“`html

The Federal Reserve cut rates by 25 basis points on December 10, lowering the benchmark federal funds rate to a range of 3.5-3.75%, down from a previous high of 5.25-5.5% reached in 2023. This dovish shift is benefiting rate-sensitive companies and boosting consumer spending, with expectations for increased profitability in the financial sector.

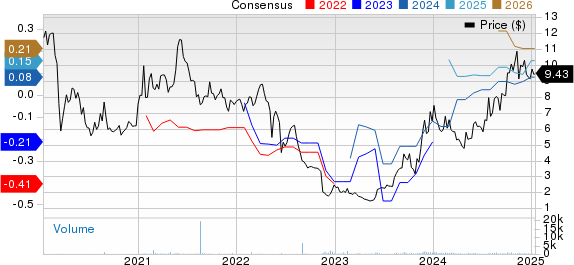

Three finance stocks are highlighted as prime beneficiaries of the Fed’s easing cycle: LendingTree (TREE), which has a stock price of $55 and year-to-date performance of +44%, expects annual sales to rise by 20% in fiscal 2025; PJT Partners (PJT) with a stock price of $177 and +12% YTD performance anticipates significant growth in M&A and restructuring advisory revenues; and NerdWallet (NRDS), trading at $14 with +11% YTD performance, forecasts sales nearing $1 billion, attributing revenue growth to increased consumer lending activities.

Overall, these stocks are categorized as having strong growth potential, supported by favorable operational environments and positive earnings projections driven by the Federal Reserve’s recent policy changes.

“`