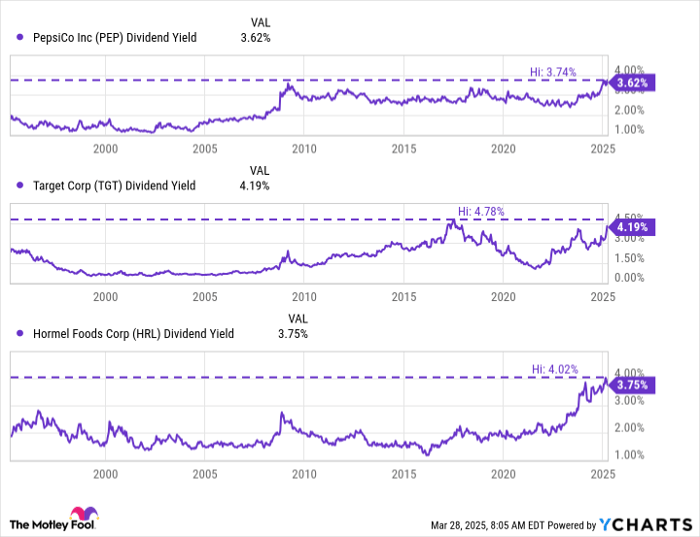

Dividend Kings: Reliable Income Sources from PepsiCo, Target, and Hormel Foods

Income investors often seek dependable dividends. While it’s relatively common for dividend-paying firms to lower or even eliminate their dividends, PepsiCo (NASDAQ: PEP), Target (NYSE: TGT), and Hormel Foods (NYSE: HRL) stand out as notable exceptions in my experience. These firms have consistently paid quarterly dividends and raised them annually for over 50 years, earning their status as Dividend Kings. They are among the most reliable dividend stocks globally.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy now. Learn More »

Currently, these stocks represent a potentially lucrative opportunity, particularly in terms of dividend payouts relative to stock prices. The dividend yield is an essential metric for investors, indicating the return based on investment. For example, investing $1,000 in a stock with a 2% yield would yield $20 annually.

Notably, a 2% yield is roughly the market average. In contrast, Pepsi, Target, and Hormel offer nearly double that average. Each company’s dividend yield is either at an all-time high or near it.

PEP Dividend Yield data by YCharts

Given their status as Dividend Kings and the favorable conditions for their dividend payments, Pepsi, Target, and Hormel deserve closer examination from investors today.

The pivotal question for each is whether their profits can continue growing in the long term, which is crucial for sustaining dividend growth. Based on the following insights, the answer appears to be yes.

1. Pepsi

PepsiCo manages over 200 food and beverage brands, with 22 of these generating over $1 billion in annual revenue. The company’s vast scale means not every aspect will be covered, but two key areas have the potential to enhance profits in the coming years.

First, Pepsi is investing in warehouse automation. Given its extensive product line, effective supply chain management is crucial. Companies like Amazon have seen profitability improve after automating their warehouses; Pepsi is expected to experience similar benefits.

Secondly, Pepsi has identified over 10 emerging international markets to target for growth. CEO Ramon Laguarta indicated that 60% of its business comes from just 5% of the global population, prompting the investment in these new markets. As these regions grow, profitability should also rise.

With a 3.6% dividend yield and a remarkable 53-year streak of dividend payments, Pepsi’s potential for profit growth signals that its dividend increases may well extend to 60 years or more.

2. Target

Target’s payout ratio is significantly lower than its peers, at just 50%. This gives the company ample room to raise dividends, even if profits stay flat. However, Target has pathways for profit enhancement.

One of the largest retailers globally, Target is expanding its e-commerce through Target Plus, which now operates as a $1 billion business with double-digit growth. This initiative allows third-party vendors to sell on its platform, which enhances profit margins much like strategies seen at companies such as Walmart.

These developments point to a potential increase in profits, thereby motivating management to raise dividends further. Consequently, securing shares now at a 4.3% yield could be a wise long-term decision.

3. Hormel

Hormel has a long-standing history of dividend payments dating back over 30 years before Target even opened its first store in 1962. The company is nearing 100 years of uninterrupted dividends and has raised its dividend for 59 consecutive years—a remarkable feat.

This track record speaks volumes about Hormel’s management and commitment to returning value to shareholders, making it another solid choice for income-focused investors.

Hormel Faces Challenges but Sees Opportunities for Profit Growth

Hormel is currently navigating significant challenges, which could hinder its ability to sustain its growth streak. The turkey industry, a crucial segment of Hormel’s operations, is experiencing negative impacts from bird flu. Additionally, the company’s over $3 billion acquisition of Planters in 2021 has yet to meet optimistic projections. Consequently, both Hormel’s gross margin and operating margin are trailing behind their 20-year averages.

HRL Gross Profit Margin data by YCharts

Identifying Profit Improvement Opportunities

Despite these hurdles, opportunities for profit improvement exist. For example, the bird flu situation impacting the turkey market is expected to eventually resolve, potentially alleviating some of the current pressures. Additionally, Hormel has made strides in the holiday quarter with its Planters brand by launching limited-time products, which may help maintain positive momentum.

One area where Hormel is focusing its efforts is on value-added items. There is growing demand for packaged food that is convenient and ready to eat, as opposed to just raw ingredients. This trend includes various packaging innovations for its Planters brand, but it also extends across Hormel’s entire product range.

Investment Plans for Future Growth

In 2023, Hormel is planning to invest up to $300 million in capital expenditures, primarily aimed at boosting manufacturing capacity for higher-margin, value-added products. As the company expands its distribution network with these profit-generating items, it may see an uptick in profits.

Market Comparisons: Hormel, Pepsi, and Target

Among three notable stocks, PepsiCo stands out as the safest investment due to its extensive portfolio and scale. Conversely, Target is perceived as the most affordable option, appealing to some investors. This places Hormel as potentially the least attractive option in this comparison. Nevertheless, Hormel’s Spam has a dedicated fan base, and the attractive dividend yield near 4% may entice long-term investors.

Should You Consider Investing in PepsiCo Now?

Before purchasing Stock in PepsiCo, be informed:

The Motley Fool Stock Advisor analyst team recently identified what they consider the 10 best stocks to buy today… and PepsiCo isn’t among them. The recommended stocks could yield substantial returns in the following years.

For instance, consider Nvidia, which joined this list on April 15, 2005… a $1,000 investment at that time would now be worth $672,177!

Stock Advisor offers an accessible roadmap for investors, featuring portfolio-building guidance, regular analyst updates, and two new stock picks each month. Since its inception, the Stock Advisor service has outperformed the S&P 500 by more than four times since 2002*. Join now to access the latest top 10 list.

see the 10 stocks »

*Stock Advisor returns as of March 24, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.