Top Affordable Internet-Software Stocks to Consider for Your Portfolio

The Zacks Internet-Software Industry currently ranks in the top 33% of nearly 240 Zacks industries. This sector features numerous stocks that have secured a place on the Zacks Rank #1 (Strong Buy) list.

What’s particularly noteworthy is that several of these highly regarded stocks are trading at attractive prices of under $15 per share.

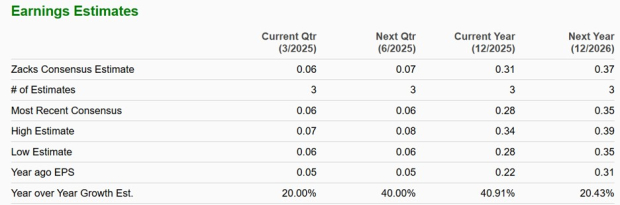

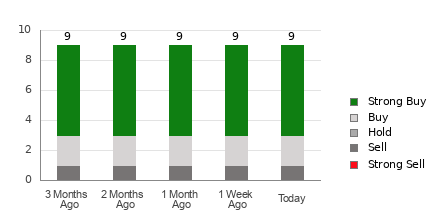

Olo – OLO

Starting with Olo Inc. OLO, which is trading at $6 per share and has a forward earnings multiple of 19.1X. As a provider of online ordering technology for restaurants, Olo anticipates significant double-digit earnings-per-share (EPS) growth in fiscal years 2025 and 2026. The company’s profitability is supported by a robust revenue stream, with total sales expected to grow by 17% this year and by another 18% in FY26, reaching $396.86 million.

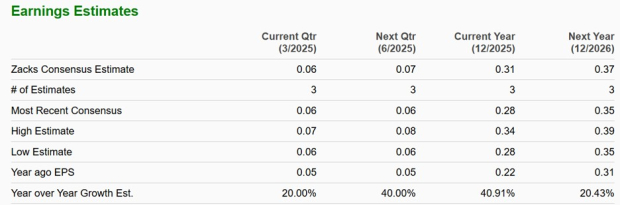

Image Source: Zacks Investment Research

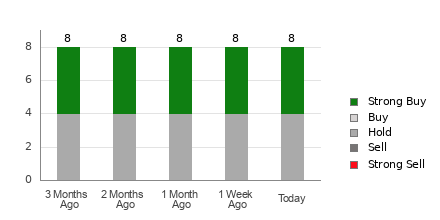

StoneCo – STNE

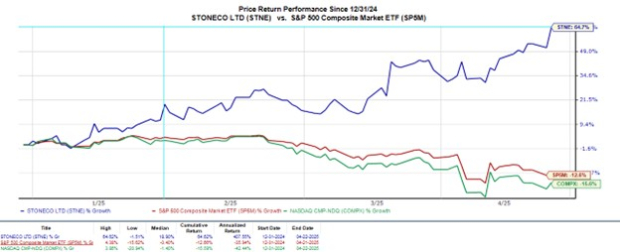

Next is StoneCo STNE, a company notable for its valuation metrics and performance indicators. As a provider of a comprehensive cloud-based platform for e-commerce across Brazil and South America, StoneCo stock trades at approximately $13, well below the ideal threshold of 2X sales.

The stock is valued at 9.5X forward earnings and has a PEG ratio of 0.36, indicating it could be undervalued relative to its growth. Additionally, the company’s Return on Equity (ROE) and Price to Cash Flow (P/CF) metrics are attractive to investors, especially following a remarkable +65% year-to-date gain, making it one of the best-performing stocks despite broader market corrections.

Image Source: Zacks Investment Research

UiPath – PATH

Finally, we have UiPath PATH, which provides an integrated platform for automation, focusing on Robotic Process Automation solutions for digital business operations. Since going public in 2021, UiPath has been a highly anticipated software IPO, generating over a billion dollars in annual sales. Despite the stock’s decline from its IPO price of $65 per share, it now offers a favorable entry point for potential investors at around $10, reflecting a more reasonable valuation.

Image Source: Zacks Investment Research

Bottom Line

It is an opportune moment to consider these top-rated internet-software stocks. Each company is experiencing a positive evolving trend with upward revisions in earnings estimates for the current fiscal year. This trend supports the view that Olo, StoneCo, and UiPath are undervalued, as it has led to a stabilization in their Price-to-Earnings (P/E) valuations.

5 Stocks Set to Double

Each of these stocks has been carefully selected by a Zacks expert as the #1 choice to gain +100% or more by 2024. While not every selection will be a winner, past recommendations have soared by +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks included in this report are currently under the radar of Wall Street, presenting a valuable opportunity for early investors.

Today, See These 5 Potential Home Runs >>

UiPath, Inc. (PATH) : Free Stock Analysis Report

Olo Inc. (OLO) : Free Stock Analysis Report

StoneCo Ltd. (STNE) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.