similarly, if you invested $1,000 in Nvidia when it was recommended on April 15, 2005, you’d now have $679,900!*

The Stock Advisor has posted an average total return of 796%, significantly outpacing the S&P 500’s 155%.

See the 10 stocks »

*Stock Advisor returns as of April 10, 2025

It is important to note that John Mackey, the former CEO of Whole Foods Market (owned by Amazon), and Randi Zuckerberg, a past marketing director of Facebook (sister of Meta Platforms CEO), serve on The Motley Fool’s board. Additionally, Keithen Drury holds positions in Amazon and The Trade Desk, while The Motley Fool recommends Amazon, Meta Platforms, and The Trade Desk. A disclosure policy is available.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.