Buffett’s Stock Picks: Why Apple and Amazon Are Solid Investments for 2024

Warren Buffett, known as the Oracle of Omaha, is often regarded as one of the greatest investors in history. His investment strategies have yielded impressive returns over decades. As we enter 2024, it’s worth looking at Buffett’s current stock choices, particularly those within his holding company, Berkshire Hathaway.

Investing Insights: Where Should You Put $1,000 Right Now?

According to our analysts, there are 10 top stocks to consider investing in today. Check out the 10 stocks »

1. Apple: A Long-Term Winner

Apple has long been a favorite of Buffett’s investment portfolio. Berkshire Hathaway purchased its first shares in 2016. While Apple’s business has evolved since then, the stock remains a strong option for long-term investors. Here are three reasons why.

First, Apple has rolled out new artificial intelligence (AI) features across its latest iPhones and devices. This could lead to a significant sales boost as users may feel compelled to upgrade. Second, as CEO Tim Cook articulated, Apple’s AI journey is just beginning, creating excitement for future advancements.

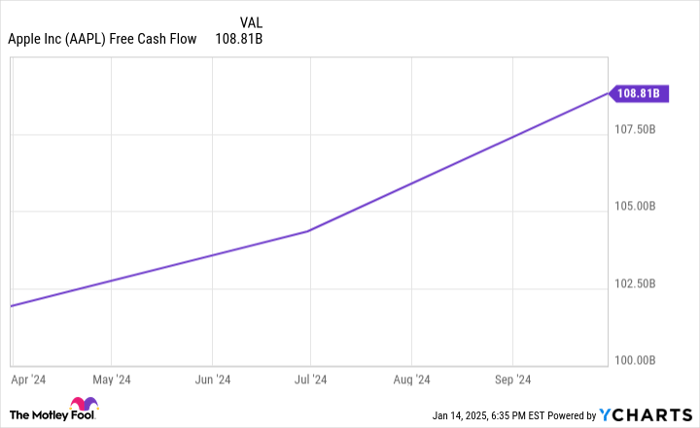

The company has a proven history of enhancing its products and remains committed to innovation. Its culture fosters creativity, and the strong free cash flow it generates provides ample resources for growth in AI.

AAPL Free Cash Flow data by YCharts.

Third, Apple’s services sector has been expanding rapidly, outpacing other areas of the business. With over 2 billion active devices and more than 1 billion paid subscriptions, there are several avenues to further monetize this vast user base, covering industries from healthcare to entertainment.

Apple’s competitive advantages, including high switching costs and a powerful brand, strengthen its market position. Additionally, the company’s dividend offerings make it an attractive choice for many investors. Despite recent challenges, Apple continues to be a top pick for this year and beyond.

2. Amazon: The E-Commerce Giant

Even though Amazon represents a small segment of Berkshire Hathaway’s portfolio, it still offers significant investment potential. As of 2023, Amazon holds a commanding 37.6% share of the U.S. e-commerce market.

However, the e-commerce aspect is just one piece of the puzzle. Amazon Web Services (AWS), its cloud computing branch, is the global leader in cloud infrastructure and has fueled much of Amazon’s profit in recent years.

During the first nine months of 2024, Amazon’s total sales climbed by 11% year over year, reaching $450.2 billion. AWS sales surged by 18%, amounting to $78.8 billion. While AWS only makes up 17.5% of total revenue, it contributes a remarkable 61.6% to the company’s operating income.

The cloud division is seeing continued growth thanks in part to AI services, which are projected to drive significant revenue. As the demand for cloud computing and AI capabilities expands, Amazon stands to gain substantially.

Moreover, Amazon is also a leader in various sectors such as video streaming and grocery delivery. Its recent foray into healthcare, particularly the pharmacy segment, represents another area of growth opportunity.

For investors, Amazon’s valuation of over $2 trillion is well justified. The company’s robust growth prospects signal that it is poised for strong financial performance in the future.

Should You Invest $1,000 in Apple Now?

Before making any investments, consider this:

The Motley Fool Stock Advisor team has identified ten stocks as prime picks for now, and Apple is not among them. The chosen stocks hold potential for significant returns in the upcoming years.

Reflect on the past: when Nvidia was recommended on April 15, 2005, a $1,000 investment at that time would now be worth $818,587!*

Stock Advisor offers investors a straightforward guide to achieving investment success, including portfolio-building advice and monthly stock picks. Since its inception, the service has consistently outperformed the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

John Mackey, the former CEO of Whole Foods Market (an Amazon subsidiary), is on the board of directors for The Motley Fool. Prosper Junior Bakiny holds positions in Amazon. The Motley Fool recommends Amazon, Apple, and Berkshire Hathaway and has ownership in them. Please refer to The Motley Fool’s disclosure policy for details.

The views expressed here belong to the author and do not necessarily reflect those of Nasdaq, Inc.