Investing in AI: Three Tech Giants Poised for Growth

The art of successful investing often requires a long-term perspective, particularly in the face of fleeting market trends. Instead of focusing on quarterly earnings or momentary investor sentiments, my strategy is to identify companies capable of compounding value over many years, or even decades.

The rise of artificial intelligence (AI) presents one such opportunity. While some remain skeptical about the current AI boom, it is becoming increasingly clear that the technology has the potential to fundamentally change our economy.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Industry analysts project that AI could contribute trillions to global gross domestic product (GDP) by 2030, significantly altering how we work, innovate, and solve problems. For investors with a long-term viewpoint, this provides an exceptional chance to engage with a technological revolution right from the start.

Image source: Getty Images.

As we approach 2025, three companies emerge as leaders in the AI space. They vary in their contributions, from creating the hardware needed for AI operations to developing quantum systems that may propel AI further. Here’s why I am making targeted purchases in these three tech stocks in 2025.

ASML: The Core of AI Manufacturing

ASML Holding N.V. (NASDAQ: ASML) leads the market in extreme ultraviolet (EUV) lithography equipment, crucial for semiconductor manufacturing. Its stock trades at 27.4 times forward earnings, which is a notable premium over the S&P 500‘s valuation of 24.2. This premium reflects investor confidence in ongoing growth in AI chip demand throughout the upcoming decade.

Besides its key role in AI, ASML offers a growing income stream with its 0.97% dividend yield, supported by a conservative payout ratio of 35.2%. The company has boosted its dividend at an exceptional rate of 23.4% annually over the last five years, placing it among the highest growth rates globally.

Consequently, ASML is a strong candidate for long-term investors due to its unique status in advanced chip manufacturing and a rapidly growing dividend.

Nvidia: The AI Stock to Watch

Nvidia (NASDAQ: NVDA) dominates the AI chip market with its graphics processing units (GPUs). Currently trading at 31.3 times forward earnings, Nvidia commands a solid premium over the S&P 500, signaling its role as the primary beneficiary of AI’s expanding reach. Although the present dividend yield sits at a mere 0.03%, Nvidia’s impressive 16.3% growth rate over the last five years indicates considerable potential for future dividend increases.

Nvidia’s latest quarterly results highlight its market leadership, showcasing a 94% year-over-year revenue increase. This success marks six straight quarters of exceeding guidance by at least $2 billion. The company’s GPUs, in conjunction with its proprietary software, have become essential for AI development, fostering significant customer loyalty.

As AI adoption continues to flourish across various sectors, Nvidia stands solidly as a foundational asset for investors focused on AI.

IonQ: Pioneering Quantum Computing

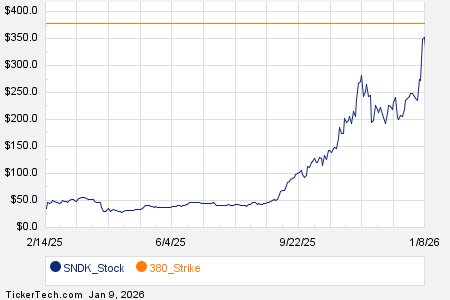

IonQ (NYSE: IONQ) is at the forefront of quantum-computing technology, although its current valuation at 233 times trailing sales requires careful thought. In 2024, IonQ witnessed a 237% surge in share price, driven by positive industry trends associated with developments at Alphabet and Amazon.

A standout feature of IonQ’s approach is its cloud-based distribution strategy. Through collaborations with Microsoft Azure, Amazon Web Services, and Google Cloud Platform, the company offers accessible quantum systems, simplifying enterprise integration and scaling as technology evolves.

Investors should keep several factors in mind. Although IonQ has demonstrated promising coherence times, significant engineering challenges remain for practical applications. Furthermore, the revenue base is modest, and scaling up commercially necessitates overcoming both technical hurdles and educating the market.

AI advancements could unexpectedly catalyze quantum-computing development, particularly in optimizing complex problems and innovating in fields like materials science. Given IonQ’s strategic partnerships and technological expertise, it is well-positioned to leverage potential breakthroughs in this arena.

Even amid skepticism, IonQ’s leading position in quantum technology and partnerships in the cloud sector position it for value creation as the market matures. While its high valuation might deter conservative investors, those looking for transformative tech could find IonQ’s potential appealing.

Looking Ahead

The future of computing hinges on three crucial elements: the precision of ASML’s manufacturing, Nvidia’s AI ecosystem dominance, and IonQ’s quantum potential. Despite their high valuations, each company’s strong competitive positioning and growth prospects in an increasingly compute-dependent landscape make them attractive investments. Therefore, I plan to increase my investments in Nvidia and IonQ while starting a new position in ASML in 2025.

Thinking About Investing $1,000 in ASML?

Before considering it, note the following:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors, and ASML didn’t make the list. The chosen stocks could generate impressive returns in the future.

For instance, when Nvidia was selected for this list on April 15, 2005, a $1,000 investment would now be worth $823,000!*

Stock Advisor offers investors a clear strategy for success, featuring portfolio-building guidance, analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, which is now an Amazon subsidiary, is also a board member. George Budwell has holdings in IonQ, Microsoft, and Nvidia. The Motley Fool has positions in and recommends ASML, Alphabet, Amazon, Microsoft, and Nvidia. Additionally, The Motley Fool endorses long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a disclosure policy.

The views expressed here represent the author’s opinions and do not necessarily reflect those of Nasdaq, Inc.