Retail Giants Target and Amazon Navigate Economic Pressures

Retailers have faced numerous challenges recently, including supply chain issues, rising inflation, and the ongoing effects of President Donald Trump’s import tariffs. Such pressures on prices present challenges for retailers in two significant ways: they incur higher costs while customers experience reduced buying power.

This scenario is not new and can impact even well-established companies. However, there is a silver lining; some retailers have the potential to overcome these hurdles long term. As they grapple with these difficulties, their market valuations might decline, creating a prime opportunity for investors to acquire shares at favorable prices.

Top Stock Picks for Current Investment

With these factors in play, let’s examine two of the most promising stocks to consider right now.

Image source: Getty Images.

1. Target (NYSE: TGT)

Target has encountered difficulties as economic conditions have diminished consumers’ purchasing power. In the latest quarter, net sales dropped by 2.8%. Additionally, the company faced backlash for its diversity initiatives, which contributed to stagnant sales growth.

Yet there are noteworthy positive indicators that could support Target’s long-term revenue growth. During the early pandemic, Target experienced a surge in sales, gaining over $30 billion, which it has largely maintained.

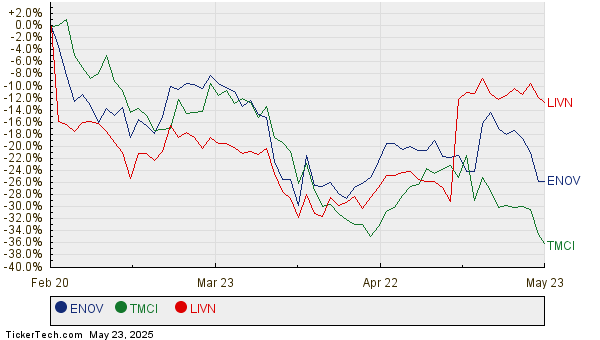

TGT Revenue (Annual) data by YCharts.

Target has expanded its digital presence significantly, achieving a 4.7% increase in digital comparable sales, even amid recent slowdowns. To further streamline operations, the company launched its Enterprise Acceleration Office aimed at enhancing efficiency.

Moreover, Target boasts over 40 “owned brands,” with a quarter generating billion-dollar revenues. The control over costs with these brands provides substantial growth prospects, as they typically yield higher gross margins compared to national brands.

As a Dividend King, Target has increased its dividend for over 50 years, now offering a yield of 4.8%, surpassing the S&P 500 yield of 1.2%. Currently trading at approximately 11 times forward earnings estimates, Target presents a compelling recovery story for investors.

2. Amazon (NASDAQ: AMZN)

Amazon has seen its stock decline this year due to concerns over Trump’s import tariff plan and potential impacts on its thriving e-commerce and cloud computing sectors. The company relies heavily on global imports for its e-commerce operations, while its cloud computing arm, Amazon Web Services (AWS), may face budget cuts from clients coping with higher prices.

While these elements have caused caution among investors recently, it’s crucial to maintain a long-term perspective. Amazon’s leadership in these sectors positions it well to navigate current challenges.

Initially, Amazon faced profit losses due to inflation but successfully revamped its cost structure, allowing a return to profitability. A significant aspect of this strategy included creating regional centers for inventory management, enhancing efficiency and reducing costs for shipping.

In terms of cloud services, Amazon is heavily invested in artificial intelligence (AI), which is among the fastest-growing sectors. AWS has achieved a remarkable annual revenue run rate of $117 billion.

Amazon currently trades at 32 times forward earnings estimates, down from over 40 times earlier this year, offering a potentially attractive entry point for long-term investors.

Should You Invest in Target Now?

Before investing in Target, keep this in mind:

The Motley Fool Stock Advisor analyst team has recently identified its top 10 stocks for investors, and Target was not among them. The listed stocks are projected to generate substantial returns in the years ahead.

Consider the historical performance of stocks like Netflix and Nvidia when they were featured on this list. An investment of $1,000 in Netflix on December 17, 2004, would now be worth approximately $644,254, while an investment in Nvidia on April 15, 2005, would have grown to roughly $807,814.

The Stock Advisor program has achieved an average return of 962%, contrasting sharply with the S&P 500’s 169%. Don’t miss the opportunity to see the latest top 10 list.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino holds positions in both Amazon and Target. The Motley Fool has positions in and recommends both Amazon and Target.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.