Three “Magnificent Seven” Stocks Now Offer Attractive Value

The “Magnificent Seven” group of stocks, comprising major tech players, is known for its high valuations. This group includes prominent names that have historically led the market but have faced declines this year. The stocks are:

- Apple

- Microsoft

- Nvidia(NASDAQ: NVDA)

- Alphabet(NASDAQ: GOOG) (NASDAQ: GOOGL)

- Amazon

- Meta Platforms(NASDAQ: META)

- Tesla

All seven stocks are currently below their all-time highs, impacted by market uncertainties linked to trade policies. However, Nvidia, Alphabet, and Meta Platforms have reached valuations that may be considered a bargain.

Investing in Nvidia

Nvidia has experienced substantial growth over recent years, but the pace has slowed in 2025. Its graphics processing units (GPUs) are renowned for their performance, particularly in the AI sector.

GPUs excel in performing parallel calculations, and when clustered, they offer even greater computing power for training AI models. Despite concerns about a potential trade war affecting data center spending, investor fears haven’t fully materialized yet.

Microsoft plans to maintain its capital expenditures for fiscal 2026 (ending July 2026), including investments in data centers. Alphabet shares a similar stance. Despite ongoing speculation about Nvidia’s competitive position, its current valuation is notably lower than historical norms.

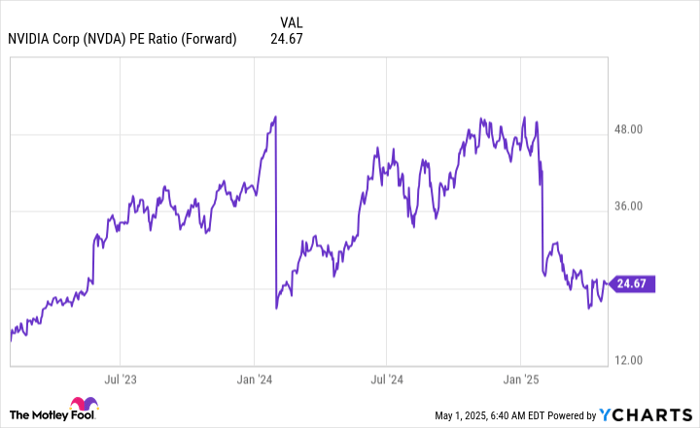

With a forward P/E ratio below 25, Nvidia appears attractively priced, particularly as its anticipated growth remains robust. This valuation is comparable to the S&P 500’s forward P/E of 20.5, presenting a compelling opportunity for potential investors.

NVDA PE Ratio (Forward) data by YCharts; PE = price to earnings.

Evaluating Alphabet and Meta Platforms

Similar to Nvidia, both Alphabet and Meta Platforms are facing concerns about how trade tensions might impact advertising revenues. Ad spending is often the first expense cut during economic downturns, which could affect both companies significantly.

However, history shows that advertising revenues typically rebound as economic conditions improve. Current market prices may therefore reflect excessive caution regarding future revenue potential.

GOOGL PE Ratio (Forward) data by YCharts.

Currently trading at under 17 times forward earnings, Alphabet appears undervalued. Two ongoing court cases concerning its market position, however, have dampened investor sentiment. Meta Platforms does not face these challenges but trades at a forward P/E multiple of 22, one of the lowest it has seen recently.

In conclusion, Nvidia, Alphabet, and Meta Platforms present appealing investment opportunities as they are trading at lower valuations. As market conditions evolve, these stocks may not stay cheap for long.

Assessing Future Investment Opportunities

*The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.