Gaming Industry Thrives Amid Rising Interest Rates and Sports Betting Boom

The Zacks Gaming industry is currently benefiting from favorable economic conditions, including the Federal Reserve’s recent interest rate cut and a surge in sports betting popularity. With increased visitor numbers and spending from younger audiences, companies like Flutter Entertainment plc FLUT, DoubleDown Interactive Co., Ltd. DDI, and GDEV Inc. GDEV are expected to thrive in this optimistic climate.

Understanding the Gaming Industry Landscape

The Zacks Gaming industry consists of businesses that operate integrated casinos, hotels, and entertainment resorts. It includes companies that provide gaming technology, such as lottery systems and electronic gaming machines, along with services for sports betting and interactive gaming. Additionally, many firms develop mobile gaming applications and e-sports content solutions.

Significant Factors Influencing the Gaming Sector

Impact of Interest Rate Cuts: Recently, the Federal Reserve lowered interest rates by 50 basis points to support economic growth and enhance the labor market. The Fed has kept interest rates between 4.75% and 5% and has signaled the possibility of further cuts in the next couple of years. Many gaming companies rely on debt for their operations and expansion. Lower interest rates mean reduced borrowing costs, which can boost growth by freeing up capital for new projects and reducing overall interest payments.

Recovery of Macau’s Gaming Revenues: The return of visitors has contributed to the recovery of gaming revenues in Macau, which surged 15.5% year over year in September. Casino operators are focusing on operational efficiency, enhancing marketing strategies, and improving service quality to draw in gamers.

Strong Performance of U.S. Gaming Revenues: The U.S. gaming sector is showing remarkable growth. According to the American Gaming Association, gambling revenues reached a record $17.63 billion in the second quarter of 2024, a rise of 8.9% compared to last year. This marks the industry’s 14th consecutive quarter of annual revenue growth.

The Role of Sports Betting: The expansion of legalized sports betting across multiple states has significantly contributed to the industry’s growth. Bettors can now place wagers online in many states, with popular platforms including DraftKings, FanDuel, and BetMGM attracting large audiences.

Zacks Industry Rank Indicates Positive Outlook

The Zacks Gaming industry belongs to the larger Zacks Consumer Discretionary sector and currently holds a Zacks Industry Rank of #103, indicating it is positioned in the top 41% of over 250 Zacks industries. Strong earnings expectations are boosting the industry’s rank, with forecasts for the current year up by 9.5% since late April 2024.

Gaming Industry’s Performance vs. S&P 500

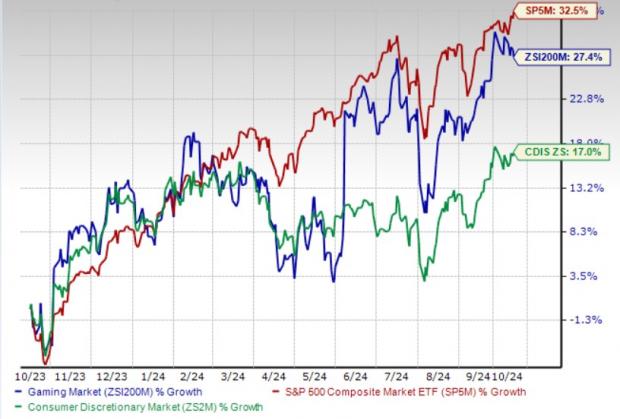

Over the past year, the Zacks Gaming industry has underperformed relative to the S&P 500 Index and the broader Consumer Discretionary sector. The industry saw a 27.4% increase, while the S&P 500 gained 32.5%, and the Consumer Discretionary sector climbed 17% during the same timeframe.

One-Year Price Performance

Valuation Insights for Gaming Companies

The gaming industry relies heavily on debt, making the EV/EBITDA (Enterprise Value to Earnings before Interest, Taxes, Depreciation, and Amortization) ratio a relevant measure for valuation. Currently, the industry has a forward 12-month EV/EBITDA ratio of 11.93, below the S&P 500’s 14.47 ratio. Historically, the industry has seen an EV/EBITDA range of 6.56X to 22.53X over the last five years, with a median of 15.30X.

Enterprise Value-to-EBITDA Ratio (Past 5 Years)

.jpg)

Three Promising Gaming Stocks to Consider

Flutter Entertainment: Flutter has posted strong growth in the U.K., attaining market share gains for ten consecutive quarters. Recently, it transitioned FanDuel Casino to its proprietary technology, enhancing stability and access to exclusive content. The company’s shares have risen by 6% in the past three months, with 2024 earnings estimates increasing from $4.07 to $5.71.

Price & Consensus: FLUT

DoubleDown Interactive: This company continues to thrive with its social casino business, which reported a 7% revenue increase in the second quarter of 2024, marking three straight quarters of growth. Its shares have climbed by 12.8% recently, with 2024 earnings estimates rising 13.5% to $2.35.

Price & Consensus: DDI

GDEV: GDEV is focusing on sustainable growth and operational efficiency, enhancing player experiences through superior game offerings and talented recruitment. Its shares have surged 29.4% over the past three months, with earnings estimates for 2024 rising from 15 cents to 60 cents.

Price & Consensus: GDEV

Top 7 Stocks to Watch

Recently released: Experts selected 7 top-performing stocks from the current pool of 220 Zacks Rank #1 Strong Buy stocks, anticipating these to be “Most Likely for Early Price Pops.”

Since 1988, this exclusive list has consistently outperformed the market, achieving an average annual return of over 23.7%—a compelling reason to consider these stocks carefully.

Interested in the latest recommendations from Zacks Investment Research? Download the report titled “5 Stocks Set to Double” for free today.

Flutter Entertainment PLC (FLUT): Free Stock Analysis Report

GDEV Inc. (GDEV): Free Stock Analysis Report

DoubleDown Interactive Co., Ltd. Sponsored ADR (DDI): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.