Three Financial Stocks to Watch for Upcoming Q3 Earnings Reports

Several top-rated Zacks stocks are set to reveal their third-quarter results this week, with several notable ones in the financial sector.

Highlighted with a Zacks Rank #2 (Buy), here are three compelling finance stocks to monitor as their Q3 reports approach on Tuesday, October 22.

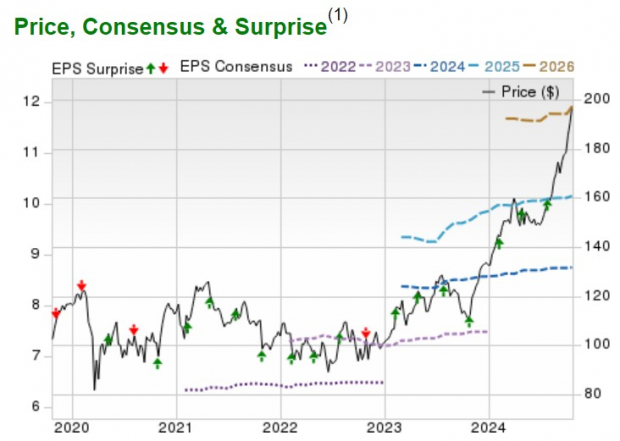

Fiserv – FI

Leading the charge in financial transaction services, Fiserv FI has witnessed its stock climb nearly +50% this year, drawing strong interest from investors due to promising growth prospects. Despite its recent surge, Fiserv’s stock still trades at a reasonable 22.5X forward earnings multiple. Analysts predict Q3 earnings will rise 15% to $2.24 per share, with double-digit EPS growth anticipated for fiscal 2024 and FY25.

Notably, Fiserv has consistently met or exceeded earnings expectations for 10 straight quarters, boasting an average earnings surprise of 2.75% over its last four reports. With fintech solutions serving over 12,000 clients worldwide, Fiserv’s steady revenue growth looks promising. Sales for Q3 are expected to have increased by 6% to $4.9 billion.

Image Source: Zacks Investment Research

Invesco – IVZ

Trading for less than $20 per share, Invesco’s IVZ stock holds an impressive “A” Zacks Style Scores grade for both Growth and Value. As an investment management firm, Invesco offers a wide array of securities, including fixed-income products, ETFs, index funds, and other equities.

What stands out is that Invesco’s stock trades at 11.1X forward earnings, with Q3 EPS expected to surge by 26% to $0.44, up from $0.35 in the same quarter last year. Q3 sales are anticipated to rise slightly to $1.11 billion. Additionally, IVZ trades below the preferred level of under 2X sales, and its revenue is forecasted to grow by 2% in FY24 and another 5% in FY25, reaching $4.62 billion.

Image Source: Zacks Investment Research

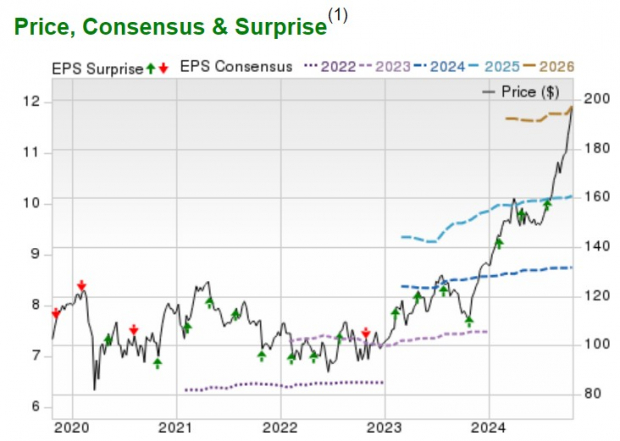

Moody’s – MCO

A key player in credit assessment, Moody’s MCO has gained more than +20% in its stock value thus far this year. Its expected strong performance continues, with Q3 EPS projected to rise 18% to $2.89, paired with anticipated sales of $1.73 billion—a 17% year-over-year increase.

Notably, Moody’s growth trajectory is likely to surpass its record fiscal 2021, which saw EPS at $12.29 and total sales of $6.21 billion. The stock has appreciated more than +100% over the past five years, indicating robust investor confidence.

Image Source: Zacks Investment Research

Conclusion

Due to their favorable ratings, earnings estimate revisions are suggesting positive momentum for these three financial stocks. Investors will be keen to see if these companies can meet or exceed Q3 expectations while providing strong guidance going forward.

Zacks Identifies #1 Semiconductor Stock

Our top semiconductor pick is just 1/9,000th the size of NVIDIA, which has seen growth of over +800% since our recommendation. Though NVIDIA remains strong, this new chip stock has substantial potential for growth.

With solid earnings growth and a growing customer base, it is well-positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is projected to rise from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Moody’s Corporation (MCO) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.