Domino’s Pizza: A Solid Choice for Steady Growth in Food Stocks

Food-service stocks may not often grab attention, but occasionally a strong candidate emerges. Domino’s Pizza (NYSE: DPZ) stands out as a promising option for investors looking for steady growth. Here are three compelling reasons to consider adding this ticker to your portfolio.

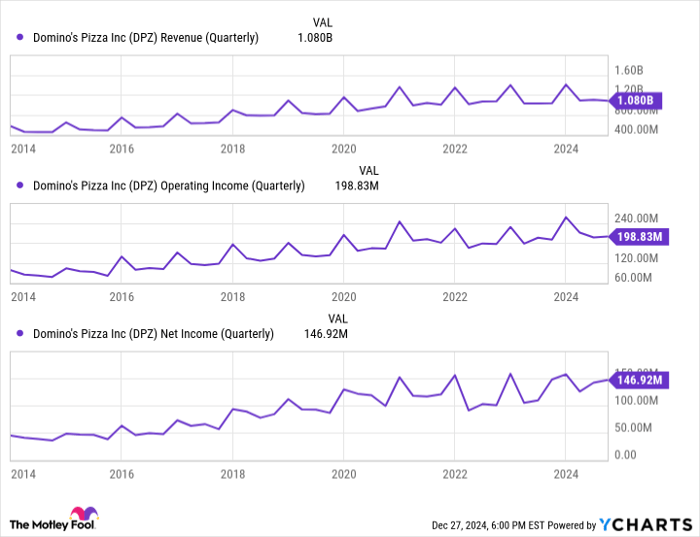

1. Proven Track Record of Growth

Domino’s success is undeniable. In 2021, it became the world’s largest pizza chain, boasting 18,848 locations and surpassing Pizza Hut. Alongside its growing number of stores, the company’s total revenue has also increased significantly since its growth strategy accelerated in 2013.

During this time, the chain has consistently reported positive same-store sales growth—excluding the pandemic’s peak period. Notably, its profits have outpaced inflation trends, largely due to effective management that capitalizes on its expanding operations.

DPZ Revenue (Quarterly) data by YCharts.

This steady progress indicates that Domino’s understands market demand, unlike some of its competitors.

2. Stock Valued at a Good Price

Currently, Domino’s pizza stock offers a favorable buying opportunity. Shares have decreased by 17% since their peak in June, which, while not an overwhelming drop, is significant for this stock.

The decline traces back to 2022 when investor sentiment shifted after pandemic restrictions eased. While the market response was uncertain, analysts remain optimistic. Most analysts rate the stock as a strong buy, with a consensus price target of $483.57—roughly 12% above its current price.

3. Reliable Dividend Growth

Another incentive to invest in Domino’s is its dividend. Currently, the stock yields 1.4%, a modest return for income-seeking investors. Still, this dividend should be seen as an additional benefit complemented by strong growth potential.

Over the past 11 years, Domino’s has increased its quarterly dividend from $0.20 to $1.51 per share, translating to a compound annual growth rate of about 20%—a pace that surpasses many traditional dividend stocks.

DPZ Payout Ratio data by YCharts.

Furthermore, only about one-third of its net earnings are allocated for dividends, providing a robust safety net for future payouts.

4. Buffett’s Approval Bolsters Confidence

A noteworthy supporter of Domino’s is Warren Buffett. His $500 million stake in the company demonstrates confidence in its value. Although this investment may be relatively small compared to Buffett’s overall portfolio, it highlights the potential he sees for Domino’s growth.

Buffett’s company, Berkshire Hathaway, has a successful history of outperforming the S&P 500 over time, making his endorsement significant for prospective investors.

Should You Invest in Domino’s Pizza Now?

While Domino’s Pizza has several appealing qualities, it’s crucial to make informed decisions:

The Motley Fool Stock Advisor has identified other stocks that it believes are top choices for investment right now, and surprisingly, Domino’s is not on this list. They suggest exploring the top 10 stocks with strong potential for significant returns.

For context, consider Nvidia; if you had invested $1,000 on April 15, 2005, it would now be worth approximately $839,670!

Stock Advisor offers a structured approach to investing, including regular updates, guidance on portfolio management, and two new stock picks each month. Since its launch in 2002, it has more than quadrupled the returns of the S&P 500.

*Stock Advisor returns as of December 23, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Domino’s Pizza. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.