“`html

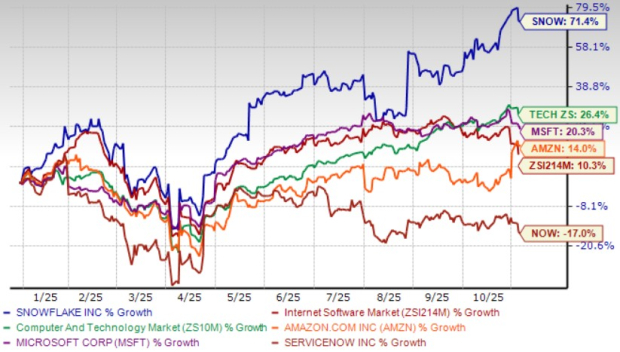

Snowflake Inc. (SNOW) has seen a remarkable 71.4% year-to-date surge as of now, significantly outperforming the Zacks Internet Software industry‘s 10.3% and the broader Computer and Technology sector’s 26.4%. This superior gain is attributed to strong execution, accelerating product momentum, and a growing opportunity in AI data cloud, with third-quarter fiscal 2026 revenue estimates at $1.18 billion, a 25.4% year-over-year increase.

The company is projected to have 12,482 total customers in Q3 fiscal 2026, a 21.8% increase year-over-year, with remaining performance obligations expected at $7.46 billion, indicating a 30.8% year-over-year growth. Its consumption-based model and ongoing partnerships with major cloud service providers like Microsoft Azure and Amazon Web Services are enhancing its competitive advantage in AI-ready data infrastructure.

Snowflake’s forward price-to-sales multiple stands at 16.65X, surpassing industry (5.09X) and sector averages (6.92X). The anticipated earnings for Q3 fiscal 2026 are at 31 cents per share, reflecting a 55% year-over-year increase. Overall, Snowflake is positioned for long-term growth, benefiting from its expanding ecosystem and effective AI integration.

“`