PayPal’s Stock: Struggles and Opportunities for Growth

PayPal (NASDAQ: PYPL) has seen a notable increase in its stock, rising 29% since early 2024. CEO Alex Chriss, who began his tenure in late 2023, aims to enhance the company’s offerings and address investor worries regarding slow growth.

Despite this uptick, recent earnings reports fell short of expectations, causing the stock to drop by 13% shortly thereafter. Nonetheless, several factors suggest that PayPal presents a good opportunity for long-term investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

1. Dominance in the Digital Payments Market

Founded in 1998, PayPal has established itself as a leader in the digital payments arena. It is now one of the most trusted digital payment applications in the United States.

A survey by The Motley Fool Ascent, which included 2,000 Americans, revealed that PayPal is the preferred digital payment app, used by 85% of respondents. In contrast, Block‘s Cash App held 54%, while Venmo, also owned by PayPal, came in at 38%.

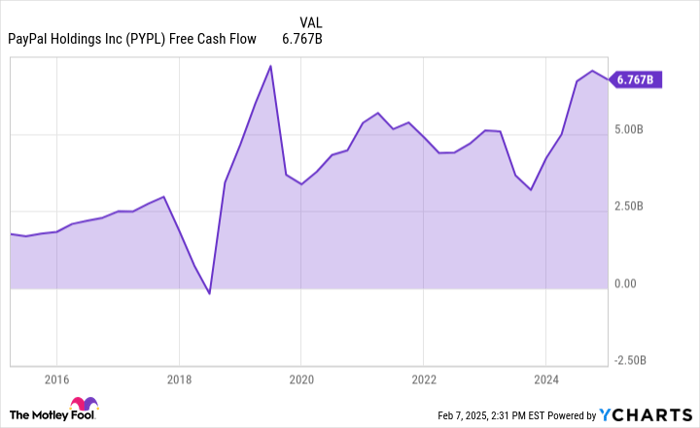

These statistics underscore PayPal’s significant influence and strong network effects built over many years. Last year, the company’s total payment volume grew by 10% to nearly $1.7 trillion, with operating income rising 6% to $5.3 billion. Additionally, PayPal generated $6.8 billion in free cash flow and initiated a $15 billion stock buyback program.

PYPL Free Cash Flow data by YCharts.

2. Innovations May Spark New Growth

Reigniting growth is crucial for PayPal, and CEO Chriss has been working on several strategic improvements for over a year. Investor concerns have centered around the company’s stagnating growth and tighter profit margins.

Chriss, previously with Intuit, aims to enhance PayPal’s offerings to attract more customers, particularly small and medium-sized businesses. One of his key initiatives includes revamping PayPal’s checkout options.

An emerging product, Fastlane by PayPal, has shown early promise. This feature allows for quicker, one-click checkouts for PayPal users, decreasing checkout time by 32%. Major clients, such as Salesforce, Adobe, and BigCommerce, have already adopted this service.

Additionally, PayPal will process payments for Shopify Payments in the U.S. and has partnered with Amazon to enhance the checkout experience for Buy with Prime customers. Chriss sees this as a significant growth opportunity.

3. Growth Potential in Advertising

PayPal is in a strong position to use its extensive payment data from 434 million active accounts to create targeted advertising. The company plans to utilize artificial intelligence to offer tailored recommendations and discounts based on consumer purchasing habits.

Image source: Getty Images.

To bolster its advertising segment, PayPal has brought on Mark Grether from Uber, who previously built Uber’s advertising unit into a billion-dollar enterprise. Current estimates suggest that digital marketing could grow by 9.5% annually over the next decade, presenting yet another potential growth sector for PayPal.

A Strong Investment Opportunity

PayPal ranks as the leading digital payments app in the U.S. and continues to evolve as it enhances its business. There is promising potential in its advertising strategy, coupled with a valuation close to 12 times its free cash flow. This makes the stock an attractive buy for those looking to invest long-term.

A Second Chance at a Profitable Investment

Do you worry about missing investment opportunities in top-performing stocks? If so, pay attention.

Our analysts occasionally issue a “Double Down” stock recommendation for companies they believe are on the cusp of significant growth. If you’re concerned about missing your chance to invest, now may be the moment to act. Consider these past successes:

- Nvidia: If you invested $1,000 in 2009, you’d have $344,352!

- Apple: A $1,000 investment in 2008 would be worth $44,103!

- Netflix: Investing $1,000 in 2004 would have grown to $543,649!

Currently, we’re issuing “Double Down” alerts for three promising companies, and opportunities like this are rare.

Learn more »

*Stock Advisor returns as of February 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Courtney Carlsen has positions in Block and PayPal. The Motley Fool has positions in and recommends Adobe, Amazon, Block, Intuit, PayPal, Salesforce, Shopify, and Uber Technologies. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal, and short March 2025 $85 calls on PayPal. The Motley Fool has a disclosure policy.

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.