Top AI Investments Set to Shine in 2025: Nvidia, Alphabet, and Taiwan Semiconductor

Investment in artificial intelligence (AI) has captured attention for two years, and this trend shows no signs of fading in 2025. The industry remains in its early stages, offering numerous growth opportunities.

Among the stocks with significant potential are Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Taiwan Semiconductor Manufacturing (NYSE: TSM). These companies are major players in the AI sector and are well-positioned for impressive returns in the coming year.

1. Nvidia: Sustained Growth Ahead

You might be wondering: “Isn’t Nvidia already at its peak?” While it has seen significant price increases, analysts believe there is still room for growth.

Nvidia produces graphics processing units (GPUs), which serve as the backbone for many AI innovations. Its dominant position in this sector has made it the main beneficiary of recent AI investments.

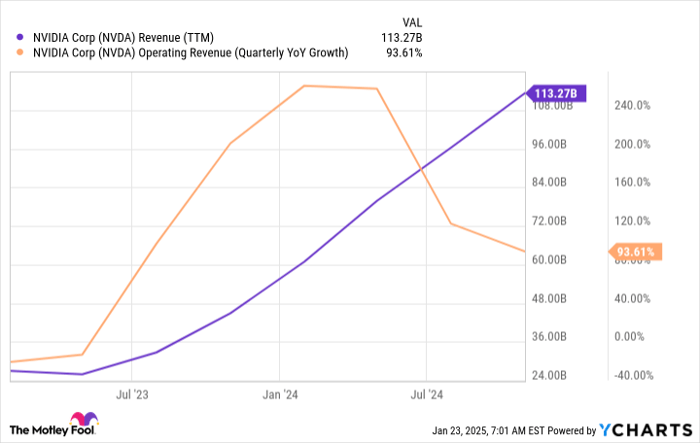

The company’s revenue growth has been remarkable over the last few years.

NVDA revenue (TTM), data by YCharts; TTM = trailing 12 months.

Although growth figures are starting to taper, can you call a company that recorded a 94% year-over-year revenue increase “slow growth”? I think not.

Looking ahead, Nvidia is projected to reach $196 billion in revenue by the end of fiscal 2026, representing a 52% increase from fiscal 2025.

This sustained growth will likely continue to surprise investors in 2025, even if returns are not as high as in previous years.

2. Alphabet: A Leader in AI Innovation

Alphabet is another significant player in the AI landscape, particularly with its Google Gemini generative AI platform. This platform has positively impacted Alphabet’s advertising revenue, which constitutes 75% of the company’s total income.

These advancements ensure that Alphabet maintains its competitive edge, as Google Gemini can also be utilized by other companies.

In addition, its Google Cloud division has experienced tremendous growth, fueled by AI advancements. Many businesses opt to rent computing resources from providers like Google Cloud instead of investing in costly servers featuring Nvidia GPUs. This sector alone saw a 35% year-over-year increase in revenue during the third quarter.

Alphabet’s stock remains a bargain, trading at about 22 times forward earnings—significantly less than many competitors like Apple, which trades at 30 times forward earnings. Alphabet’s combination of value and growth potential positions it well for impressive returns.

3. Taiwan Semiconductor: The Backbone of AI Technology

No current AI technology would exist without Taiwan Semiconductor, known as TSMC. The company has a reputation for consistently producing advanced chips, making it an essential player in AI development.

Unlike others in the AI race, TSMC benefits from making chips for nearly every company involved in AI innovations, allowing investors to capitalize broadly on the AI trend.

AI has led to considerable revenue growth for TSMC, with related revenue tripling in 2024. Management anticipates AI revenue will double again in 2025, projecting a robust mid-40% compound annual growth rate (CAGR) over the next five years. This kind of growth is worth considering for investors.

Overall, TSMC expects its revenue to rise at about 20% CAGR over the next five years—a target few companies achieve. As a result, Taiwan Semiconductor is a strong investment choice.

Is Nvidia a Wise Investment in 2025?

Before purchasing Nvidia stock, keep this in mind:

The Motley Fool Stock Advisor analyst team has shared a list of what they believe are the 10 best stocks to buy now—Nvidia did not make the cut. These selected stocks have the potential for substantial returns in the years ahead.

Consider this: If you had invested $1,000 in Nvidia on our recommendation back on April 15, 2005, your investment would have grown to around $874,051!

Stock Advisor provides investors with a straightforward roadmap to success, including portfolio-building guidance, ongoing updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns.*

Learn more »

*Stock Advisor returns as of January 21, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool also has positions in and recommends Alphabet, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.