Earnings Season Approaches: Nvidia, Palantir, and Vertiv in Focus

Key Insights

- Investors look forward to earnings from key AI and Data Center companies.

- Nvidia’s stock has remained stable over the past three months following a significant run-up in valuation.

- Palantir shares surged nearly 300% over the past year, while Vertiv is experiencing strong sales growth in data center services.

The Q4 earnings season for 2024 is about to gain momentum following reports from major banks.

It appears to be another promising earnings period, fueled by robust technology sector growth. Once again, attention is focused on AI and Data Center companies, a trend we have come to expect in recent years.

Let’s analyze the expectations for Vertiv (VRT), Nvidia (NVDA), and Palantir (PLTR).

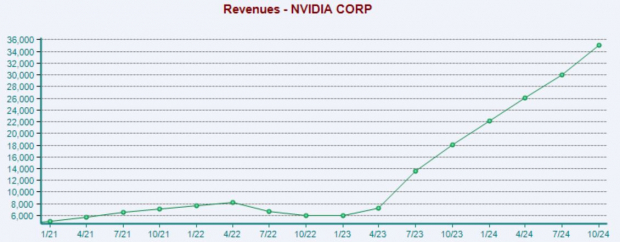

Nvidia Continues as AI Powerhouse

Nvidia is expected to present the most crucial earnings report this cycle, with results scheduled for mid-February. Although Nvidia tends to report later than other companies, insights from fellow AI leaders, such as Advanced Micro Devices, might influence market expectations beforehand.

The stock has not varied much in the last few months, remaining flat in a three-month timeframe after its impressive price run. Still, positive expectations for both revenue and earnings per share (EPS) have increased in recent months, with the stock holding a favorable Zacks Rank #2 (Buy).

Analysts are estimating a 61% growth in EPS, fueled by a 70% increase in sales, primarily from continued strong performance in Nvidia’s Data Center segment. Below is a chart depicting the company’s significant quarterly sales growth.

Image Source: Zacks Investment Research

Nvidia’s Data Center results have consistently exceeded expectations, with the most recent performance beating estimates by a notable $1.8 billion. Given the sustained demand for AI products, another successful quarter seems likely.

Image Source: Zacks Investment Research

Palantir Experiences Soaring Demand

Palantir has positioned itself at the forefront of the AI wave, following impressive quarterly results driven by strong demand, resulting in a nearly +300% stock increase over the last year.

While EPS estimates have remained stable recently, the forecast for revenue has notably improved, with anticipated sales of $779 million, up 4% year over year.

Image Source: Zacks Investment Research

Despite a 12% drop so far in 2025, a compelling quarterly report could rejuvenate interest in Palantir’s stock, reinforcing the enduring narrative surrounding AI technologies.

After the company’s recent Q3 results, CEO Alexander Karp stated, “We absolutely eviscerated this quarter, driven by unrelenting AI demand that won’t slow down. This is a U.S.-driven AI revolution that has taken full hold. The world will be divided between AI haves and have-nots. At Palantir, we plan to power the winners.”

Vertiv Set for Continued Sales Expansion

Vertiv offers critical services for data centers, communication networks, and industrial facilities, providing a wide range of power, cooling, and IT infrastructure solutions.

Surging demand has positively impacted Vertiv’s quarterly outcomes, with the company exceeding Zacks Consensus EPS estimates by around 10% on average across its last four earnings reports. Vertiv has consistently demonstrated year-over-year revenue growth, achieving double-digit increases in seven consecutive quarters.

Below is a chart showcasing Vertiv’s sales growth quarterly.

Image Source: Zacks Investment Research

Recent positive EPS revisions suggest expected earnings of $0.84 per share, reflecting a 50% increase year-over-year. Sales predictions remain stable, forecasting $25.1 billion in revenue, 15% above the previous year’s numbers, thereby extending the company’s growth streak.

Valuation multiples have been adjusted as investors react to these optimistic growth forecasts. Nonetheless, Vertiv’s current PEG ratio of 0.9X indicates a balance of value and growth potential.

Image Source: Zacks Investment Research

Conclusion

As the 2024 Q4 earnings cycle ramps up following the major banks’ reports, investors should keep a close watch on the upcoming results from Vertiv (VRT), Nvidia (NVDA), and Palantir (PLTR), particularly within the context of the ongoing AI and Data Center surge.

Explore New Investment Opportunities with Nuclear Energy

The demand for electricity is rising sharply, while nations aim to reduce reliance on fossil fuels. Nuclear energy presents an effective solution.

Leaders from the U.S. and 21 other countries have recently pledged to triple the world’s nuclear energy capacity. This ambitious shift could unlock significant profits for nuclear-related stocks, offering early investors a substantial opportunity.

Our urgent report, Atomic Opportunity: Nuclear Energy’s Comeback, outlines the key players and technologies driving this shift, highlighting three standout stocks that are poised to gain the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

For the latest investment recommendations from Zacks Investment Research, you can also download 7 Best Stocks for the Next 30 Days. Click to access this free report.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Vertiv Holdings Co. (VRT): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.