The Rapid Growth of the AI Industry and Key Investment Options

Millions of businesses and individuals use artificial intelligence (AI) tools like ChatGPT daily. While the growth over the last 12 to 24 months has been impressive, it is clear the AI revolution has just begun.

Estimates of AI’s future size vary, but most forecasters expect significant growth in demand over the next decade. For instance, the United Nations Trade and Development organization predicts that AI will become a $4.8 trillion industry by 2033, up from just $189 billion in 2023.

Market Trends Amidst AI Stock Corrections

In early 2025, many AI stocks faced brief corrections. Amid uncertainty about future movements, three AI companies stand out as potential leaders poised to gain value before year’s end.

Nvidia Remains the Leader in Artificial Intelligence

Investors looking to gain exposure to the AI growth should consider purchasing stocks in Nvidia (NASDAQ: NVDA). The company is fundamentally linked to the AI technology explosion.

Nvidia focuses on manufacturing graphics processing units (GPUs), crucial for processing the extensive data required to train and run AI models and conduct machine-learning tasks. Without these GPUs, the current AI revolution might not have occurred as it has.

Currently, Nvidia commands a market share of 80% to 95% for GPUs used in AI-specific tasks. Although historical trends suggest competitors may catch up, Nvidia’s proprietary developer platform, CUDA, helps maintain customer loyalty by allowing customization of its chips for specific applications.

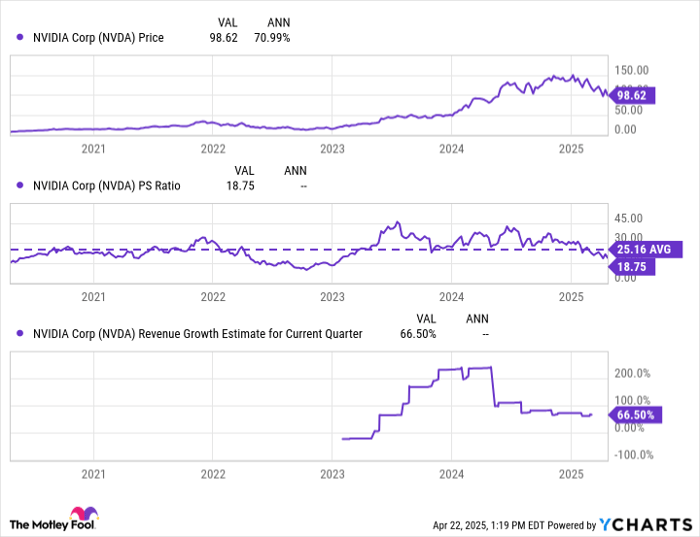

Despite Nvidia’s stock appearing expensive at 18.4 times sales, this figure is below its trailing-five-year average. With ongoing strong sales growth, Nvidia presents an attractive long-term investment opportunity.

NVDA data by YCharts; PS = price to sales.

Key Players: Microsoft and Amazon

While many do not think of Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN) as AI companies, they are well-positioned for AI growth due to their robust cloud computing segments, rather than their established products.

Amazon’s cloud service is known as Amazon Web Services (AWS), while Microsoft’s counterpart is Azure. Both services play crucial roles in enabling businesses to develop and deliver AI solutions efficiently.

The majority of companies purchasing Nvidia’s GPUs are cloud-based businesses like AWS and Azure, benefitting from scalable infrastructure that can adjust quickly—perfect for AI companies testing and deploying their products.

AWS and Azure hold substantial market shares of 30% and 24%, respectively. Their dominance in cloud computing translates to a similar position in the AI sector, allowing them to maintain leadership as the market expands.

MSFT data by YCharts.

While these companies grow at slower rates than Nvidia due to their diversified portfolios, lower valuations may present unique buying opportunities as the AI market continues to develop. Over time, the market may begin to recognize their critical roles as key suppliers in AI.

Is It Time to Invest in Nvidia Stock?

Before investing in Stock Nvidia, it is important to analyze various factors.

The Motley Fool Stock Advisor analyst team has identified their top ten stock picks for current investors, and Nvidia did not make the list. These selected stocks could yield substantial returns in the coming years.

For example, consider when Netflix was recommended on December 17, 2004; a $1,000 investment at that time would have grown to $561,046! Similarly, when Nvidia made the list on April 15, 2005, a $1,000 investment would now be worth approximately $606,106!

(The total average return for Stock Advisor stands at 811%, surpassing the S&P 500’s return of 153%. This highlights the potential of their stock selections.)

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.