“`html

Top Business Services Stocks to Watch for Continued Growth in 2024

As we move further into 2024, investors are keeping a keen eye on stocks showing strong performance.

Focusing on the Zacks Business Services sector reveals several standout options for potential gains.

This sector, which includes financial transaction services and tech-driven applications, presents various growth opportunities. Given the ongoing technological advancements, these companies are increasingly essential.

A crucial indicator of future growth is the upward trend in earnings estimates for these stocks. With estimates surging over 100% in the past year, it appears that these companies may continue to experience significant gains.

Here are three business services stocks with a Zacks Rank of #1 (Strong Buy) that you might want to consider.

The Apps King

While companies like Wix.com WIX offer tools for small businesses, AppLovin APP has established itself as a powerhouse in app development.

Since its public debut in 2021, AppLovin has captured attention through its commitment to profitability and rapid growth. Its platform aids enterprise-level developers in marketing and creating their own applications.

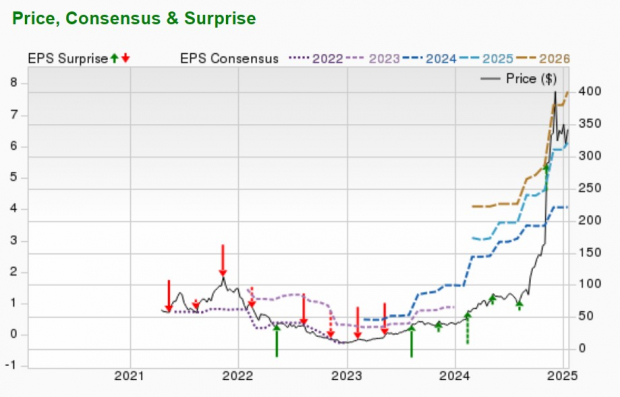

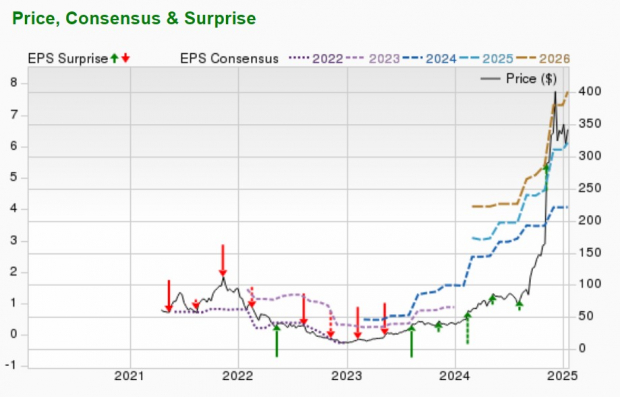

This interconnected approach has propelled AppLovin’s growth, with shares trading above $300 after more than 300% gains over the last year.

Image Source: Zacks Investment Research

Even at its current price, many analysts believe that AppLovin can continue its rally, as it consistently meets or exceeds quarterly expectations.

The company is set to announce its Q4 results for fiscal 2024 in February, with earnings estimated at $4.06 per share, compared to $0.98 the previous year. Additionally, FY25 EPS is projected to increase by another 50%, reflecting a 6% rise in estimates in the last two months.

Image Source: Zacks Investment Research

Crypto Exchange Leader

Coinbase’s COIN share price has jumped by 140% over the past year, closely following Bitcoin’s trajectory. As the largest cryptocurrency exchange, it benefits from favorable earnings revisions, especially given the recent trends in cryptocurrency regulation.

The favorable political climate, including President Trump’s re-election, has helped push Bitcoin prices beyond $100,000. Since its IPO in 2021, Coinbase has also progressed beyond profitability. It will report its Q4 results for FY24 in February, with annual EPS expected to leap to $5.71 from just $0.37 a share in 2023.

While forecasts indicate a dip to $3.48 per share this year, projections for FY24 and FY25 EPS have risen by 13% and 28%, respectively, in the past two months.

Image Source: TradingView

Digital Payments Leader

Sezzle SEZL emerges as a frontrunner in digital payment solutions, enhancing consumer purchasing power through interest-free installment plans at various retailers.

Since its 2023 IPO, Sezzle’s stock has surged nearly 200%, following an exceptional 600% rebound last year. With total sales projected to rise by 56% to $249.23 million by the end of FY24, Sezzle continues to attract consumers.

Image Source: Zacks Investment Research

Following this trend, Sezzle’s annual EPS is anticipated to reach $9.85, marking an impressive increase of 688%.

“`

Sezzle’s Strong Performance Signals Growth Potential for 2025

Solid Earnings Estimates Support Continued Momentum

In 2023, Sezzle Inc. (SEZL) has demonstrated impressive operating performance, currently trading at approximately $238 per share. The stock maintains a reasonable forward earnings multiple of 18.2X, with FY25 earnings per share (EPS) projected to be a remarkable $12.61. Additionally, earnings estimates for FY24 and FY25 have surged over the past quarter, showcasing a positive trend as Sezzle prepares to disclose its Q4 results in late February.

Image Source: Zacks Investment Research

Future Outlook for Business Services Stocks

There is a strong possibility that the high performance of top-ranked business services stocks continues, especially if they outperform expectations in Q4. Stocks like AppLovin, Coinbase, and Sezzle are emerging as promising investments for 2025 and beyond. Furthermore, they could present solid buy-the-dip opportunities should there be a post-earnings selloff.

Experts Highlight 7 Stocks to Watch

Recently released insights identify seven elite stocks from Zacks Rank #1 Strong Buys, projected as “Most Likely for Early Price Pops.” Historically, this curated list has outperformed the market significantly since 1988, with an average annual gain of +24.3%. It’s worth considering these recommendations as potential investment opportunities.

Download 7 Best Stocks for the Next 30 Days from Zacks Investment Research for free.

AppLovin Corporation (APP): Free Stock Analysis Report

Coinbase Global, Inc. (COIN): Free Stock Analysis Report

Sezzle Inc. (SEZL): Free Stock Analysis Report

Wix.com Ltd. (WIX): Free Stock Analysis Report

Read more about this topic on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.